Oatly Results Presentation Deck

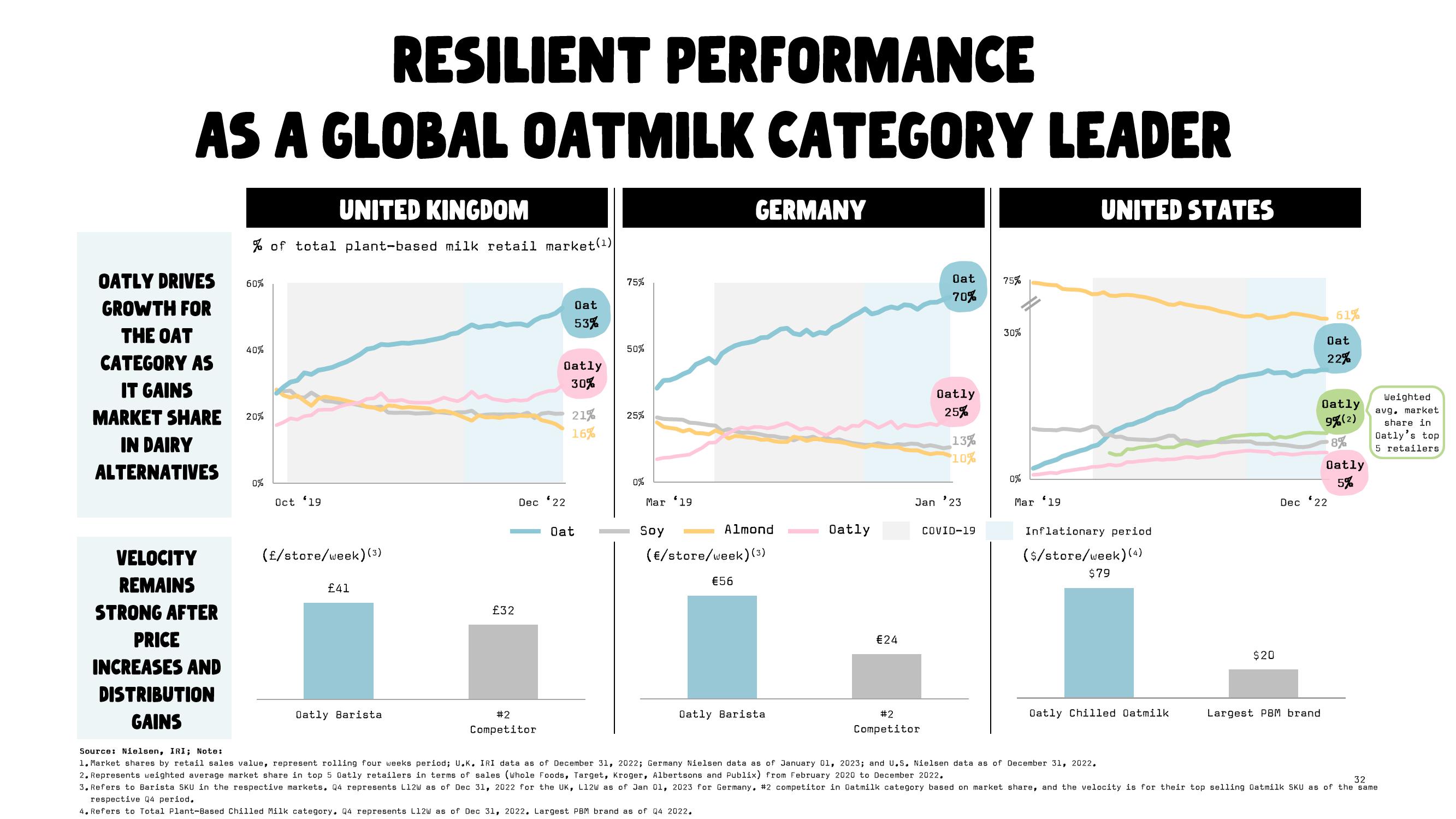

RESILIENT PERFORMANCE

AS A GLOBAL OATMILK CATEGORY LEADER

UNITED STATES

OATLY DRIVES 60%

GROWTH FOR

THE OAT

CATEGORY AS

IT GAINS

MARKET SHARE

IN DAIRY

ALTERNATIVES

UNITED KINGDOM

% of total plant-based milk retail market (¹)

VELOCITY

REMAINS

STRONG AFTER

PRICE

INCREASES AND

DISTRIBUTION

GAINS

40%

20%

0%

Oct '19

(£/store/week) (3)

£41

Oatly Barista

£32

Dec 22

#2

Competitor

Oat

53%

Oatly

30%

21%

16%

Oat

75%

50%

25%

0%

Mar 19.

Soy

Almond

(€/store/week) (³)

GERMANY

€56

Oatly Barista

Oatly

€24

Oat

70%

#2

Competitor

Oatly

25%

13%

10%

Jan '23

COVID-19

75%

30%

0%

Mar 19

Inflationary period

($/store/week) (4)

$79

Oatly Chilled Oatmilk

$20

61%

Oat

22%

Oatly

9%(2)

Largest PBM brand.

Dec 22

8%

Oatly

5%

Weighted

avg. market

share in

Oatly's top

5 retailers

Source: Nielsen, IRI; Note:

1. Market shares by retail sales value, represent rolling four weeks period; U.K. IRI data as of December 31, 2022; Germany Nielsen data as of January 01, 2023; and U.S. Nielsen data as of December 31, 2022.

2. Represents weighted average market share in top 5 Oatly retailers in terms of sales (whole Foods, Target, Kroger, Albertsons and Publix) from February 2020 to December 2022.

32

3. Refers to Barista SKU in the respective markets. Q4 represents L12W as of Dec 31, 2022 for the UK, L12W as of Jan 01, 2023 for Germany. #2 competitor in Oatmilk category based on market share, and the velocity is for their top selling Oatmilk SKU as of the same

respective Q4 period.

4. Refers to Total Plant-Based Chilled Milk category. Q4 represents L12W as of Dec 31, 2022. Largest PBM brand as of Q4 2022.View entire presentation