Deutsche Bank Fixed Income Presentation Deck

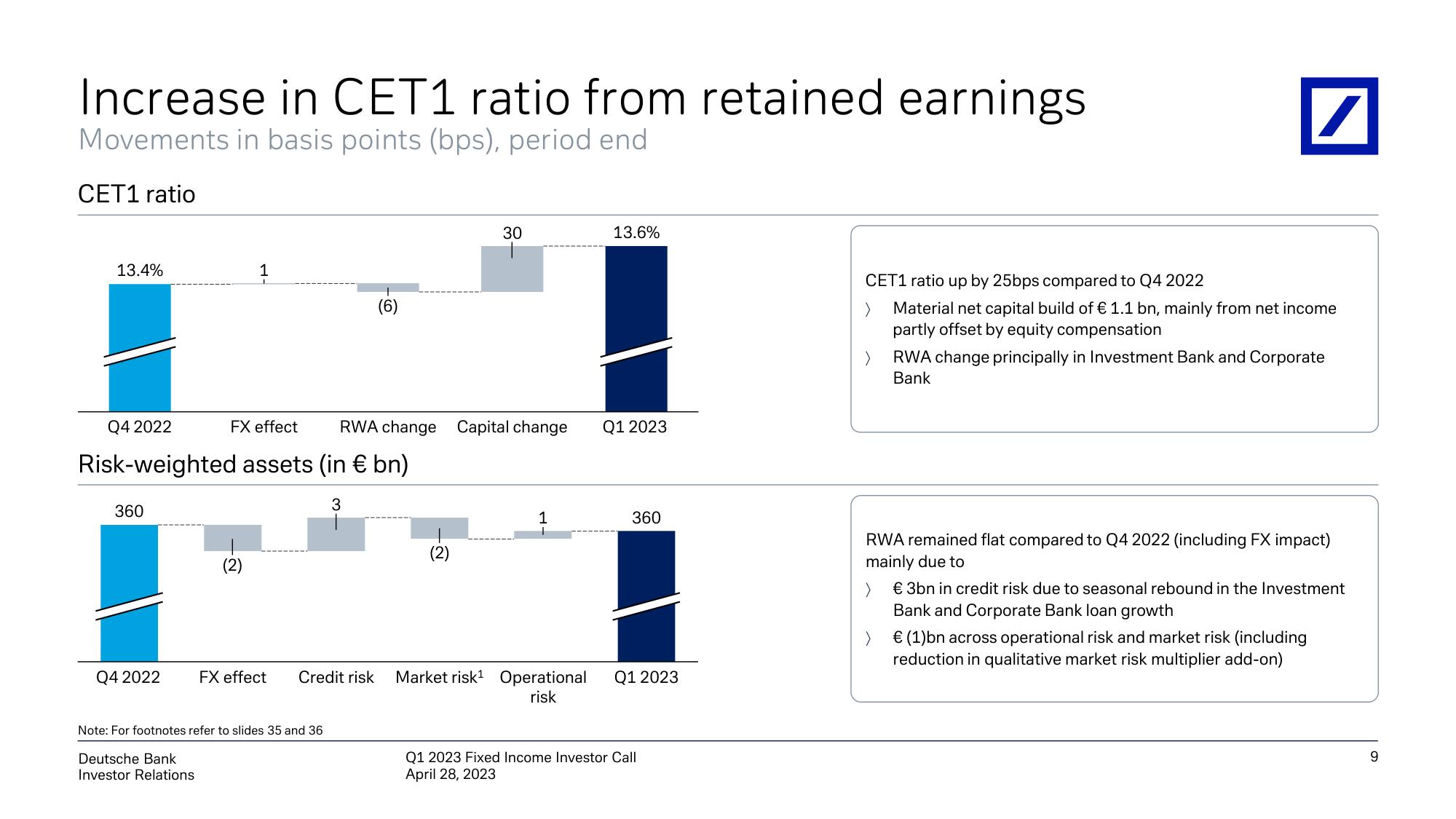

Increase in CET1 ratio from retained earnings

Movements in basis points (bps), period end

CET1 ratio

13.4%

360

Q4 2022

Risk-weighted assets (in € bn)

Q4 2022

Deutsche Bank

Investor Relations

FX effect RWA change Capital change

(2)

Note: For footnotes refer to slides 35 and 36

(6)

3

FX effect Credit risk

30

1

Market risk¹ Operational

risk

13.6%

Q1 2023

360

Q1 2023

Q1 2023 Fixed Income Investor Call

April 28, 2023

/

CET1 ratio up by 25bps compared to Q4 2022

Material net capital build of € 1.1 bn, mainly from net income

partly offset by equity compensation

> RWA change principally in Investment Bank and Corporate

Bank

RWA remained flat compared to Q4 2022 (including FX impact)

mainly due to

> € 3bn in credit risk due to seasonal rebound in the Investment

Bank and Corporate Bank loan growth

€ (1) bn across operational risk market risk (including

reduction in qualitative market risk multiplier add-on)

9View entire presentation