KKR Real Estate Finance Trust Investor Presentation Deck

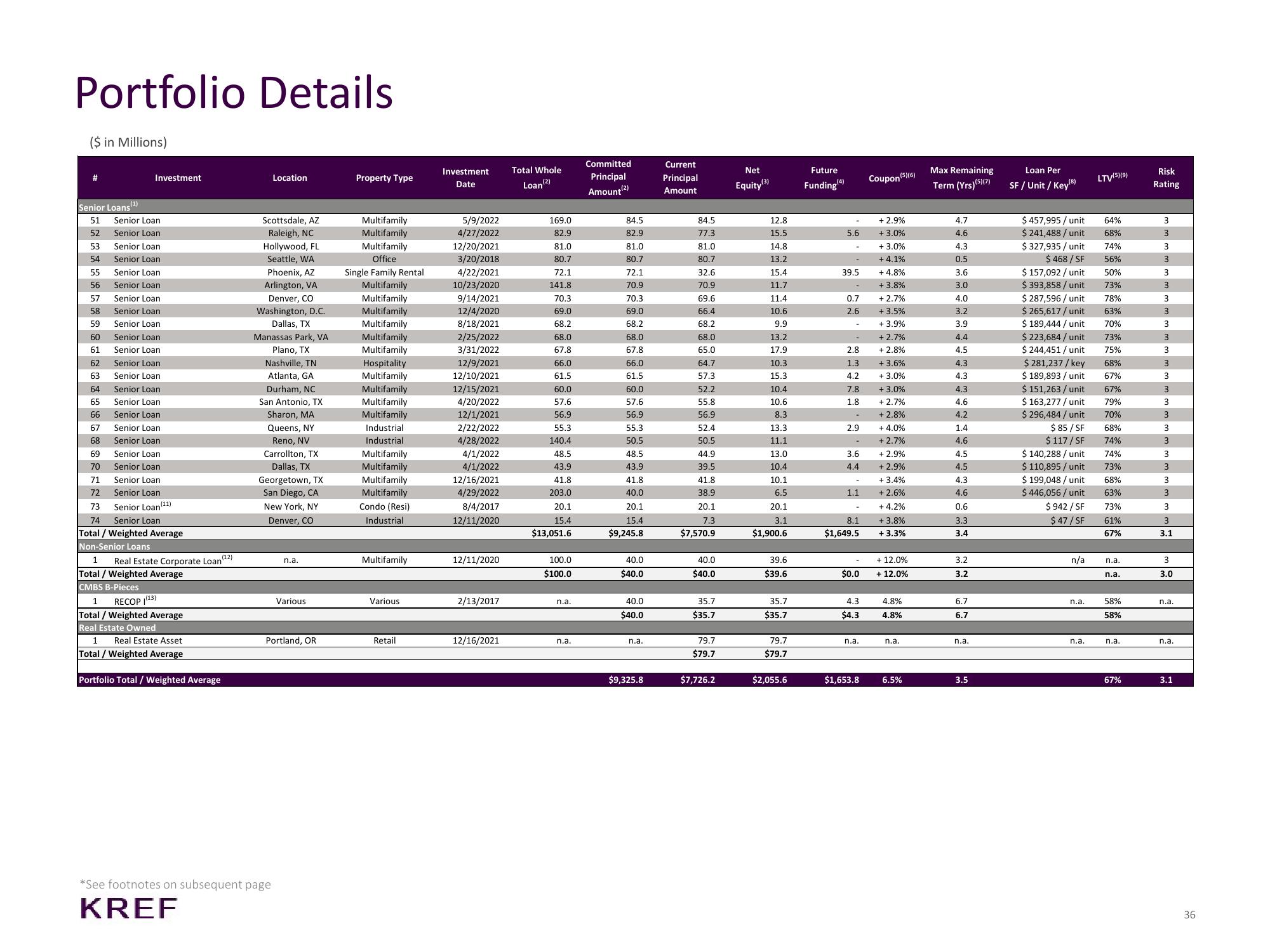

Portfolio Details

($ in Millions)

Senior Loans (¹)

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

Investment

Senior Loan.

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan (11)

73

74 Senior Loan

Total / Weighted Average

Non-Senior Loans

1 Real Estate Corporate Loan (¹2)

Total / Weighted Average

CMBS B-Pieces

1

RECOP (13)

Total / Weighted Average

Real Estate Owned

1 Real Estate Asset

Total / Weighted Average

Portfolio Total / Weighted Average

Location

Scottsdale, AZ

Raleigh, NC

Hollywood, FL

Seattle, WA

Phoenix, AZ

Arlington, VA

Denver, CO

Washington, D.C.

Dallas, TX

Manassas Park, VA

Plano, TX

Nashville, TN

Atlanta, GA

Durham, NC

San Antonio, TX

Sharon, MA

Queens, NY

Reno, NV

Carrollton, TX

Dallas, TX

Georgetown, TX

San Diego, CA

New York, NY

Denver, CO

*See footnotes on subsequent page

KREF

n.a.

