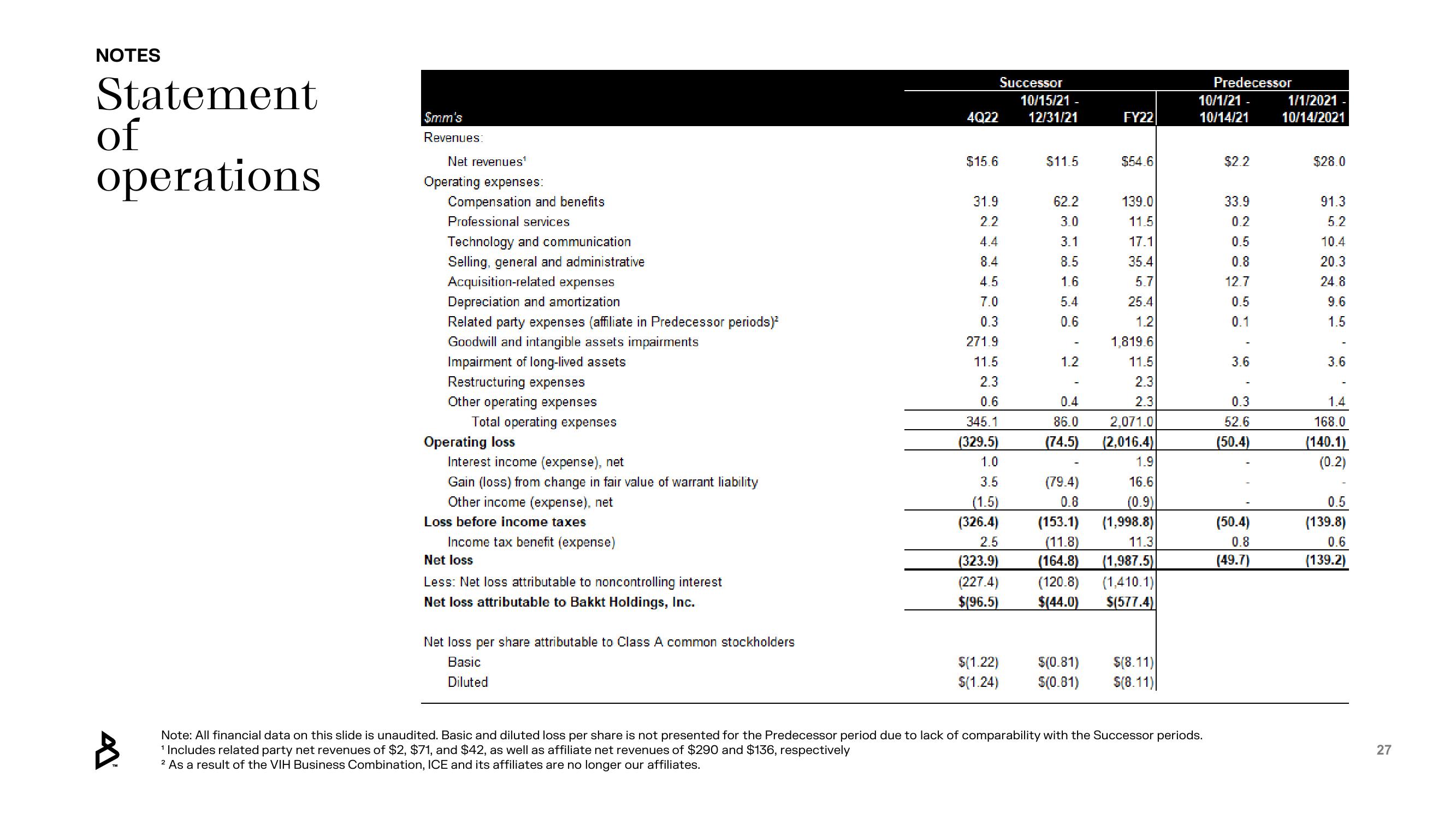

Bakkt Results Presentation Deck

NOTES

Statement

of

operations

A

$mm's

Revenues:

Net revenues¹

Operating expenses:

Compensation and benefits

Professional services

Technology and communication

Selling, general and administrative

Acquisition-related expenses

Depreciation and amortization

Related party expenses (affiliate in Predecessor periods)²

Goodwill and intangible assets impairments

Impairment of long-lived assets

Restructuring expenses

Other operating expenses

Total operating expenses

Operating loss

Interest income (expense), net

Gain (loss) from change in fair value of warrant liability

Other income (expense), net

Loss before income taxes

Income tax benefit (expense)

Net loss

Less: Net loss attributable to noncontrolling interest

Net loss attributable to Bakkt Holdings, Inc.

Net loss per share attributable to Class A common stockholders

Basic

Diluted

4Q22

$15.6

Successor

10/15/21 -

12/31/21

31.9

2.2

4.4

8.4

4.5

7.0

0.3

271.9

11.5

2.3

0.6

345.1

(329.5)

1.0

3.5

(1.5)

(326.4)

2.5

(323.9)

(227.4)

$(96.5)

$(1.22)

$(1.24)

$11.5

62.2

3.0

3.1

8.5

1.6

5.4

0.6

1.2

0.4

86.0

(74.5)

FY22

$(0.81)

$(0.81)

$54.6

139.0

11.5

17.1

35.4

5.7

25.4

1.2

1,819.6

11.5

2.3

2.3

2,071.0

(2,016.4)

1.9

16.6

(0.9)

(1,998.8)

11.3

(79.4)

0.8

(153.1)

(11.8)

(164.8) (1,987.5)

(120.8) (1,410.1)

$(44.0) $(577.4)

$(8.11)

$(8.11)

Predecessor

10/1/21 -

10/14/21

Note: All financial data on this slide is unaudited. Basic and diluted loss per share is not presented for the Predecessor period due to lack of comparability with the Successor periods.

¹ Includes related party net revenues of $2, $71, and $42, as well as affiliate net revenues of $290 and $136, respectively

2 As a result of the VIH Business Combination, ICE and its affiliates are no longer our affiliates.

$2.2

33.9

0.2

0.5

0.8

12.7

0.5

0.1

3.6

0.3

52.6

(50.4)

(50.4)

0.8

(49.7)

1/1/2021 -

10/14/2021

$28.0

91.3

5.2

10.4

20.3

24.8

9.6

1.5

3.6

1.4

168.0

(140.1)

(0.2)

0.5

(139.8)

0.6

(139.2)

27View entire presentation