Matson Investor Presentation Deck

5

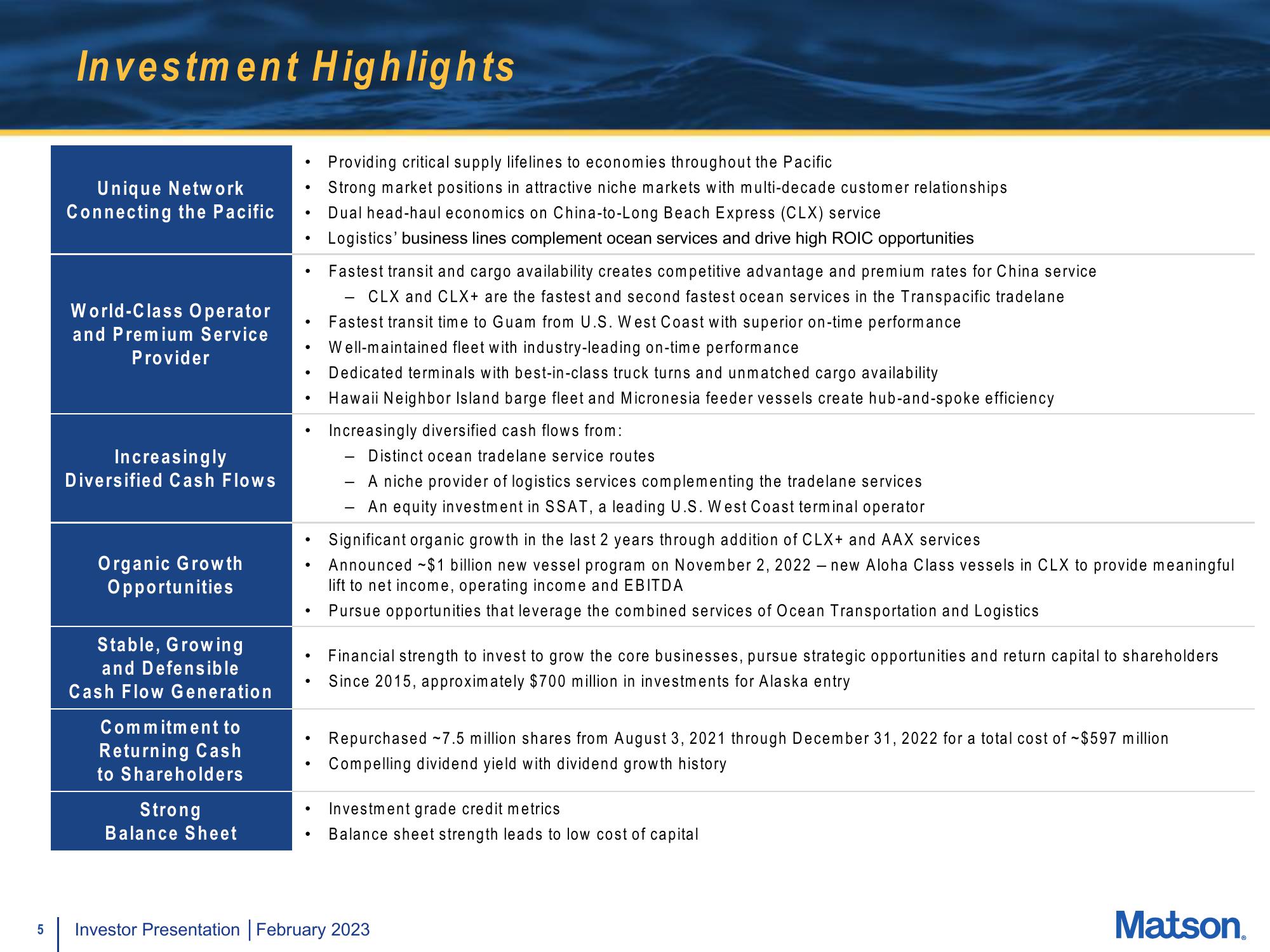

Investment Highlights

Unique Network

Connecting the Pacific

World-Class Operator

and Premium Service

Provider

Increasingly

Diversified Cash Flows

Organic Growth

Opportunities

Stable, Growing

and Defensible

Cash Flow Generation

Commitment to

Returning Cash

to Shareholders

Strong

Balance Sheet

●

●

●

●

●

●

●

Providing critical supply lifelines to economies throughout the Pacific

Strong market positions in attractive niche markets with multi-decade customer relationships

Dual head-haul economics on China-to-Long Beach Express (CLX) service

Logistics' business lines complement ocean services and drive high ROIC opportunities

Fastest transit and cargo availability creates competitive advantage and premium rates for China service

CLX and CLX+ are the fastest and second fastest ocean services in the Transpacific tradelane

Fastest transit time to Guam from U.S. West Coast with superior on-time performance

Well-maintained fleet with industry-leading on-time performance

Dedicated terminals with best-in-class truck turns and unmatched cargo availability

Hawaii Neighbor Island barge fleet and Micronesia feeder vessels create hub-and-spoke efficiency

Increasingly diversified cash flows from:

-

-

Distinct ocean tradelane service routes

A niche provider of logistics services complementing the tradelane services

An equity investment in SSAT, a leading U.S. West Coast terminal operator

Significant organic growth in the last 2 years through addition of CLX+ and AAX services

Announced $1 billion new vessel program on November 2, 2022 - new Aloha Class vessels in CLX to provide meaningful

lift to net income, operating income and EBITDA

Pursue opportunities that leverage the combined services of Ocean Transportation and Logistics

Financial strength to invest to grow the core businesses, pursue strategic opportunities and return capital to shareholders

Since 2015, approximately $700 million in investments for Alaska entry

Repurchased -7.5 million shares from August 3, 2021 through December 31, 2022 for a total cost of ~$597 million

Compelling dividend yield with dividend growth history

Investment grade credit metrics

Balance sheet strength leads to low cost of capital

Investor Presentation | February 2023

Matson.View entire presentation