Kore SPAC Presentation Deck

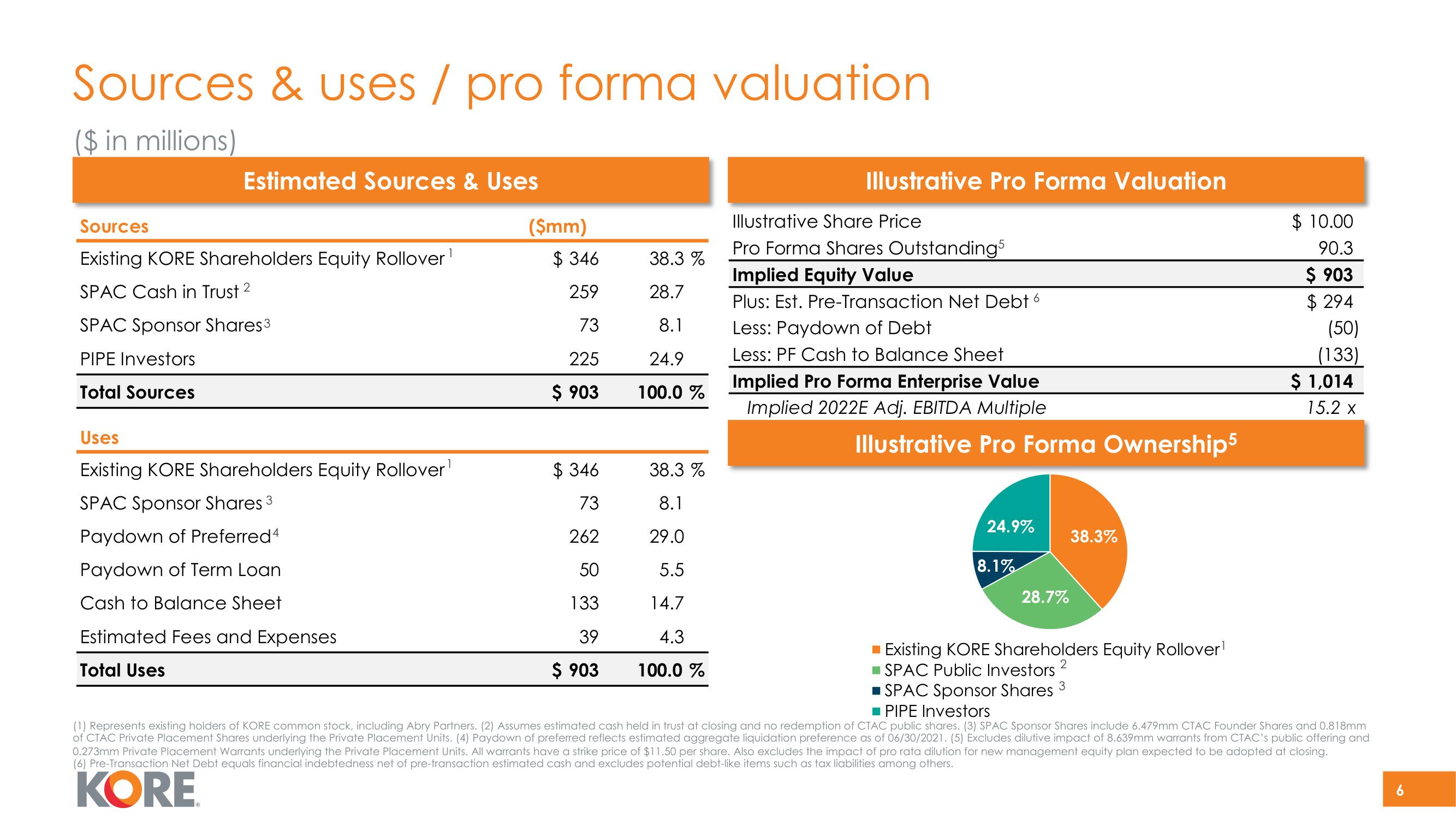

Sources & uses / pro forma valuation

($ in millions)

Estimated Sources & Uses

Sources

Existing KORE Shareholders Equity Rollover¹

SPAC Cash in Trust 2

SPAC Sponsor Shares³

PIPE Investors

Total Sources

Uses

Existing KORE Shareholders Equity Rollover¹

SPAC Sponsor Shares 3

Paydown of Preferred 4

Paydown of Term Loan

Cash to Balance Sheet

Estimated Fees and Expenses

Total Uses

($mm)

$346

259

73

225

$ 903

$346

73

262

50

133

39

$ 903

38.3 %

28.7

8.1

24.9

100.0 %

38.3 %

8.1

29.0

5.5

14.7

4.3

100.0 %

Illustrative Pro Forma Valuation

Illustrative Share Price

Pro Forma Shares Outstanding5

Implied Equity Value

Plus: Est. Pre-Transaction Net Debt6

Less: Paydown of Debt

Less: PF Cash to Balance Sheet

Implied Pro Forma Enterprise Value

Implied 2022E Adj. EBITDA Multiple

Illustrative Pro Forma Ownership5

24.9%

8.1%

28.7%

38.3%

■ Existing KORE Shareholders Equity Rollover¹

SPAC Public Investors

3

$10.00

90.3

$ 903

$294

(50)

(133)

$ 1,014

15.2 x

SPAC Sponsor Shares

■ PIPE Investors

(1) Represents existing holders of KORE common stock, including Abry Partners. (2) Assumes estimated cash held in trust at closing and no redemption of CTAC public shares. (3) SPAC Sponsor Shares include 6.479mm CTAC Founder Shares and 0.818mm

of CTAC Private Placement Shares underlying the Private Placement Units. (4) Paydown of preferred reflects estimated aggregate liquidation preference as of 06/30/2021. (5) Excludes dilutive impact of 8.639mm warrants from CTAC's public offering and

0.273mm Private Placement Warrants underlying the Private Placement Units. All warrants have a strike price of $11.50 per share. Also excludes the impact of pro rata dilution for new management equity plan expected to be adopted at closing.

(6) Pre-Transaction Net Debt equals financial indebtedness net of pre-transaction estimated cash and excludes potential debt-like items such as tax liabilities among others.

KORE

6View entire presentation