Alcon Q1 2023 Earnings Presentation

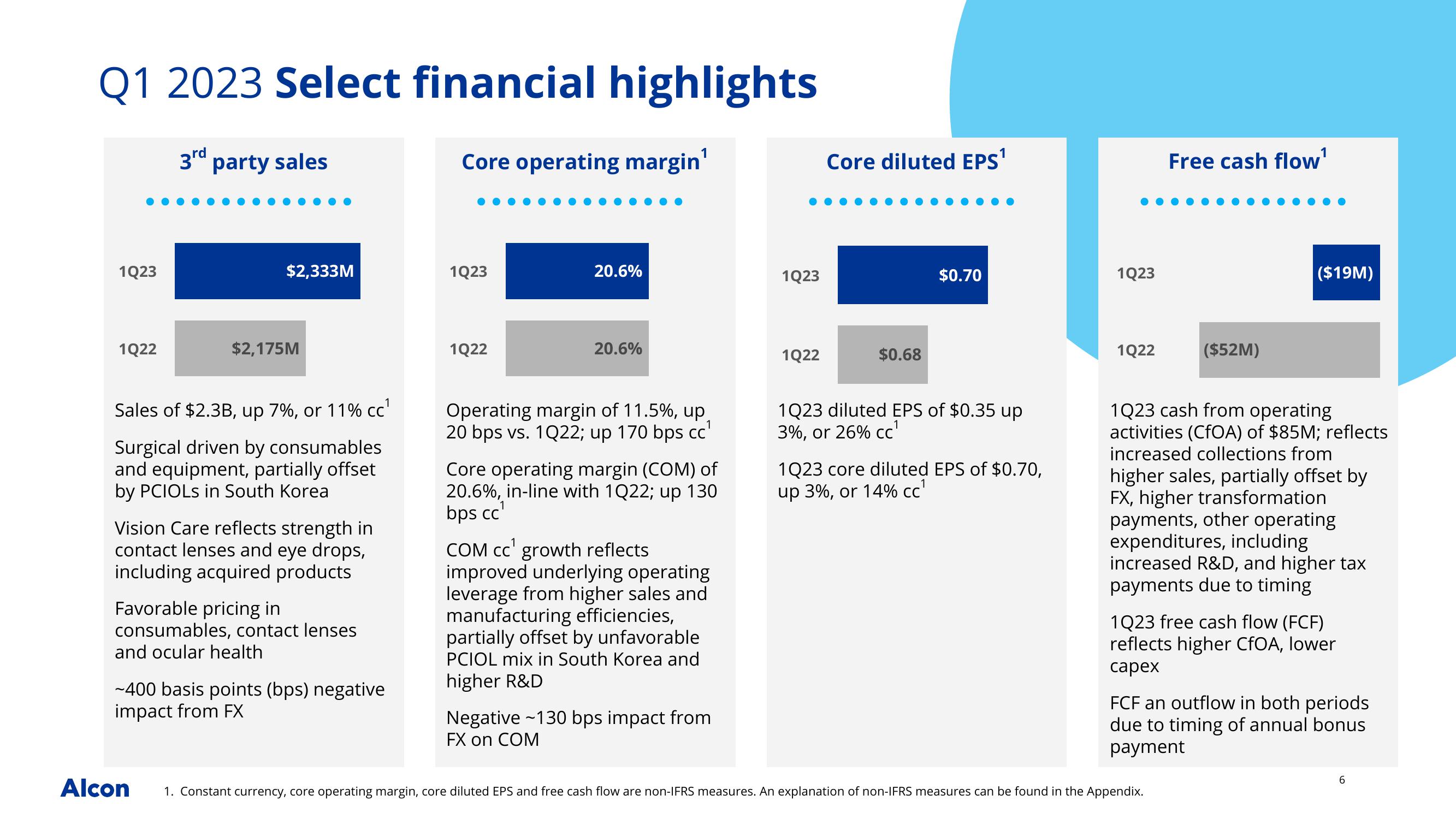

Q1 2023 Select financial highlights

Core operating margin'

1Q23

1Q22

3rd

party sales

$2,333M

$2,175M

Sales of $2.3B, up 7%, or 11% cc¹

Surgical driven by consumables

and equipment, partially offset

by PCIOLS in South Korea

Alcon

Vision Care reflects strength in

contact lenses and eye drops,

including acquired products

Favorable pricing in

consumables, contact lenses

and ocular health

~400 basis points (bps) negative

impact from FX

1Q23

1Q22

20.6%

20.6%

Operating margin of 11.5%, up

20 bps vs. 1Q22; up 170 bps cc¹

Core operating margin (COM) of

20.6%, in-line with 1Q22; up 130

bps cc¹

COM cc growth reflects

improved underlying operating

leverage from higher sales and

manufacturing efficiencies,

partially offset by unfavorable

PCIOL mix in South Korea and

higher R&D

Negative -130 bps impact from

FX on COM

1Q23

1Q22

Core diluted EPS¹

$0.68

$0.70

1Q23 diluted EPS of $0.35 up

3%, or 26% cc¹

1Q23 core diluted EPS of $0.70,

up 3%, or 14% cc¹

1Q23

1Q22

Free cash flow¹

($52M)

($19M)

1Q23 cash from operating

activities (CfOA) of $85M; reflects

increased collections from

higher sales, tially offset by

FX, higher transformation

payments, other operating

expenditures, including

increased R&D, and higher tax

payments due to timing

1. Constant currency, core operating margin, core diluted EPS and free cash flow are non-IFRS measures. An explanation of non-IFRS measures can be found in the Appendix.

1Q23 free cash flow (FCF)

reflects higher CfOA, lower

capex

FCF an outflow in both periods

due to timing of annual bonus

payment

6View entire presentation