Trian Partners Activist Presentation Deck

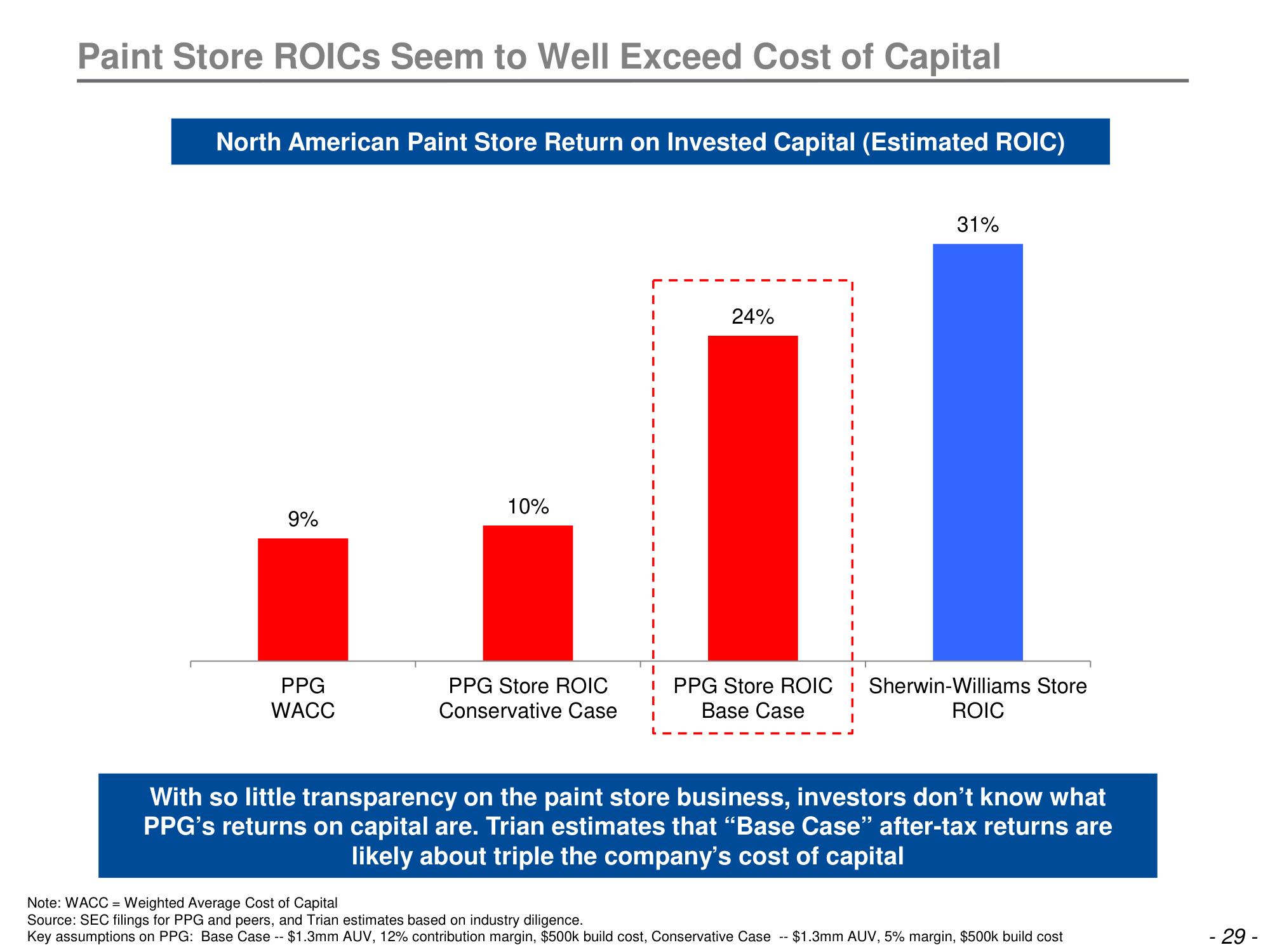

Paint Store ROICs Seem to Well Exceed Cost of Capital

North American Paint Store Return on Invested Capital (Estimated ROIC)

9%

PPG

WACC

10%

PPG Store ROIC

Conservative Case

24%

PPG Store ROIC

Base Case

31%

Sherwin-Williams Store

ROIC

With so little transparency on the paint store business, investors don't know what

PPG's returns on capital are. Trian estimates that "Base Case" after-tax returns are

likely about triple the company's cost of capital

Note: WACC = Weighted Average Cost of Capital

Source: SEC filings for PPG and peers, and Trian estimates based on industry diligence.

Key assumptions on PPG: Base Case -- $1.3mm AUV, 12% contribution margin, $500k build cost, Conservative Case -- $1.3mm AUV, 5% margin, $500k build cost

- 29 -View entire presentation