First Quarter 2023 Earnings Conference Call

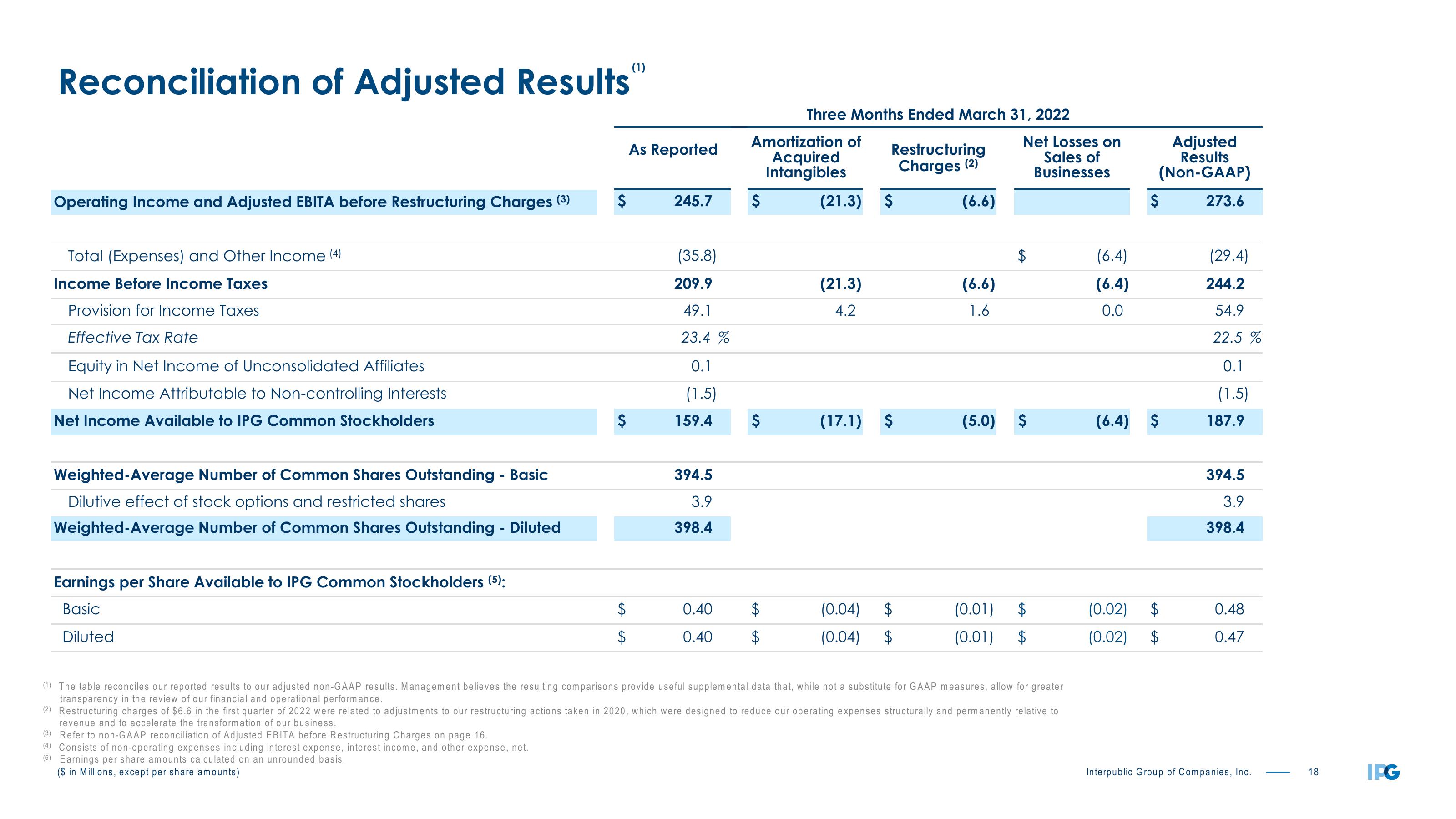

Reconciliation of Adjusted Results

Operating Income and Adjusted EBITA before Restructuring Charges (3)

Total (Expenses) and Other Income (4)

Income Before Income Taxes

Provision for Income Taxes

Effective Tax Rate

Equity in Net Income of Unconsolidated Affiliates

Net Income Attributable to Non-controlling Interests

Net Income Available to IPG Common Stockholders

Weighted-Average Number of Common Shares Outstanding - Basic

Dilutive effect of stock options and restricted shares

Weighted-Average Number of Common Shares Outstanding - Diluted

Earnings per Share Available to IPG Common Stockholders (5):

Basic

Diluted

$

(3) Refer to non-GAAP reconciliation of Adjusted EBITA before Restructuring Charges on page 16.

(4) Consists of non-operating expenses including interest expense, interest income, and other expense, net.

(5) Earnings per share amounts calculated on an unrounded basis.

($ in Millions, except per share amounts)

$

(1)

$

As Reported

245.7

(35.8)

209.9

49.1

23.4%

0.1

(1.5)

159.4

394.5

3.9

398.4

0.40

0.40

Amortization of

Acquired

Intangibles

$

Three Months Ended March 31, 2022

$

(21.3) $

(21.3)

4.2

Restructuring

Charges (2)

(17.1) $

(0.04)

(0.04)

A

(6.6)

(6.6)

1.6

Net Losses on

Sales of

Businesses

(5.0) $

(0.01)

(0.01)

(1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP measures, allow for greater

transparency in the review of our financial and operational performance.

(2) Restructuring charges of $6.6 in the first quarter of 2022 were related to adjustments to our restructuring actions taken in 2020, which were designed to reduce our operating expenses structurally and permanently relative to

revenue and to accelerate the transformation of our business.

(6.4)

(6.4)

0.0

(0.02)

(0.02)

Adjusted

Results

(Non-GAAP)

273.6

$

(6.4) $

A

(29.4)

244.2

54.9

22.5 %

0.1

(1.5)

187.9

394.5

3.9

398.4

0.48

0.47

Interpublic Group of Companies, Inc.

18

IPGView entire presentation