Paysafe Results Presentation Deck

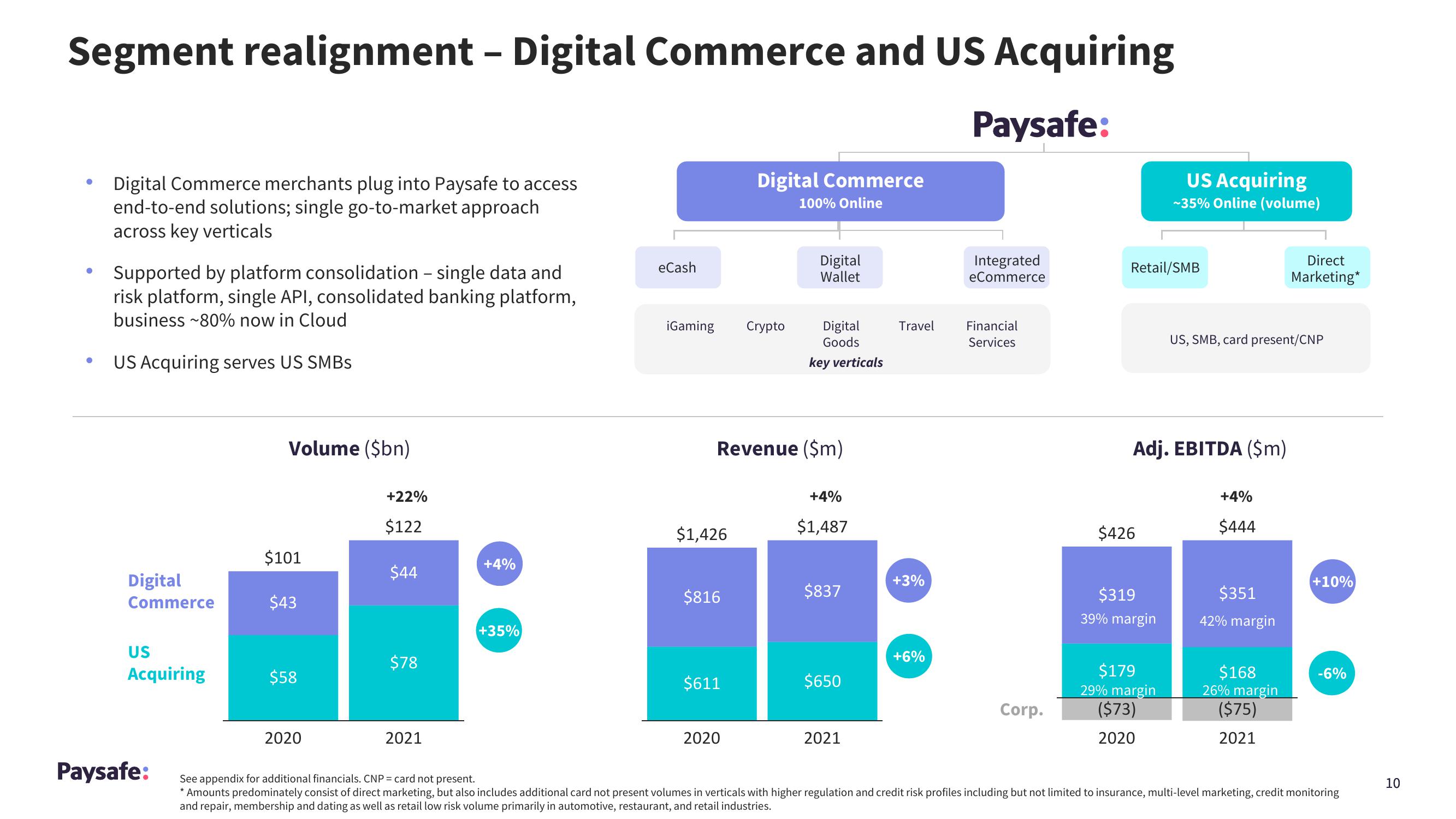

Segment realignment - Digital Commerce and US Acquiring

Paysafe:

●

●

Digital Commerce merchants plug into Paysafe to access

end-to-end solutions; single go-to-market approach

across key verticals

Supported by platform consolidation - single data and

risk platform, single API, consolidated banking platform,

business ~80% now in Cloud

US Acquiring serves US SMBs

Digital

Commerce

US

Acquiring

Paysafe:

Volume ($bn)

$101

$43

$58

2020

+22%

$122

$44

$78

2021

+4%

+35%

eCash

iGaming Crypto

$1,426

$816

Digital Commerce

100% Online

Revenue ($m)

$611

2020

Digital

Wallet

Digital

Goods

key verticals

+4%

$1,487

$837

$650

2021

Travel

+3%

+6%

Integrated

eCommerce

Financial

Services

Corp.

Retail/SMB

$426

US Acquiring

-35% Online (volume)

Adj. EBITDA ($m)

$319

39% margin

$179

29% margin

($73)

2020

US, SMB, card present/CNP

+4%

$444

$351

42% margin

Direct

Marketing*

$168

26% margin

($75)

2021

+10%

-6%

See appendix for additional financials. CNP = card not present.

* Amounts predominately consist of direct marketing, but also includes additional card not present volumes in verticals with higher regulation and credit risk profiles including but not limited to insurance, multi-level marketing, credit monitoring

and repair, membership and dating as well as retail low risk volume primarily in automotive, restaurant, and retail industries.

10View entire presentation