Tesla Results Presentation Deck

HIGHLIGHTS

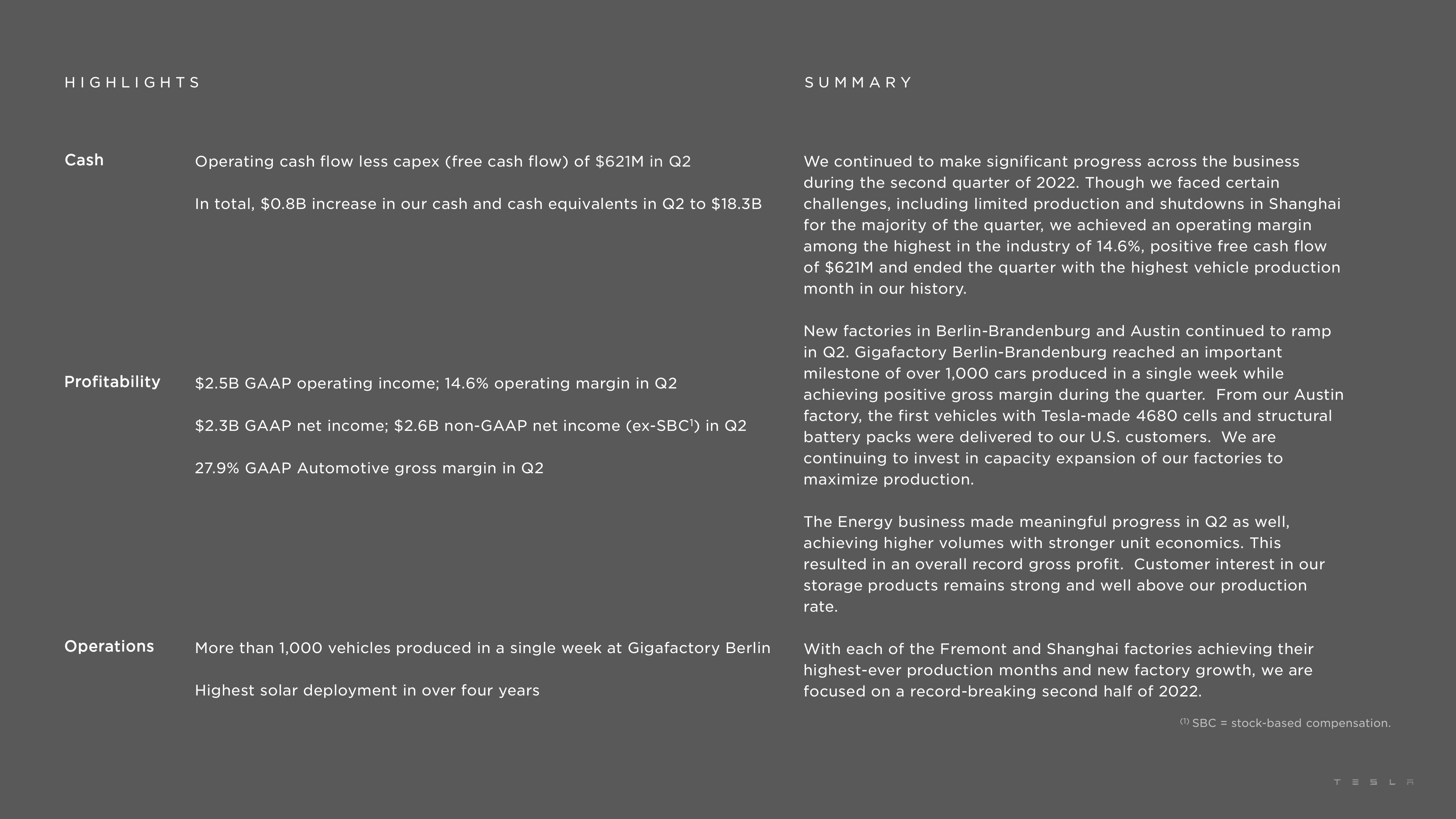

Cash

Profitability

Operations

Operating cash flow less capex (free cash flow) of $621M in Q2

In total, $0.8B increase in our cash and cash equivalents in Q2 to $18.3B

$2.5B GAAP operating income; 14.6% operating margin in Q2

$2.3B GAAP net income; $2.6B non-GAAP net income (ex-SBC¹) in Q2

27.9% GAAP Automotive gross margin in Q2

More than 1,000 vehicles produced in a single week at Gigafactory Berlin

Highest solar deployment in over four years

SUMMARY

We continued to make significant progress across the business

during the second quarter of 2022. Though we faced certain

challenges, including limited production and shutdowns in Shanghai

for the majority of the quarter, we achieved an operating margin

among the highest in the industry of 14.6%, positive free cash flow

of $621M and ended the quarter with the highest vehicle production

month in our history.

New factories in Berlin-Brandenburg and Austin continued to ramp

in Q2. Gigafactory Berlin-Brandenburg reached an important

milestone of over 1,000 cars produced in a single week while

achieving positive gross margin during the quarter. From our Austin

factory, the first vehicles with Tesla-made 4680 cells and structural

battery packs were delivered to our U.S. customers. We are

continuing to invest in capacity expansion of our factories to

maximize production.

The Energy business made meaningful progress in Q2 as well,

achieving higher volumes with stronger unit economics. This

resulted in an overall record gross profit. Customer interest in our

storage products remains strong and well above our production

rate.

With each of the Fremont and Shanghai factories achieving their

highest-ever production months and new factory growth, we are

focused on a record-breaking second half of 2022.

(1) SBC = stock-based compensation.

TESLAView entire presentation