Q4 2020 Investor Presentation

Liquidity

"

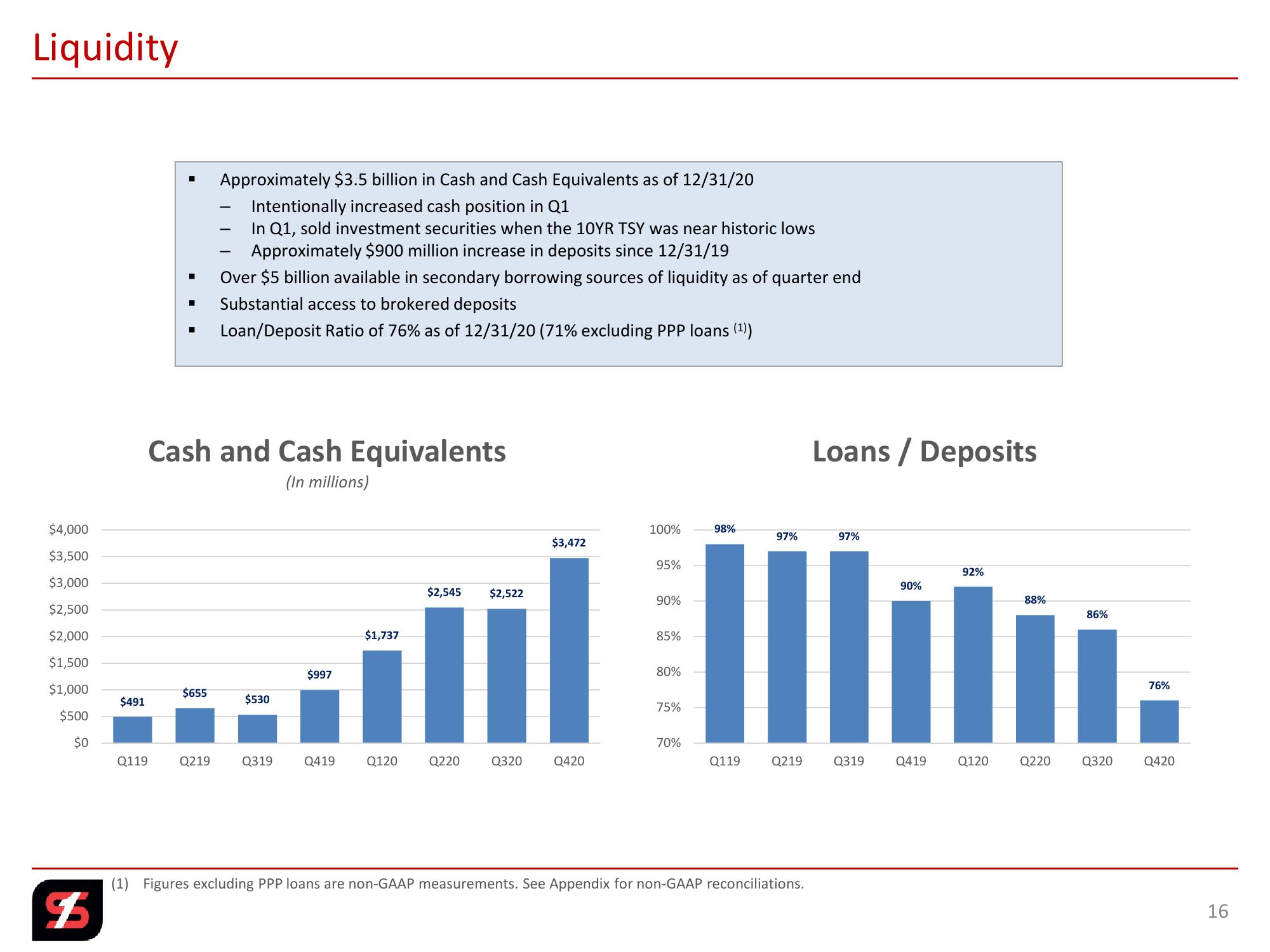

Approximately $3.5 billion in Cash and Cash Equivalents as of 12/31/20

Intentionally increased cash position in Q1

In Q1, sold investment securities when the 10YR TSY was near historic lows

Approximately $900 million increase in deposits since 12/31/19

Over $5 billion available in secondary borrowing sources of liquidity as of quarter end

Substantial access to brokered deposits

Loan/Deposit Ratio of 76% as of 12/31/20 (71% excluding PPP loans (1))

Cash and Cash Equivalents

(In millions)

Loans/Deposits

$4,000

$3,500

$3,000

$2,545

$2,522

$2,500

$2,000

$1,737

100%

98%

97%

97%

$3,472

95%

90%

85%

92%

90%

88%

86%

$1,500

$997

80%

$1,000

76%

$655

$491

$530

75%

$500

$0

70%

Q119

Q219

Q319

Q419

Q120

Q220

Q320

Q420

Q119

Q219

Q319

Q419

Q120

Q220

Q320

Q420

F

(1) Figures excluding PPP loans are non-GAAP measurements. See Appendix for non-GAAP reconciliations.

16View entire presentation