HSBC Investor Day Presentation Deck

Mortgage portfolio

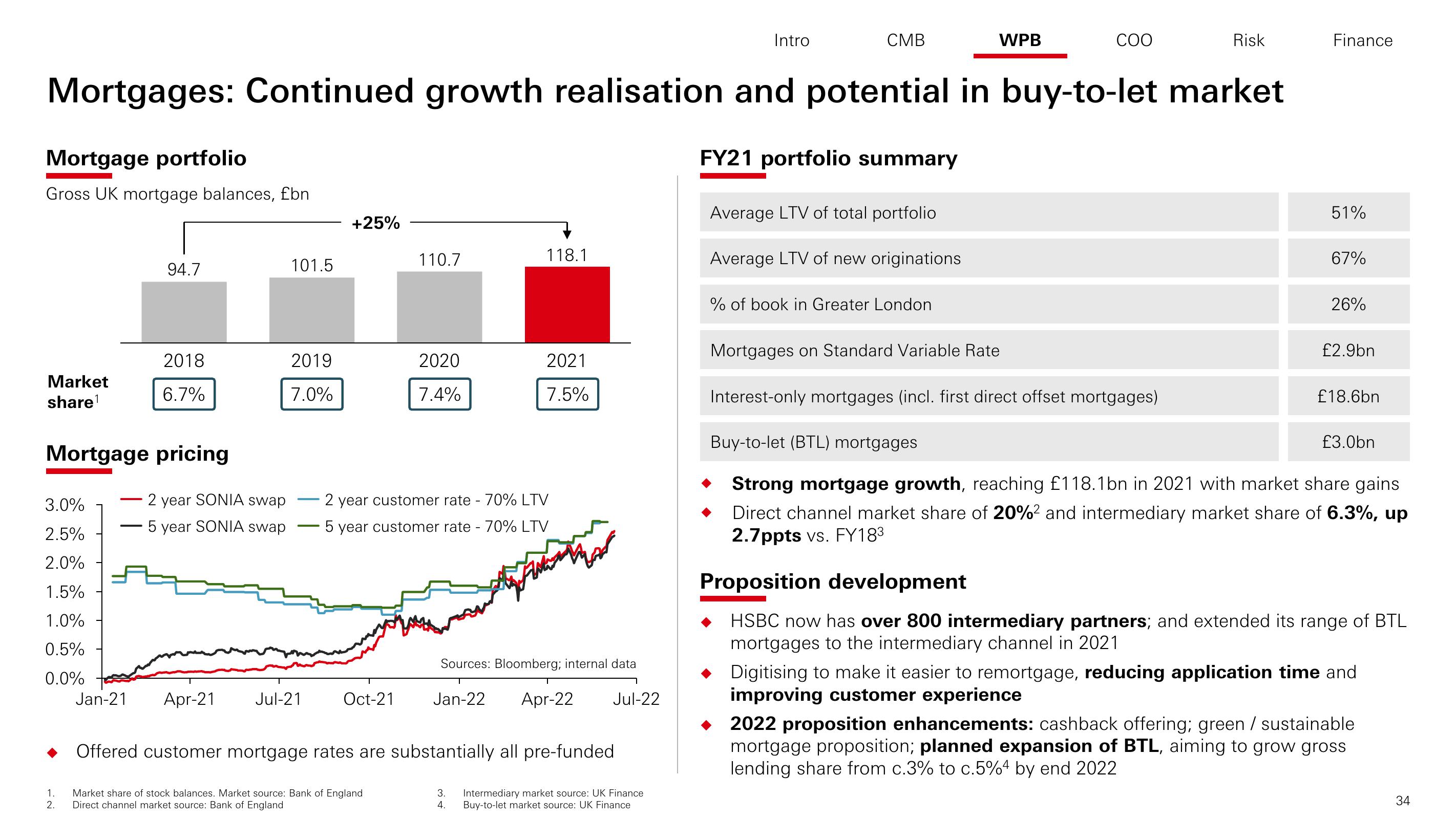

Gross UK mortgage balances, £bn

Market

share¹

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

Mortgages: Continued growth realisation and potential in buy-to-let market

Mortgage pricing

1.

2.

94.7

Jan-21

2018

6.7%

2 year SONIA swap

5 year SONIA swap

101.5

2019

7.0%

-

Apr-21 Jul-21

+25%

Oct-21

110.7

2020

7.4%

Market share of stock balances. Market source: Bank of England

Direct channel market source: Bank of England

118.1

2 year customer rate - 70% LTV

5 year customer rate - 70% LTV

2021

7.5%

Sources: Bloomberg; internal data

Jan-22 Apr-22 Jul-22

Offered customer mortgage rates are substantially all pre-funded

Intro

3. Intermediary market source: UK Finance

4.

Buy-to-let market source: UK Finance

CMB

FY21 portfolio summary

Average LTV of total portfolio

Average LTV of new originations

WPB

% of book in Greater London

COO

Risk

Mortgages on Standard Variable Rate

Interest-only mortgages (incl. first direct offset mortgages)

Finance

51%

67%

26%

£2.9bn

£18.6bn

Buy-to-let (BTL) mortgages

Strong mortgage growth, reaching £118.1bn in 2021 with market share gains

Direct channel market share of 20%² and intermediary market share of 6.3%, up

2.7ppts vs. FY18³

£3.0bn

Proposition development

HSBC now has over 800 intermediary partners; and extended its range of BTL

mortgages to the intermediary channel in 2021

Digitising to make it easier to remortgage, reducing application time and

improving customer experience

2022 proposition enhancements: cashback offering; green / sustainable

mortgage proposition; planned expansion of BTL, aiming to grow gross

lending share from c.3% to c.5%4 by end 2022

34View entire presentation