OpenText Investor Presentation Deck

Open Text Snapshot

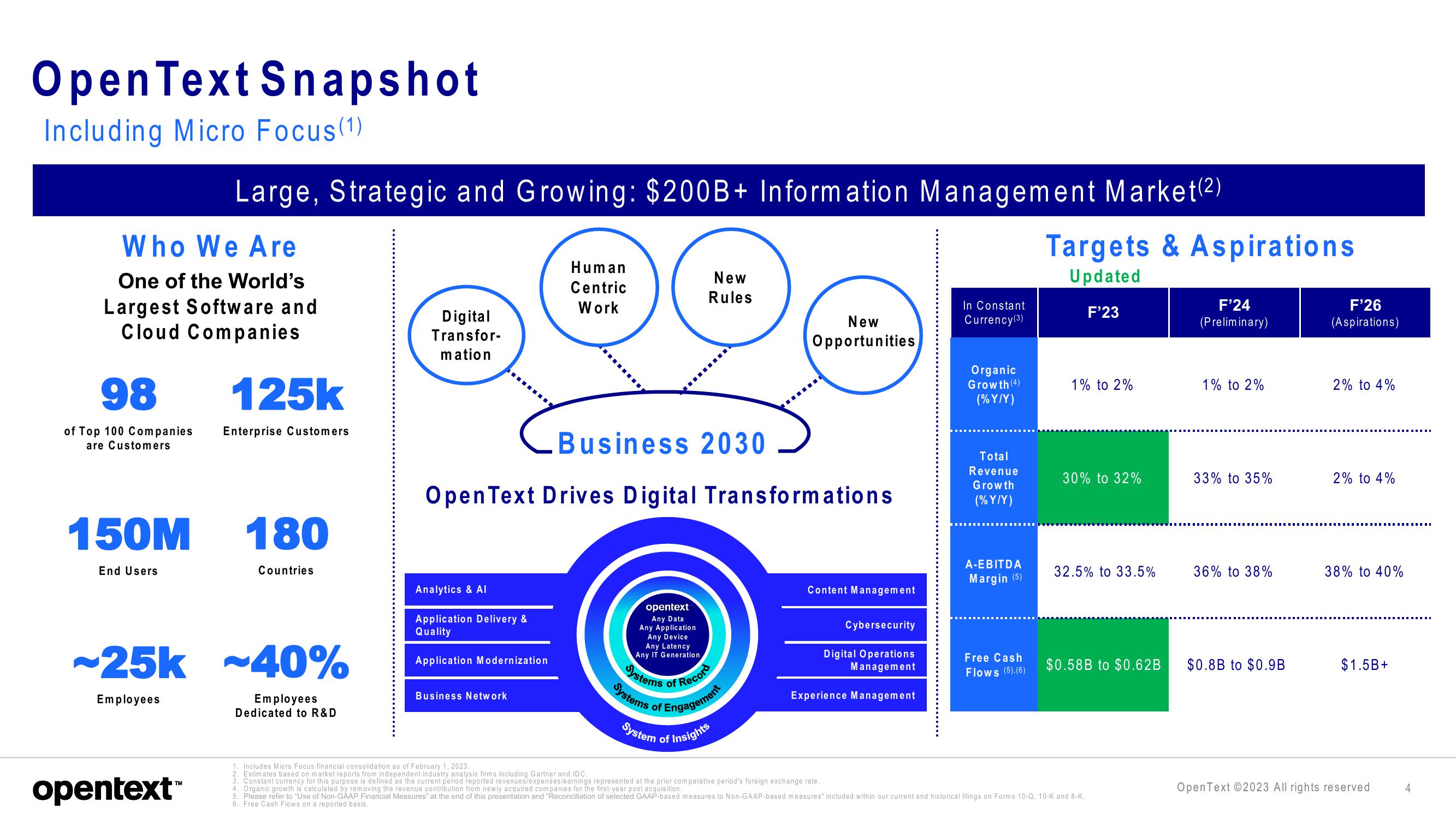

Including Micro Focus (1)

Who We Are

One of the World's

Largest Software and

Cloud Companies

98

of Top 100 Companies

are Customers

150M

End Users

Large, Strategic and Growing: $200B+ Information Management Market (2)

opentext™

125k

Enterprise Customers

180

Countries

~25k ~40%

Employees

Employees

Dedicated to R&D

Digital

Transfor-

mation

Analytics & Al

Application Delivery &

Quality

Business 2030

Open Text Drives Digital Transformations

Application Modernization

Human

Centric

Work

Business Network

opentext

Any Data

Any Application

Any Device

Any Latency

Any IT Generation

Systems

Systems

New

Rules

of

of

Record

Engagement

New

Opportunities

System of Insights

Content Management

Cybersecurity

Digital Operations

Management

Experience Management

Targets & Aspirations

Updated

In Constant

F'23

Currency (3)

Organic

Growth (4)

1% to 2%

(%Y/Y)

Total

Revenue

30% to 32%

E

Growth

(%Y/Y)

A-EBITDA

32.5% to 33.5%

Margin (5)

Free Cash

$0.58B to $0.62B

Flows (5),(6)

1. Includes Micro Focus financial consolidation as of February 1, 2023.

2. Estimates based on market reports from independent industry analysis firms including Gartner and IDC.

3. Constant currency for this purpose is defined as the current period reported revenues/expenses/earnings represented at the prior comparative period's foreign exchange rate..

4. Organic growth is calculated by removing the revenue contribution from newly acquired companies for the first-year post acquisition.

5. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

6. Free Cash Flows on a reported basis.

F'24

(Preliminary)

1% to 2%

33% to 35%

36% to 38%

$0.8B to $0.9B

F'26

(Aspirations)

2% to 4%

2% to 4%

38% to 40%

$1.5B+

‒‒‒‒‒‒‒‒

OpenText ©2023 All rights reserved

4View entire presentation