Spirit Mergers and Acquisitions Presentation Deck

》》

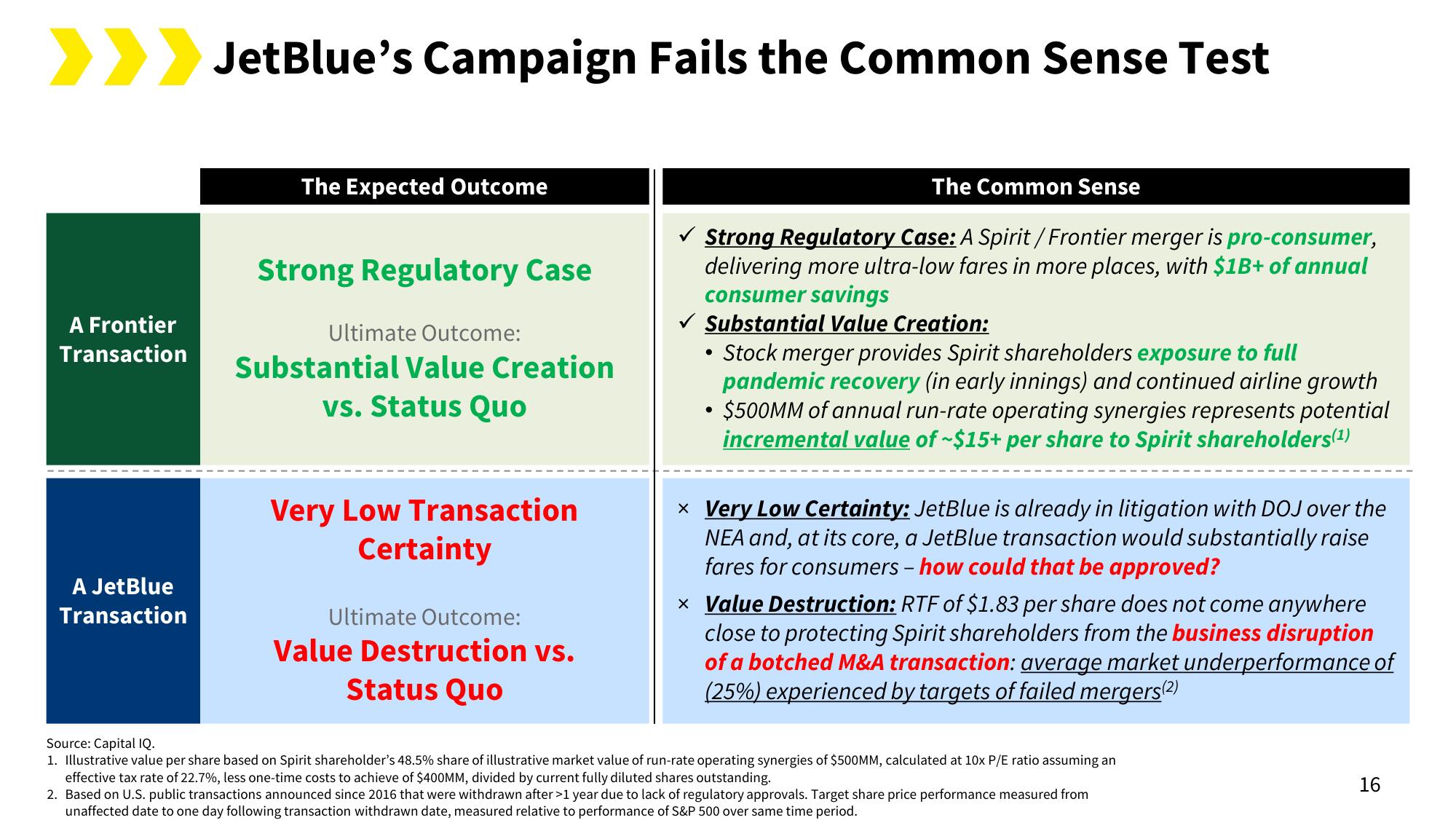

A Frontier

Transaction

A JetBlue

Transaction

JetBlue's Campaign Fails the Common Sense Test

The Expected Outcome

Strong Regulatory Case

Ultimate Outcome:

Substantial Value Creation

vs. Status Quo

Very Low Transaction

Certainty

Ultimate Outcome:

Value Destruction vs.

Status Quo

The Common Sense

Strong Regulatory Case: A Spirit / Frontier merger is pro-consumer,

delivering more ultra-low fares in more places, with $1B+ of annual

consumer savings

Substantial Value Creation:

Stock merger provides Spirit shareholders exposure to full

pandemic recovery (in early innings) and continued airline growth

●

• $500MM of annual run-rate operating synergies represents potential

incremental value of ~$15+ per share to Spirit shareholders(¹)

× Very Low Certainty: JetBlue is already in litigation with DOJ over the

NEA and, at its core, a JetBlue transaction would substantially raise

fares for consumers - how could that be approved?

× Value Destruction: RTF of $1.83 per share does not come anywhere

close to protecting Spirit shareholders from the business disruption

of a botched M&A transaction: average market underperformance of

(25%) experienced by targets of failed mergers(2)

Source: Capital IQ.

1. Illustrative value per share based on Spirit shareholder's 48.5% share of illustrative market value of run-rate operating synergies of $500MM, calculated at 10x P/E ratio assuming an

effective tax rate of 22.7%, less one-time costs to achieve of $400MM, divided by current fully diluted shares outstanding.

2. Based on U.S. public transactions announced since 2016 that were withdrawn after >1 year due to lack of regulatory approvals. Target share price performance measured from

unaffected date to one day following transaction withdrawn date, measured relative to performance of S&P 500 over same time period.

16View entire presentation