Uber Results Presentation Deck

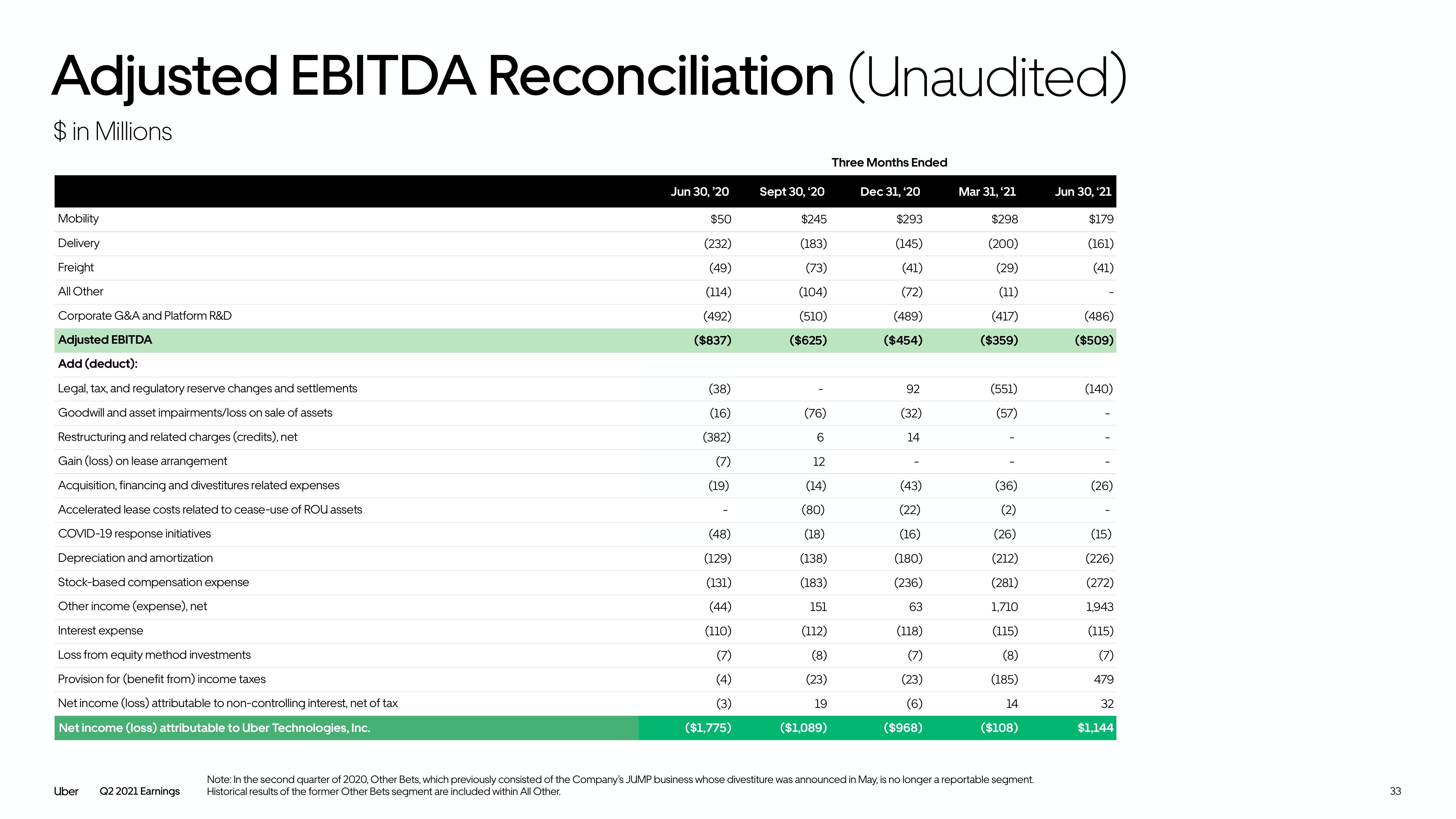

Adjusted EBITDA Reconciliation (Unaudited)

$ in Millions

Mobility

Delivery

Freight

All Other

Corporate G&A and Platform R&D

Adjusted EBITDA

Add (deduct):

Legal, tax, and regulatory reserve changes and settlements

Goodwill and asset impairments/loss on sale of assets

Restructuring and related charges (credits), net

Gain (loss) on lease arrangement

Acquisition, financing and divestitures related expenses

Accelerated lease costs related to cease-use of ROU assets

COVID-19 response initiatives

Depreciation and amortization

Stock-based compensation expense

Other income (expense), net

Interest expense

Loss from equity method investments

Provision for (benefit from) income taxes

Net income (loss) attributable to non-controlling interest, net of tax

Net income (loss) attributable to Uber Technologies, Inc.

Uber

Q2 2021 Earnings

Jun 30, '20

$50

(232)

(49)

(114)

(492)

($837)

(38)

(16)

(382)

(7)

(19)

(48)

(129)

(131)

(44)

(110)

(7)

(4)

(3)

($1,775)

Sept 30, '20

$245

(183)

(73)

(104)

(510)

($625)

(76)

6

12

(14)

(80)

(18)

(138)

(183)

151

(112)

(8)

(23)

19

($1,089)

Three Months Ended

Dec 31, 20

$293

(145)

(41)

(72)

(489)

($454)

92

(32)

14

(43)

(22)

(16)

(180)

(236)

63

(118)

(7)

(23)

(6)

($968)

Mar 31, '21

$298

(200)

(29)

(11)

(417)

($359)

(551)

(57)

(36)

(2)

(26)

(212)

(281)

1,710

(115)

(8)

(185)

14

($108)

Note: In the second quarter of 2020, Other Bets, which previously consisted of the Company's JUMP business whose divestiture was announced in May, is no longer a reportable segment.

Historical results of the former Other Bets segment are included within All Other.

Jun 30, '21

$179

(161)

(41)

(486)

($509)

(140)

(26)

(15)

(226)

(272)

1,943

(115)

(7)

479

32

$1,144

33View entire presentation