Inovalon Results Presentation Deck

Why is Adjusted EBITDA Margin Changing?

inovalon

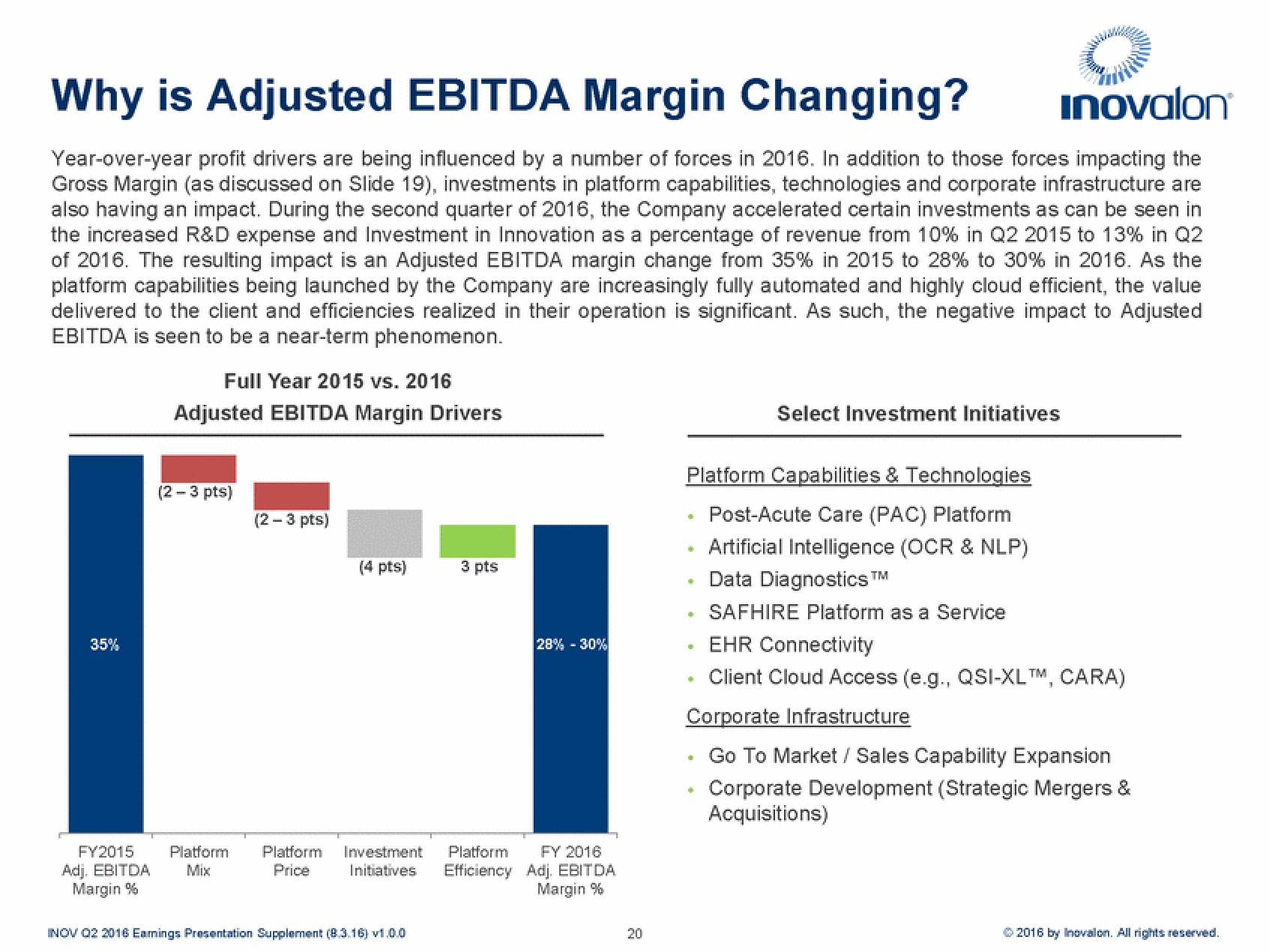

Year-over-year profit drivers are being influenced by a number of forces in 2016. In addition to those forces impacting the

Gross Margin (as discussed on Slide 19), investments in platform capabilities, technologies and corporate infrastructure are

also having an impact. During the second quarter of 2016, the Company accelerated certain investments as can be seen in

the increased R&D expense and Investment in Innovation as a percentage of revenue from 10% in Q2 2015 to 13% in Q2

of 2016. The resulting impact is an Adjusted EBITDA margin change from 35% in 2015 to 28% to 30% in 2016. As the

platform capabilities being launched by the Company are increasingly fully automated and highly cloud efficient, the value

delivered to the client and efficiencies realized in their operation is significant. As such, the negative impact to Adjusted

EBITDA is seen to be a near-term phenomenon.

35%

FY2015

Adj. EBITDA

Margin %

Full Year 2015 vs. 2016

Adjusted EBITDA Margin Drivers

(2-3 pts)

(2-3 pts)

(4 pts)

3 pts

INOV 02 2016 Eamings Presentation Supplement (8.3.16) v1.0.0

28% - 30%

Platform Platform Investment Platform FY 2016

Mix

Initiatives

Efficiency Adj. EBITDA

Price

Margin %

20

Platform Capabilities & Technologies

Post-Acute Care (PAC) Platform

Artificial Intelligence (OCR & NLP)

Data Diagnostics ™M

SAFHIRE Platform as a Service

EHR Connectivity

Client Cloud Access (e.g., QSI-XL™, CARA)

N

Select Investment Initiatives

A

Corporate Infrastructure

Go To Market / Sales Capability Expansion

Corporate Development (Strategic Mergers &

Acquisitions)

© 2016 by Inovalon. All rights reserved.View entire presentation