Evotec ESG Presentation Deck

1600%

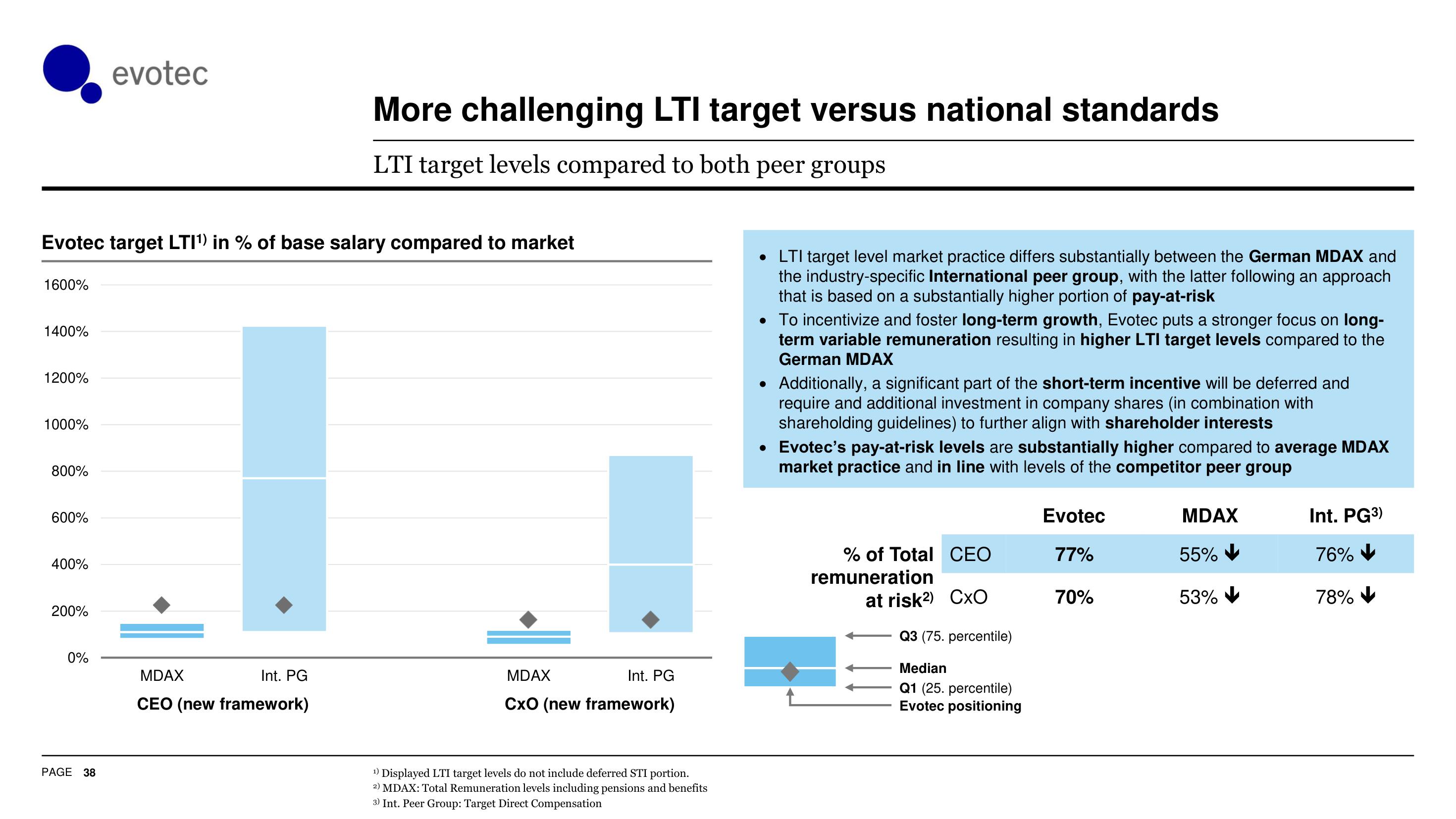

Evotec target LTI¹) in % of base salary compared to market

1400%

1200%

1000%

800%

600%

400%

200%

0%

evotec

PAGE 38

More challenging LTI target versus national standards

LTI target levels compared to both peer groups

MDAX

Int. PG

CEO (new framework)

MDAX

Int. PG

CxO (new framework)

¹) Displayed LTI target levels do not include deferred STI portion.

2) MDAX: Total Remuneration levels including pensions and benefits

3) Int. Peer Group: Target Direct Compensation

• LTI target level market practice differs substantially between the German MDAX and

the industry-specific International peer group, with the latter following an approach

that is based on a substantially higher portion of pay-at-risk

• To incentivize and foster long-term growth, Evotec puts a stronger focus on long-

term variable remuneration resulting in higher LTI target levels compared to the

German MDAX

●

Additionally, a significant part of the short-term incentive will be deferred and

require and additional investment in company shares (in combination with

shareholding guidelines) to further align with shareholder interests

• Evotec's pay-at-risk levels are substantially higher compared to average MDAX

market practice and in line with levels of the competitor peer group

% of Total CEO

remuneration

at risk2) CxO

Q3 (75. percentile)

Median

Q1 (25. percentile)

Evotec positioning

Evotec

77%

70%

MDAX

55% ✔

53% ✔

Int. PG³)

76% ✔

78%View entire presentation