Baird Investment Banking Pitch Book

EARN-OUT DISCOUNT ANALYSIS

COST OF CAPITAL ANALYSIS (¹)

12.0%

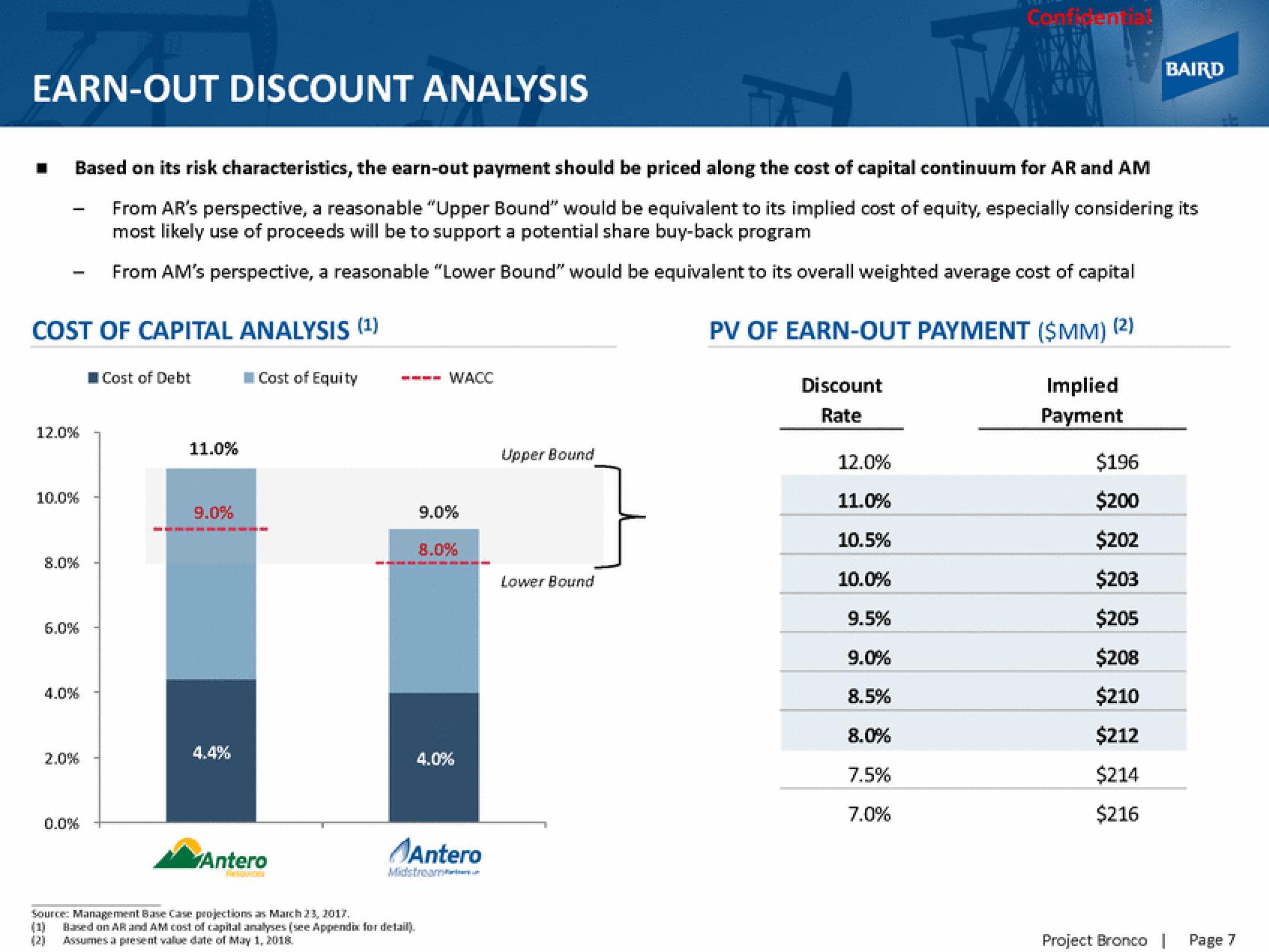

Based on its risk characteristics, the earn-out payment should be priced along the cost of capital continuum for AR and AM

From AR's perspective, a reasonable "Upper Bound" would be equivalent to its implied cost of equity, especially considering its

most likely use of proceeds will be to support a potential share buy-back program

From AM's perspective, a reasonable "Lower Bound" would be equivalent to its overall weighted average cost of capital

PV OF EARN-OUT PAYMENT ($MM) (2)

Implied

Discount

Rate

Payment

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

Cost of Debt

11.0%

9.0%

4.4%

Cost of Equity

Antero

WACC

9.0%

8.0%

| Papa a ma ka ma na m

Source: Management Base Case projections as March 23, 2017.

(1) Based on AR and AM cost of capital analyses (see Appendix for detail)

(2) Assumes a present value date of May 1, 2018

4.0%

Antero

Midstreamtare un

Upper Bound

}

Lower Bound

12.0%

11.0%

10.5%

*****

10.0%

9.5%

9.0%

8.5%

8.0%

7.5%

7.0%

Confidential

$196

$200

$202

$203

$205

$208

$210

$212

$214

$216

BAIRD

Project Bronco

Page 7View entire presentation