Analyst Day Presentation

60

61

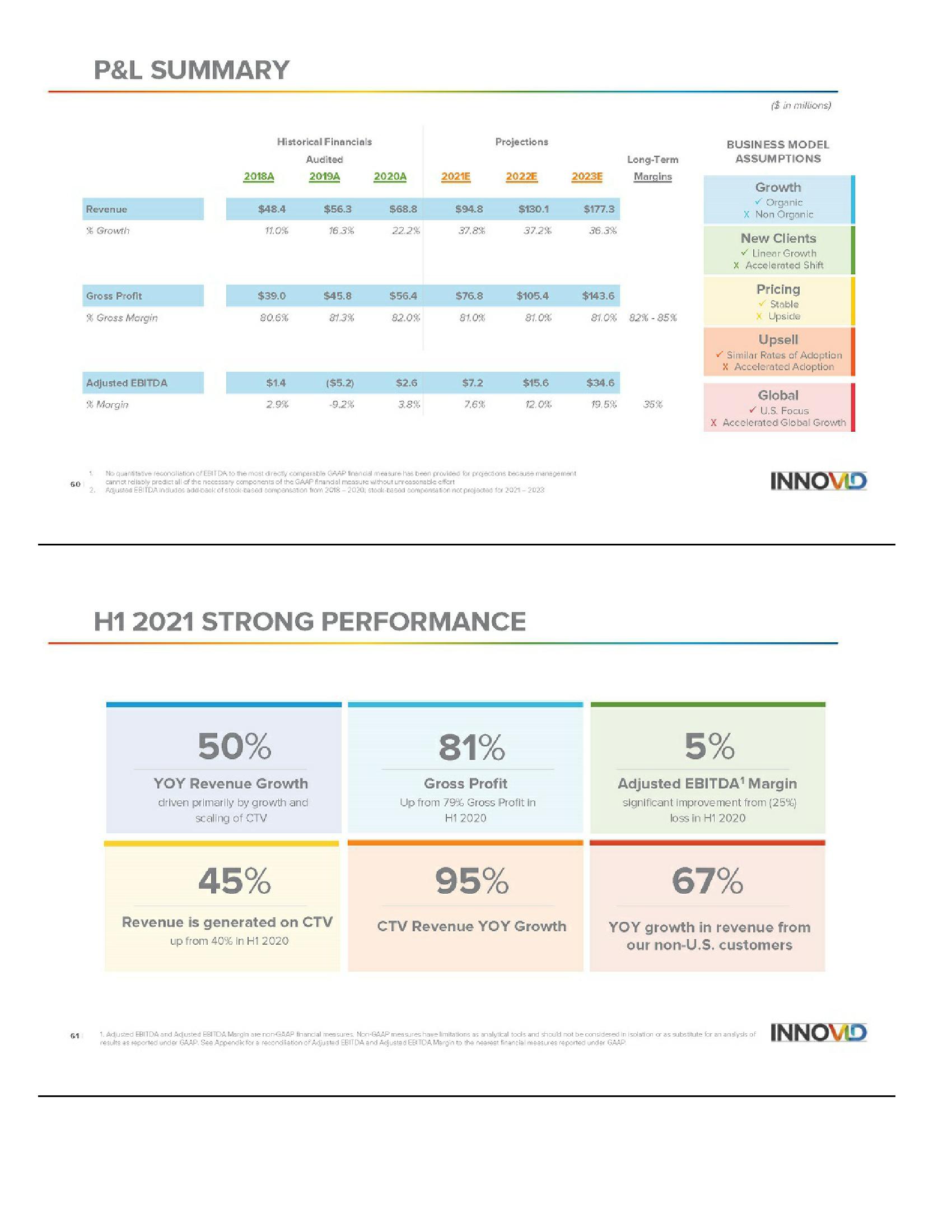

P&L SUMMARY

Revenue

% Growth

Gross Profit

% Gross Margin

Adjusted EBITDA

% Margin

1.

2.

2018A

Historical Financials

$48.4

11.0%

$39.0

$1.4

2.9%

Audited

2019A

$56.3

16.3%

50%

YOY Revenue Growth

driven primarily by growth and

scaling of CTV

$45.8

81.3%

($5.2)

-9,2%

2020A

$68.8

45%

Revenue is generated on CTV

up from 40% in H1 2020

22.2%

$56.4

82.0%

$2.6

3.8%

2021E

$94.8

37.8%

$76.8

81.0%

$7.2

7,6%

Projections

2022E

81%

$130.1

37.2%

95%

$105.4

81.0%

No quantitative reconciliation of EBITDA to the most directly comparable GAAP financial measure has been provided for projections because management

cannot reliably predict all of the necessary components of the GAAP finandal measure without unreasonable effort

Adjusted EBITDA indudes add-back of stock-based compensation from 2018-2020, stock-based compensation not projected for 2021-2023

H1 2021 STRONG PERFORMANCE

$15.6

12.0%

Gross Profit

Up from 79% Gross Profit in

H12020

2023E

CTV Revenue YOY Growth

$177.3

36.3%

$143.6

81.0% 82% -85%

$34.6

Long-Term

Margins

19,5%

($ in millions)

BUSINESS MODEL

ASSUMPTIONS

Growth

✓ Organic

X Non Organic

New Clients

✓ Linear Growth

X Accelerated Shift

Pricing

✓ Stable

x Upside

Upsell

✓Similar Rates of Adoption

X Accelerated Adoption

Global

U.S. Focus

X Accelerated Global Growth

INNOVID

5%

Adjusted EBITDA¹ Margin

significant improvement from (25%)

loss in H1 2020

67%

YOY growth in revenue from

our non-U.S. customers

1. Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. Non-GAAP measures have limitations as analytical tools and should not be considered in isolation or as substitute for an analysis of INNOVD

results as reported under GAAP See Appendic for a recondliation of Adjusted EBITDA and Adjusted EBITOA Margin to the nearest financial measures reported under GAAPView entire presentation