EVE SPAC Presentation Deck

Transaction Overview

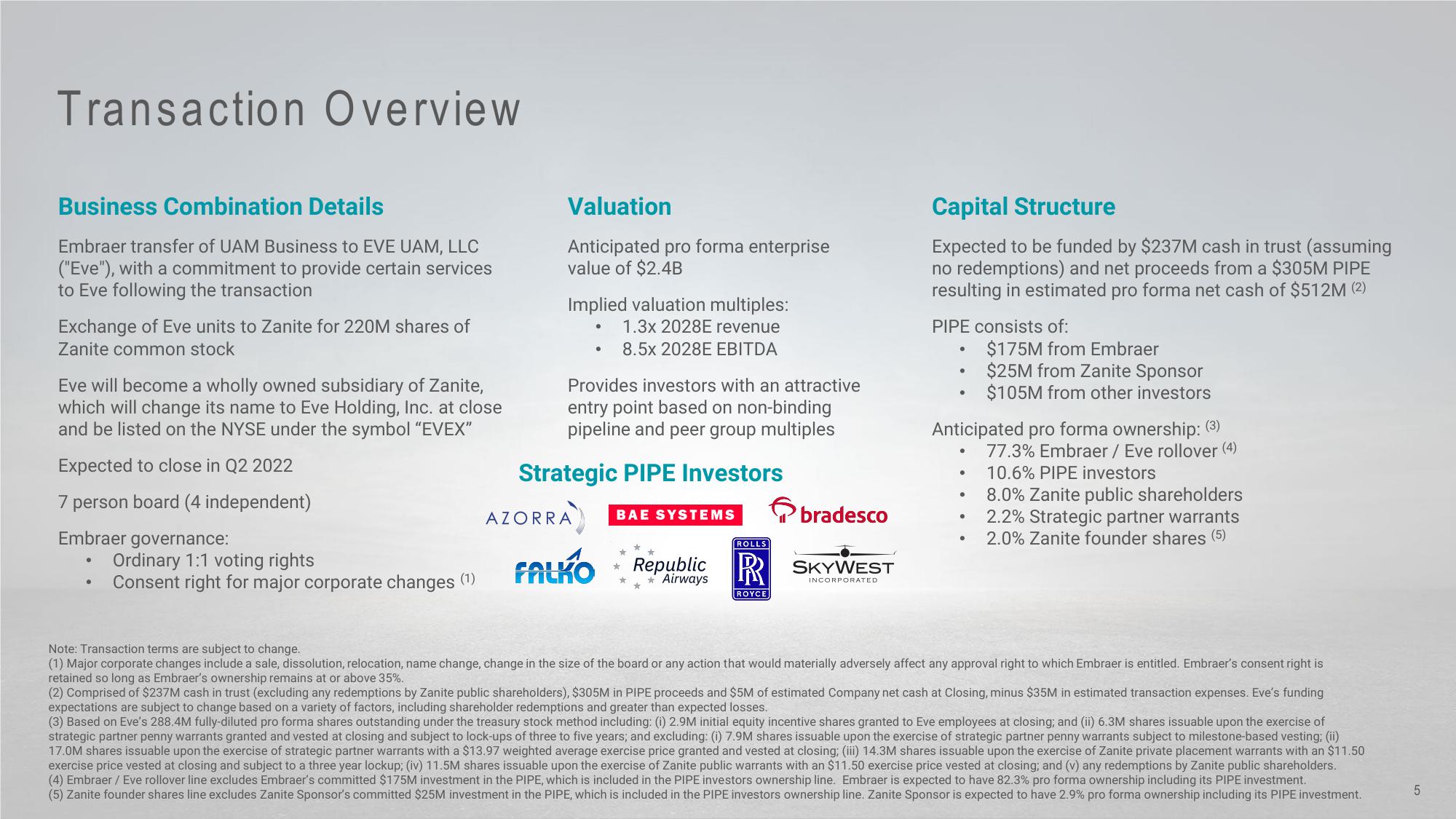

Business Combination Details

Embraer transfer of UAM Business to EVE UAM, LLC

("Eve"), with a commitment to provide certain services

to Eve following the transaction

Exchange of Eve units to Zanite for 220M shares of

Zanite common stock

Eve will become a wholly owned subsidiary of Zanite,

which will change its name to Eve Holding, Inc. at close

and be listed on the NYSE under the symbol "EVEX"

Expected to close in Q2 2022

7 person board (4 independent)

Embraer governance:

●

Ordinary 1:1 voting rights

Consent right for major corporate changes (¹)

Valuation

Anticipated pro forma enterprise

value of $2.4B

Implied valuation multiples:

1.3x 2028E revenue

8.5x 2028E EBITDA

●

Provides investors with an attractive

entry point based on non-binding

pipeline and peer group multiples

Strategic PIPE Investors

AZORRA

FALKO

BAE SYSTEMS

*

Republic

Airways

ROLLS

bradesco

RSKYWEST

ROYCE

INCORPORATED

Capital Structure

Expected to be funded by $237M cash in trust (assuming

no redemptions) and net proceeds from a $305M PIPE

resulting in estimated pro forma net cash of $512M (2)

PIPE consists of:

●

●

Anticipated pro forma ownership: (3)

77.3% Embraer / Eve rollover (4)

10.6% PIPE investors

●

.

$175M from Embraer

$25M from Zanite Sponsor

$105M from other investors

●

8.0% Zanite public shareholders

2.2% Strategic partner warrants

2.0% Zanite founder shares (5)

Note: Transaction terms are subject to change.

(1) Major corporate changes include a sale, dissolution, relocation, name change, change in the size of the board or any action that would materially adversely affect any approval right to which Embraer is entitled. Embraer's consent right is

retained so long as Embraer's ownership remains at or above 35%.

(2) Comprised of $237M cash in trust (excluding any redemptions by Zanite public shareholders), $305M in PIPE proceeds and $5M of estimated Company net cash Closing, minus $35M in estimated transaction expenses. Eve's funding

expectations are subject to change based on a variety of factors, including shareholder redemptions and greater than expected losses.

(3) Based on Eve's 288.4M fully-diluted pro forma shares outstanding under the treasury stock method including: (i) 2.9M initial equity incentive shares granted to Eve employees at closing; and (ii) 6.3M shares issuable upon the exercise of

strategic partner penny warrants granted and vested at closing and subject to lock-ups of three to five years; and excluding: (i) 7.9M shares issuable upon the exercise of strategic partner penny warrants subject to milestone-based vesting; (ii)

17.0M shares issuable upon the exercise of strategic partner warrants with a $13.97 weighted average exercise price granted and vested at closing; (iii) 14.3M shares issuable upon the exercise of Zanite private placement warrants with an $11.50

exercise price vested at closing and subject to a three year lockup; (iv) 11.5M shares issuable upon the exercise of Zanite public warrants with an $11.50 exercise price vested at closing; and (v) any redemptions by Zanite public shareholders.

(4) Embraer / Eve rollover line excludes Embraer's committed $175M investment in the PIPE, which is included in the PIPE investors ownership line. Embraer is expected to have 82.3% pro forma ownership including its PIPE investment.

(5) Zanite founder shares line excludes Zanite Sponsor's committed $25M investment in the PIPE, which is included in the PIPE investors ownership line. Zanite Sponsor is expected to have 2.9% pro forma ownership including its PIPE investment.

5View entire presentation