Azure Power Investor Presentation

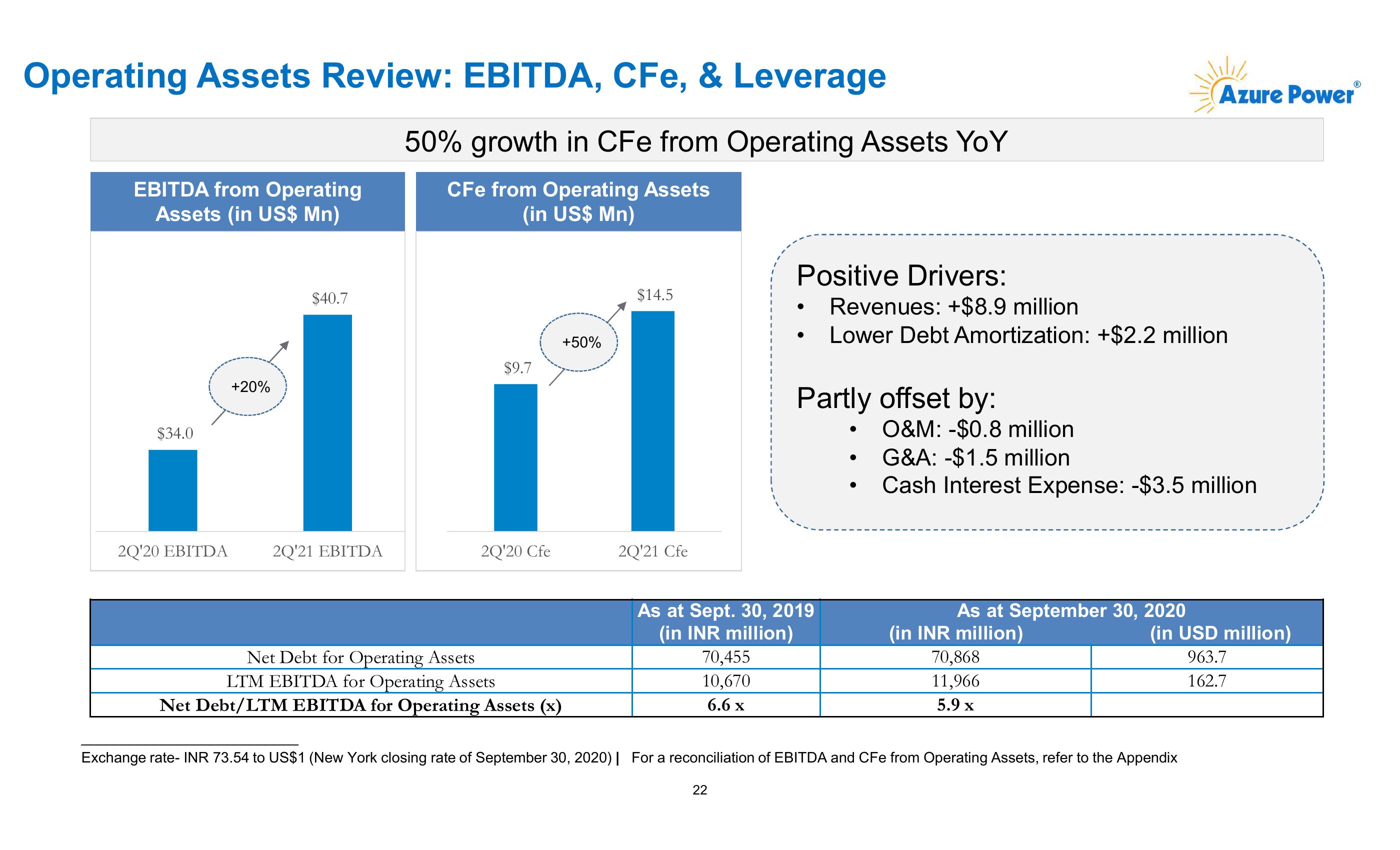

Operating Assets Review: EBITDA, CFe, & Leverage

EBITDA from Operating

Assets (in US$ Mn)

50% growth in CFe from Operating Assets YoY

CFe from Operating Assets

(in US$ Mn)

$34.0

+20%

$40.7

+50%

$9.7

$14.5

•

2Q'20 EBITDA

2Q'21 EBITDA

2Q'20 Cfe

2Q'21 Cfe

Azure Power

Positive Drivers:

Revenues: +$8.9 million

Lower Debt Amortization: +$2.2 million

Partly offset by:

•

O&M: -$0.8 million

G&A: -$1.5 million

Cash Interest Expense: -$3.5 million

As at Sept. 30, 2019

As at September 30, 2020

(in INR million)

(in INR million)

(in USD million)

Net Debt for Operating Assets

LTM EBITDA for Operating Assets

Net Debt/LTM EBITDA for Operating Assets (x)

70,455

10,670

6.6 x

70,868

11,966

5.9 x

Exchange rate- INR 73.54 to US$1 (New York closing rate of September 30, 2020) | For a reconciliation of EBITDA and CFe from Operating Assets, refer to the Appendix

22

22

963.7

162.7View entire presentation