Paysafe Results Presentation Deck

Integrated Processing segment

Paysafe:

Pay Later-

●

●

●

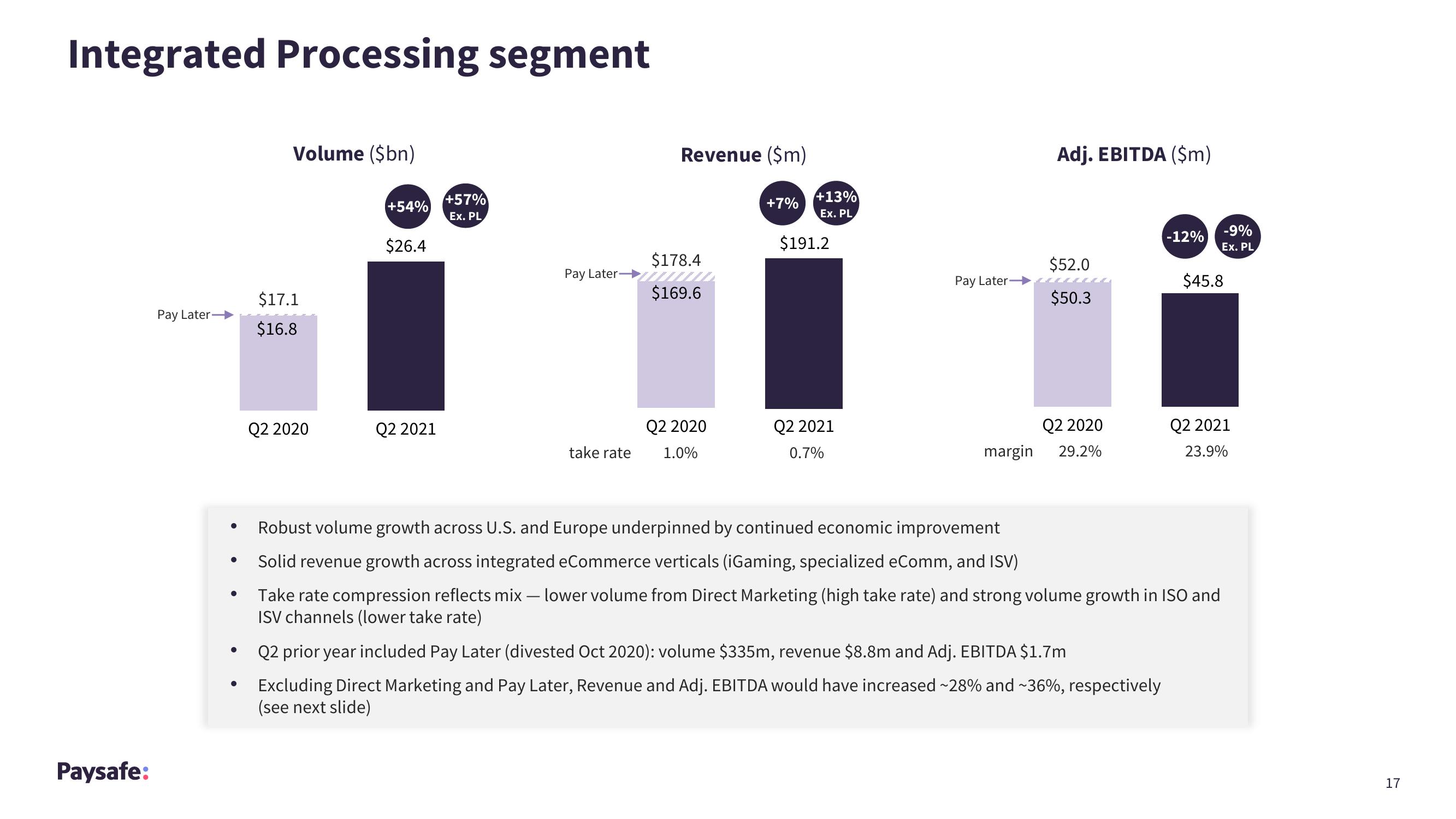

Volume ($bn)

$17.1

$16.8

Q2 2020

+54%

$26.4

Q2 2021

+57%

Ex. PL

Pay Later

take rate

Revenue ($m)

$178.4

$169.6

Q2 2020

1.0%

+7%

+13%

Ex. PL

$191.2

Q2 2021

0.7%

Pay Later

Adj. EBITDA ($m)

$52.0

$50.3

Q2 2020

margin 29.2%

-12%

Q2 prior year included Pay Later (divested Oct 2020): volume $335m, revenue $8.8m and Adj. EBITDA $1.7m

Excluding Direct Marketing and Pay Later, Revenue and Adj. EBITDA would have increased ~28% and ~36%, respectively

(see next slide)

-9%

Ex. PL

$45.8

Robust volume growth across U.S. and Europe underpinned by continued economic improvement

Solid revenue growth across integrated eCommerce verticals (iGaming, specialized eComm, and ISV)

Take rate compression reflects mix - lower volume from Direct Marketing (high take rate) and strong volume growth in ISO and

ISV channels (lower take rate)

Q2 2021

23.9%

17View entire presentation