Recommendation Report

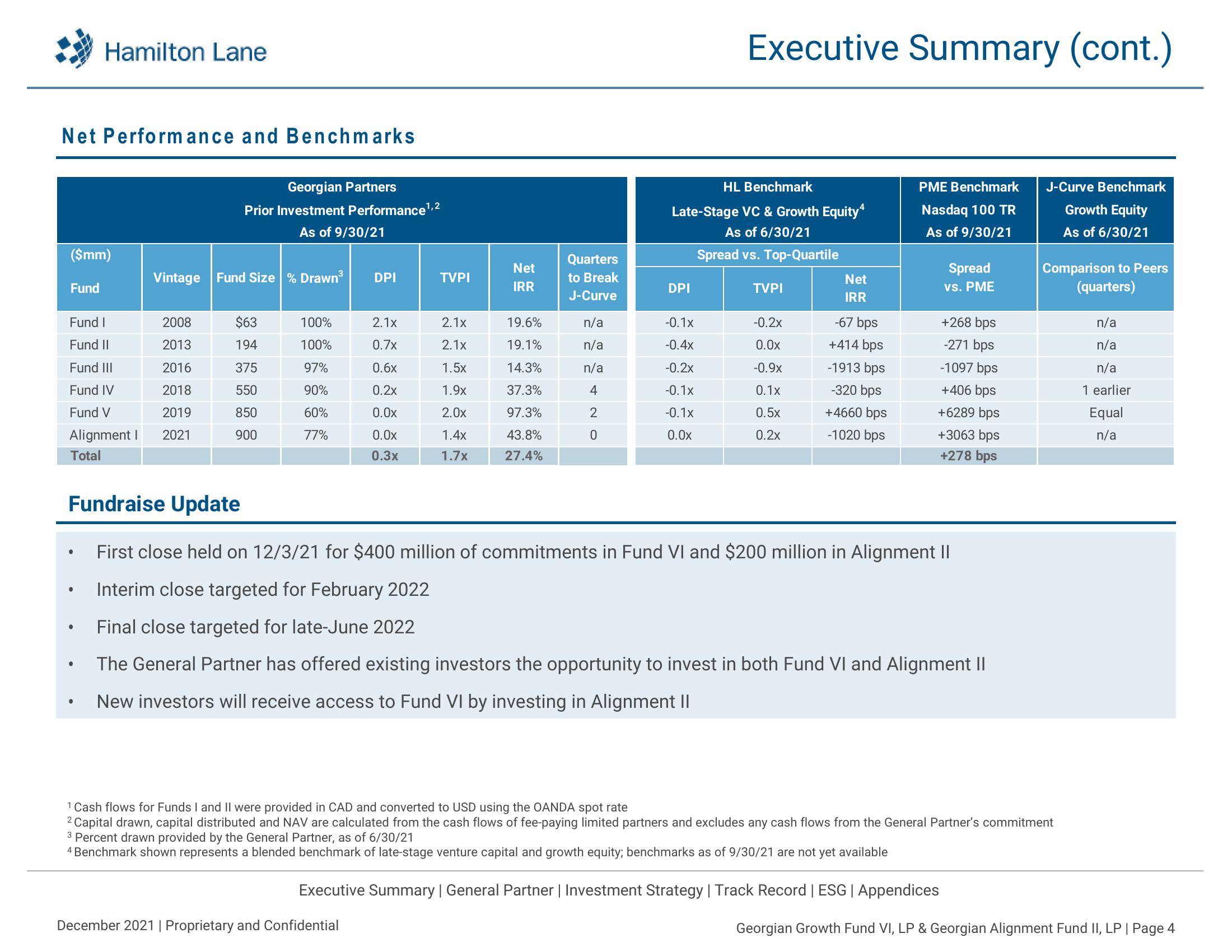

Net Performance and Benchmarks

($mm)

Fund

Fund I

Fund II

Fund III

Fund IV

Fund V

Alignment I

Total

●

Hamilton Lane

●

●

●

●

Georgian Partners

Prior Investment Performance ¹,2

As of 9/30/21

Vintage Fund Size % Drawn³

2008

2013

2016

2018

2019

2021

$63

194

375

550

850

900

100%

100%

97%

90%

60%

77%

DPI

2.1x

0.7x

0.6x

0.2x

0.0x

0.0x

0.3x

December 2021 | Proprietary and Confidential

TVPI

2.1x

2.1x

1.5x

1.9x

2.0x

1.4x

1.7x

Net

IRR

19.6%

19.1%

14.3%

37.3%

97.3%

43.8%

27.4%

Quarters

to Break

J-Curve

n/a

n/a

n/a

4

2

0

HL Benchmark

Late-Stage VC & Growth Equity4

As of 6/30/21

Spread vs. Top-Quartile

DPI

Executive Summary (cont.)

-0.1x

-0.4x

-0.2x

-0.1x

-0.1x

0.0x

TVPI

-0.2x

0.0x

-0.9x

0.1x

0.5x

0.2x

Fundraise Update

First close held on 12/3/21 for $400 million of commitments in Fund VI and $200 million in Alignment II

Interim close targeted for February 2022

Final close targeted for late-June 2022

The General Partner has offered existing investors the opportunity to invest in both Fund VI and Alignment II

New investors will receive access to Fund VI by investing in Alignment II

Net

IRR

-67 bps

+414 bps

-1913 bps

-320 bps

+4660 bps

-1020 bps

PME Benchmark J-Curve Benchmark

Nasdaq 100 TR

As of 9/30/21

Spread

vs. PME

+268 bps

-271 bps

-1097 bps

+406 bps

+6289 bps

+3063 bps

+278 bps

1 Cash flows for Funds I and II were provided in CAD and converted to USD using the OANDA spot rate

2 Capital drawn, capital distributed and NAV are calculated from the cash flows of fee-paying limited partners and excludes any cash flows from the General Partner's commitment

3 Percent drawn provided by the General Partner, as of 6/30/21

4 Benchmark shown represents a blended benchmark of late-stage venture capital and growth equity; benchmarks as of 9/30/21 are not yet available

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

Growth Equity

As of 6/30/21

Comparison to Peers

(quarters)

n/a

n/a

n/a

1 earlier

Equal

n/a

Georgian Growth Fund VI, LP & Georgian Alignment Fund II, LP | Page 4View entire presentation