HSBC Results Presentation Deck

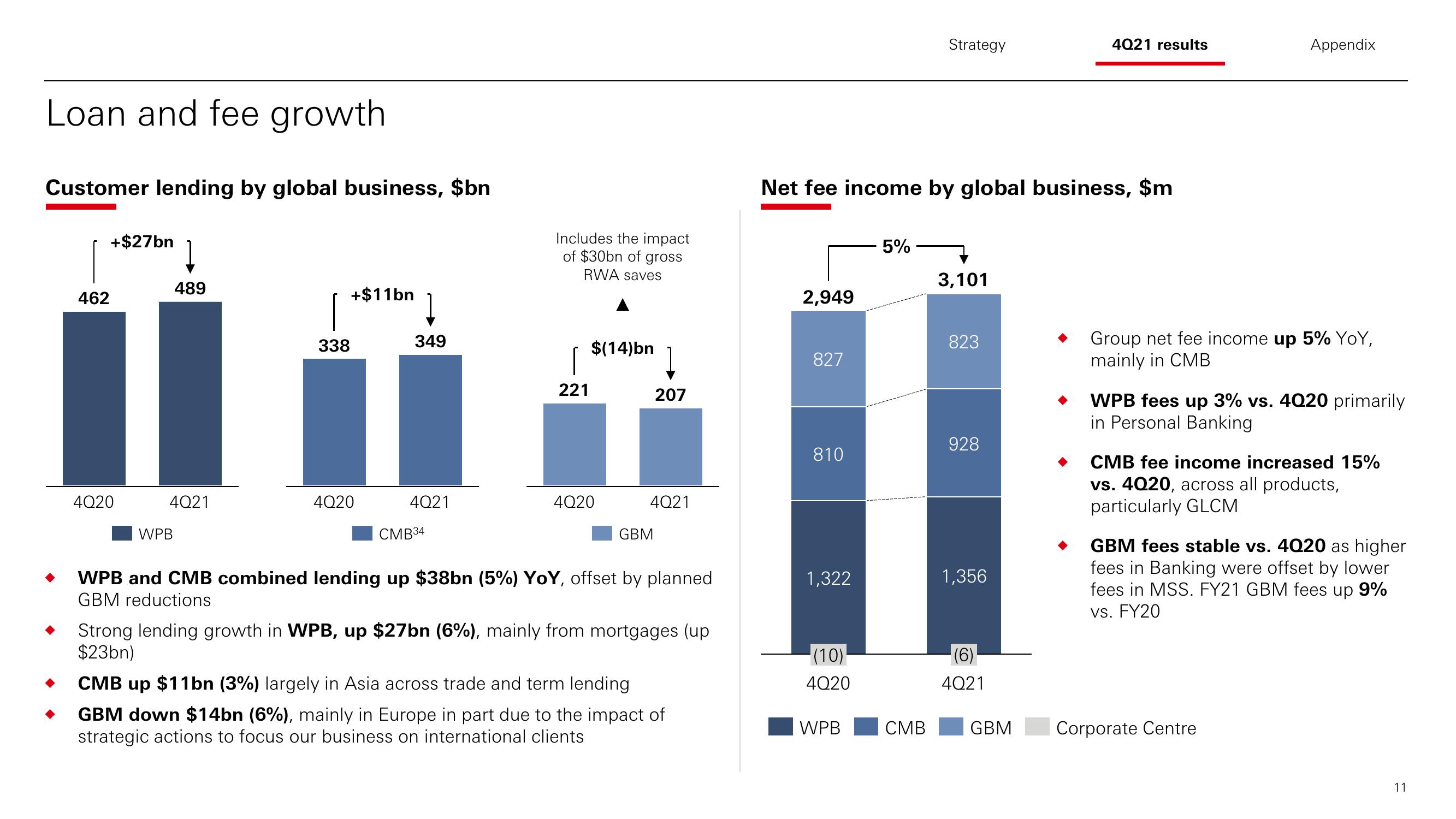

Loan and fee growth

Customer lending by global business, $bn

462

+$27bn

4Q20

489

4Q21

WPB

+$11bn

I ↓

338

349

4Q20

4Q21

CMB34

Includes the impact

of $30bn of gross

RWA saves

221

$(14)bn

4Q20

↓

207

4Q21

GBM

WPB and CMB combined lending up $38bn (5%) YoY, offset by planned

GBM reductions

Strong lending growth in WPB, up $27bn (6%), mainly from mortgages (up

$23bn)

CMB up $11bn (3%) largely in Asia across trade and term lending

GBM down $14bn (6%), mainly in Europe in part due to the impact of

strategic actions to focus our business on international clients

2,949

Net fee income by global business, $m

827

810

1,322

(10)

4Q20

WPB

5%

Strategy

CMB

3,101

823

928

1,356

(6)

4Q21

4021 results

GBM

Appendix

Group net fee income up 5% YOY,

mainly in CMB

WPB fees up 3% vs. 4020 primarily

in Personal Banking

CMB fee income increased 15%

vs. 4020, across all products,

particularly GLCM

GBM fees stable vs. 4020 as higher

fees in Banking were offset by lower

fees in MSS. FY21 GBM fees up 9%

vs. FY20

Corporate Centre

11View entire presentation