Bird Investor Presentation Deck

Strong Q1 financial results

●

●

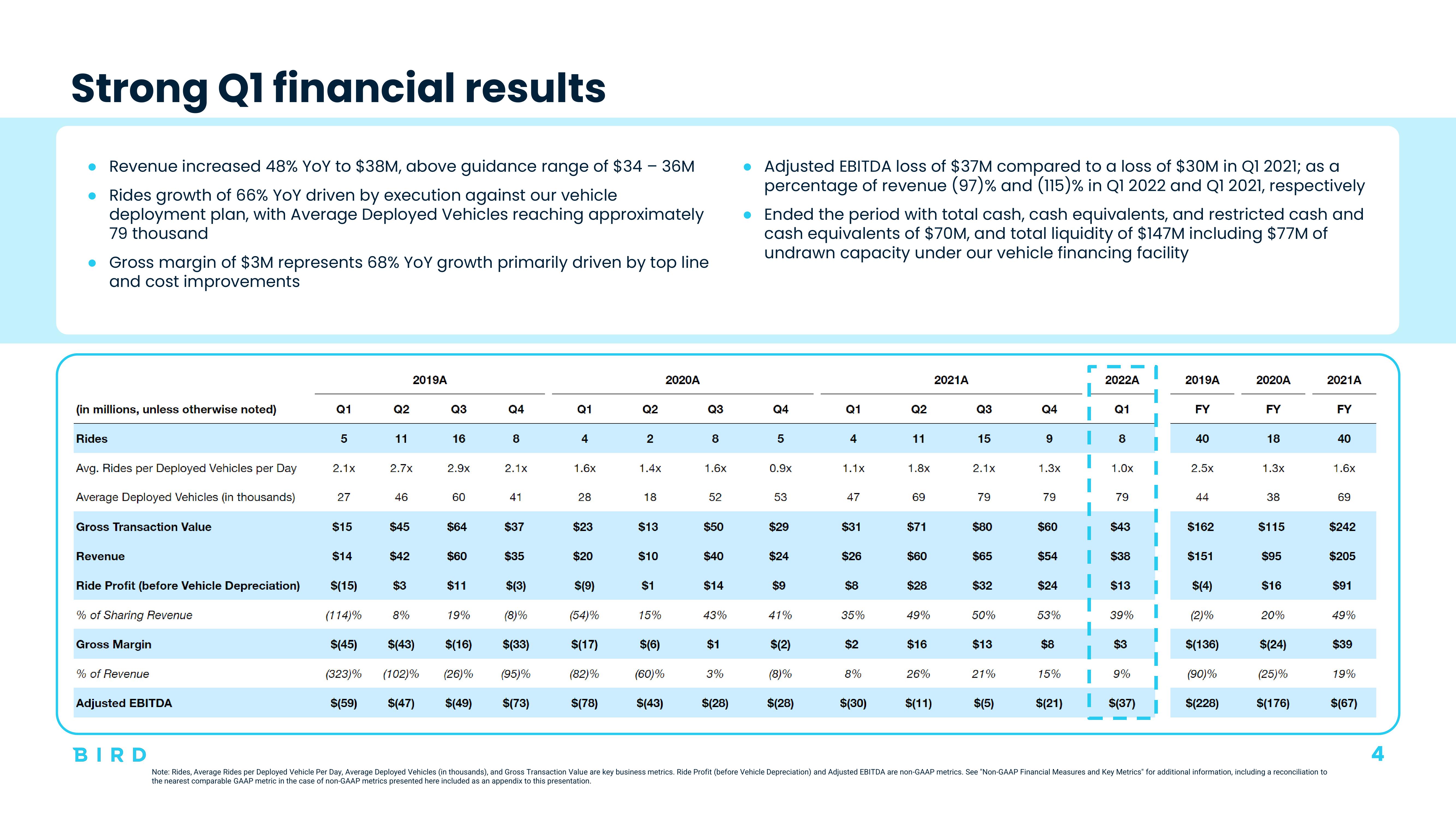

Revenue increased 48% YoY to $38M, above guidance range of $34 - 36M

Rides growth of 66% YoY driven by execution against our vehicle

deployment plan, with Average Deployed Vehicles reaching approximately

79 thousand

● Gross margin of $3M represents 68% YoY growth primarily driven by top line

and cost improvements

(in millions, unless otherwise noted)

Rides

Avg. Rides per Deployed Vehicles per Day

Average Deployed Vehicles (in thousands)

Gross Transaction Value

Revenue

Ride Profit (before Vehicle Depreciation)

% of Sharing Revenue

Gross Margin

% of Revenue

Adjusted EBITDA

BIRD

Q1

5

2.1x

27

$15

$14

$(15)

(114)%

$(45)

(323)%

$(59)

Q2

11

2.7x

46

$45

$42

2019A

$3

8%

Q3

16

2.9x

60

$64

$60

$35

$(3)

(8)%

$(43) $(16) $(33)

(102)% (26)% (95)%

$(47) $(49) $(73)

$11

Q4

19%

8

2.1x

41

$37

Q1

4

1.6x

28

$23

$20

$(9)

(54)%

$(17)

(82)%

$(78)

Q2

2

1.4x

18

$13

$10

$1

15%

$(6)

(60)%

$(43)

2020A

Q3

8

1.6x

52

$50

$40

$14

43%

$1

3%

$(28)

● Adjusted EBITDA loss of $37M compared to a loss of $30M in Q1 2021; as a

percentage of revenue (97)% and (115) % in Q1 2022 and Q1 2021, respectively

• Ended the period with total cash, cash equivalents, and restricted cash and

cash equivalents of $70M, and total liquidity of $147M including $77M of

undrawn capacity under our vehicle financing facility

Q4

5

0.9x

53

$29

$24

$9

41%

$(2)

(8)%

$(28)

Q1

4

1.1x

47

$31

$26

$8

35%

$2

8%

$(30)

Q2

11

1.8x

69

$71

$60

$28

49%

$16

26%

$(11)

2021A

Q3

15

2.1x

79

$80

$65

$32

50%

$13

21%

$(5)

Q4

9

1.3x

79

$60

$54

$24

53%

$8

15%

$(21)

2022A

Q1

8

1.0x

79

$43

$38

$13

39%

$3

9%

$(37)

1

2019A

FY

40

2.5x

44

$162

$151

$(4)

(2)%

$(136)

(90)%

$(228)

2020A

FY

18

1.3x

38

$115

$95

$16

20%

$(24)

(25)%

$(176)

2021A

Note: Rides, Average Rides per Deployed Vehicle Per Day, Average Deployed Vehicles (in thousands), and Gross Transaction Value are key business metrics. Ride Profit (before Vehicle Depreciation) and Adjusted EBITDA are non-GAAP metrics. See "Non-GAAP Financial Measures and Key Metrics" for additional information, including a reconciliation to

the nearest comparable GAAP metric in the case of non-GAAP metrics presented here included as an appendix this presentation.

FY

40

1.6x

69

$242

$205

$91

49%

$39

19%

$(67)

4View entire presentation