Zegna SPAC Presentation Deck

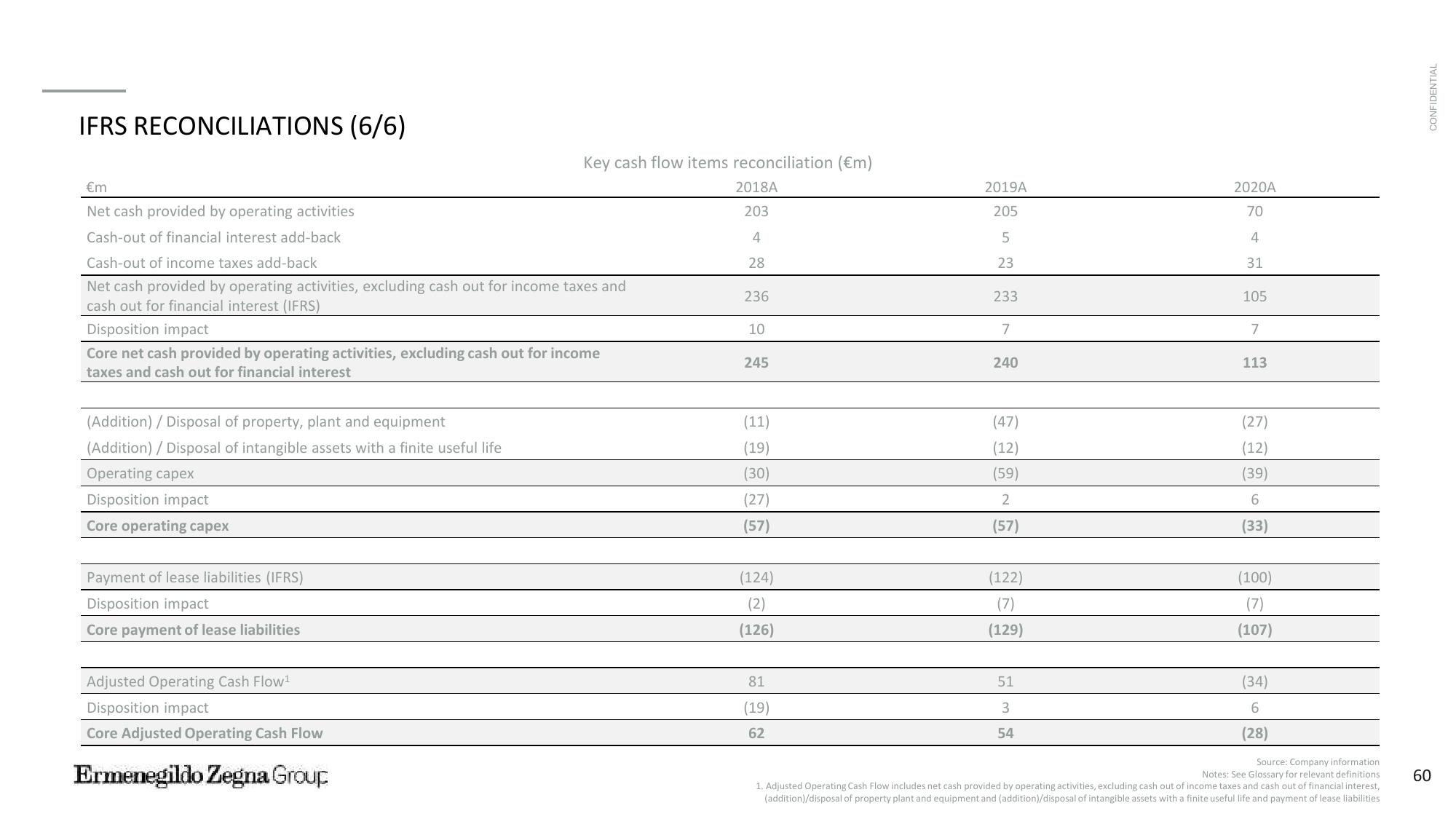

IFRS RECONCILIATIONS (6/6)

€m

Net cash provided by operating activities

Cash-out of financial interest add-back

Cash-out of income taxes add-back

Net cash provided by operating activities, excluding cash out for income taxes and

cash out for financial interest (IFRS)

Disposition impact

Core net cash provided by operating activities, excluding cash out for income

taxes and cash out for financial interest

(Addition) / Disposal of property, plant and equipment

(Addition) / Disposal of intangible assets with a finite useful life

Operating capex

Disposition impact

Core operating capex

Payment of lease liabilities (IFRS)

Disposition impact

Core payment of lease liabilities

Key cash flow items reconciliation (€m)

Adjusted Operating Cash Flow¹

Disposition impact

Core Adjusted Operating Cash Flow

Ermenegildo Zegna Group

2018A

203

4

28

236

10

245

(11)

(19)

(30)

(27)

(57)

(124)

(2)

(126)

81

(19)

62

2019A

205

5

23

233

7

240

(47)

(12)

(59)

2

(57)

(122)

(7)

(129)

51

3

54

2020A

70

4

31

105

7

113

(27)

(12)

(39)

6

(33)

(100)

(7)

(107)

(34)

6

(28)

Source: Company information.

Notes: See Glossary for relevant definitions

1. Adjusted Operating Cash Flow includes net cash provided by operating activities, excluding cash out of income taxes and cash out of financial interest,

(addition)/disposal of property plant and equipment and (addition)/disposal of intangible assets with a finite useful life and payment of lease liabilities

CONFIDENTIAL

60View entire presentation