Various

Portland, OR

Property Type

Multifamily

Multifamily

Multifamily

Office

Single Family Rental

Multifamily

Multifamily

Multifamily

Multifamily

Multifamily

Multifamily

Hospitality

Multifamily.

Multifamily

Multifamily

Multifamily

Industrial

Industrial

Multifamily

Multifamily

Multifamily

Multifamily

Condo (Resi)

Industrial

Multifamily

Various

Retail

Investment

Date

5/9/2022

4/27/2022

12/20/2021

3/20/2018

4/22/2021

10/23/2020

9/14/2021

12/4/2020

8/18/2021

2/25/2022

3/31/2022

12/9/2021

12/10/2021

12/15/2021

4/20/2022

12/1/2021

2/22/2022

4/28/2022

4/1/2022

4/1/2022

12/16/2021

4/29/2022

8/4/2017

12/11/2020

12/11/2020

2/13/2017

12/16/2021

Total Whole

Loan (2)

169.0

82.9

81.0

80.7

72.1

141.8

70.3

69.0

68.2

68.0

67.8

66.0

61.5

60.0

57.6

56.9

55.3

140.4

48.5

43.9

41.8

203.0

20.1

15.4

$13,051.6

100.0

$100.0

n.a.

n.a.

Committed

Principal

Amount (2)

84.5

82.9

81.0

80.7

72.1

70.9

70.3

69.0

68.2

68.0

67.8

66.0

61.5

60.0

57.6

56.9

55.3

50.5

48.5

43.9

41.8

40.0

20.1

15.4

$9,245.8

40.0

$40.0

40.0

$40.0

n.a.

$9,325.8

Current

Principal

Amount

84.5

77.3

81.0

80.7

32.6

70.9

69.6

66.4

68.2

68.0

65.0

64.7

57.3

52.2

55.8

56.9

52.4

50.5

44.9

39.5

41.8

38.9

20.1

7.3

$7,570.9

40.0

$40.0

35.7

$35.7

79.7

$79.7

$7,726.2

Net

Equity (3)

12.8

15.5

14.8

13.2

15.4

11.7

11.4

10.6

9.9

13.2

17.9

10.3

15.3

10.4

10.6

8.3

13.3

11.1

13.0

10.4

10.1

6.5

20.1

3.1

$1,900.6

39.6

$39.6

35.7

$35.7

79.7

$79.7

$2,055.6

Future

Funding(4)

-

5.6

39.5

0.7

2.6

2.8

1.3

4.2

7.8

1.8

2.9

-

3.6

4.4

1.1

8.1

$1,649.5

$0.0

4.3

$4.3

n.a.

$1,653.8

Coupon (5)(6)

+ 2.9%

+ 3.0%

+ 3.0%

+ 4.1%

+ 4.8%

+ 3.8%

+ 2.7%

+ 3.5%

+ 3.9%

+2.7%

+ 2.8%

+

3.6%

+ 3.0%

+ 3.0%

+ 2.7%

+ 2.8%

+ 4.0%

+ 2.7%

+ 2.9%

+ 2.9%

+ 3.4%

+ 2.6%

+ 4.2%

+ 3.8%

+ 3.3%

+ 12.0%

+ 12.0%

4.8%

4.8%

n.a.

6.5%

Max Remaining

Term (Yrs) (5) (7)

4.7

4.6

4.3

0.5

3.6

3.0

4.0

3.2

3.9

4.4

4.5

4.3

4.3

4.3

4.6

4.2

1.4

4.6

4.5

4.5

4.3

4.6

0.6

3.3

3.4

3.2

3.2

6.7

6.7

n.a.

3.5

Loan Per

SF / Unit / Key(8)

$ 457,995 / unit

$ 241,488 / unit

$327,935 / unit

$ 468/SF

$ 157,092 / unit

$ 393,858 / unit

$ 287,596 / unit

$ 265,617 / unit

$ 189,444 / unit

$223,684 / unit

$ 244,451 / unit

$ 281,237/key

$ 189,893/unit

$ 151,263/unit

$ 163,277 / unit

$ 296,484 / unit

$ 85/SF

$ 117/SF

$ 140,288 / unit

$ 110,895/ unit

$ 199,048 / unit

$ 446,056 / unit

$942/SF

$ 47/SF

n/a

n.a.

n.a.

LTV(5)(9)

64%

68%

74%

56%

50%

73%

78%

63%

70%

73%

75%

68%

67%

67%

79%

70%

68%

74%

74%

73%

68%

63%

73%

61%

67%

n.a.

n.a.

58%

58%

n.a.

67%

Risk

Rating

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3

3.1

3

3.0

n.a.

n.a.

3.1

36View entire presentation