Presentation to Vermont Pension Investment Committee

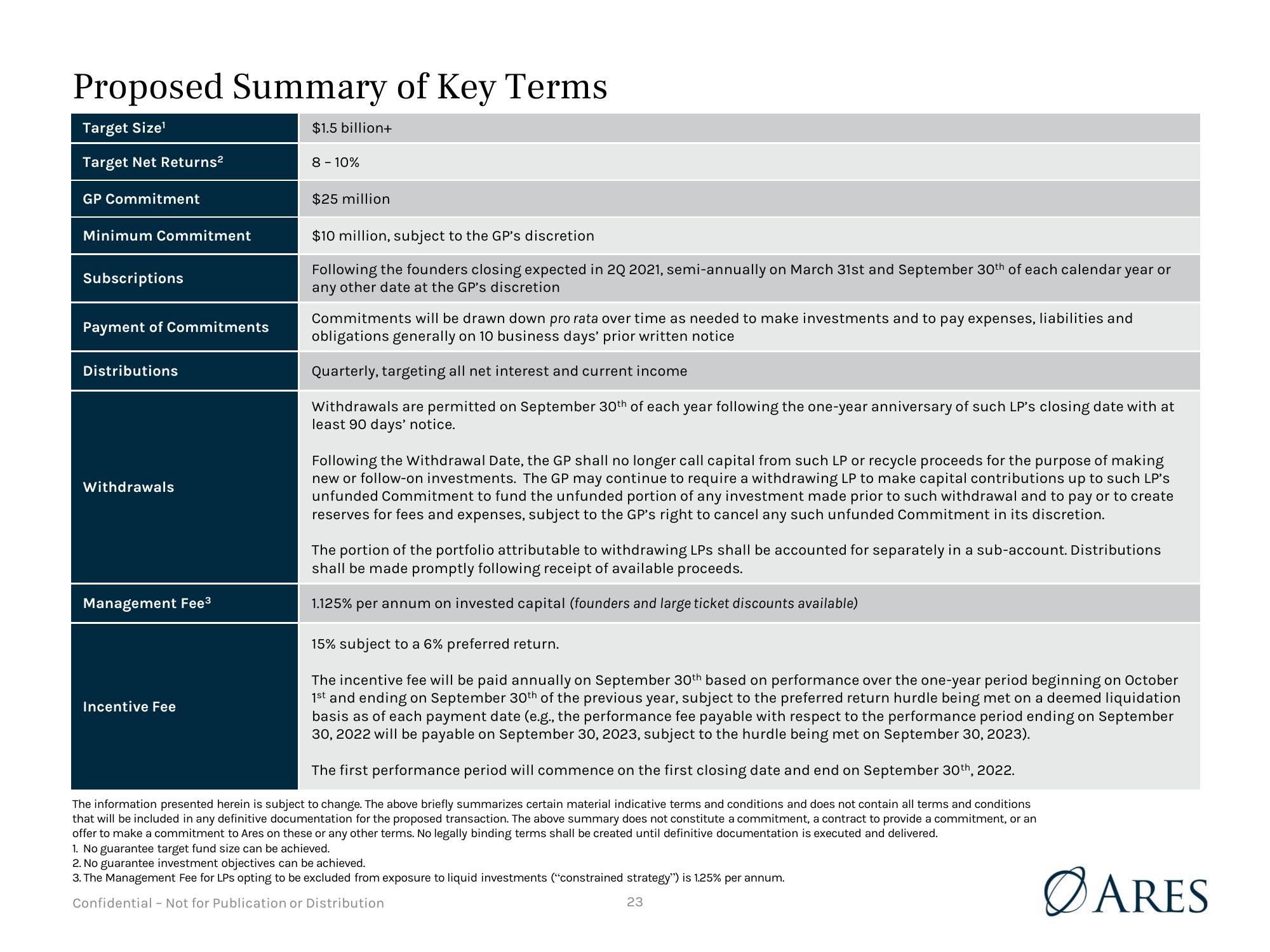

Proposed Summary of Key Terms

Target Size¹

$1.5 billion+

Target Net Returns²

GP Commitment

Minimum Commitment

Subscriptions

Payment of Commitments

Distributions

Withdrawals

Management Fee³

8 - 10%

Incentive Fee

$25 million

$10 million, subject to the GP's discretion

Following the founders closing expected in 2Q 2021, semi-annually on March 31st and September 30th of each calendar year or

any other date at the GP's discretion

Commitments will be drawn down pro rata over time as needed to make investments and to pay expenses, liabilities and

obligations generally on 10 business days' prior written notice

Quarterly, targeting all net interest and current income

Withdrawals are permitted on September 30th of each year following the one-year anniversary of such LP's closing date with at

least 90 days' notice.

Following the Withdrawal Date, the GP shall no longer call capital from such LP or recycle proceeds for the purpose of making

new or follow-on investments. The GP may continue to require a withdrawing LP to make capital contributions up to such LP's

unfunded Commitment to fund the unfunded portion of any investment made prior to such withdrawal and to pay or to create

reserves for fees and expenses, subject to the GP's right to cancel any such unfunded Commitment in its discretion.

The portion of the portfolio attributable to withdrawing LPs shall be accounted for separately in a sub-account. Distributions

shall be made promptly following receipt of available proceeds.

1.125% per annum on invested capital (founders and large ticket discounts available)

15% subject to a 6% preferred return.

The incentive fee will be paid annually on September 30th based on performance over the one-year period beginning on October

1st and ending on September 30th of the previous year, subject to the preferred return hurdle being met on a deemed liquidation

basis as of each payment date (e.g., the performance fee payable with respect to the performance period ending on September

30, 2022 will be payable on September 30, 2023, subject to the hurdle being met on September 30, 2023).

The first performance period will commence on the first closing date and end on September 30th, 2022.

The information presented herein is subject to change. The above briefly summarizes certain material indicative terms and conditions and does not contain all terms and conditions

that will be included in any definitive documentation for the proposed transaction. The above summary does not constitute a commitment, a contract to provide a commitment, or an

offer to make a commitment to Ares on these or any other terms. No legally binding terms shall be created until definitive documentation is executed and delivered.

1. No guarantee target fund size can be achieved.

2. No guarantee investment objectives can be achieved.

3. The Management Fee for LPs opting to be excluded from exposure to liquid investments ("constrained strategy") is 1.25% per annum.

Confidential - Not for Publication or Distribution

23

ØARESView entire presentation