Oatly Results Presentation Deck

2.

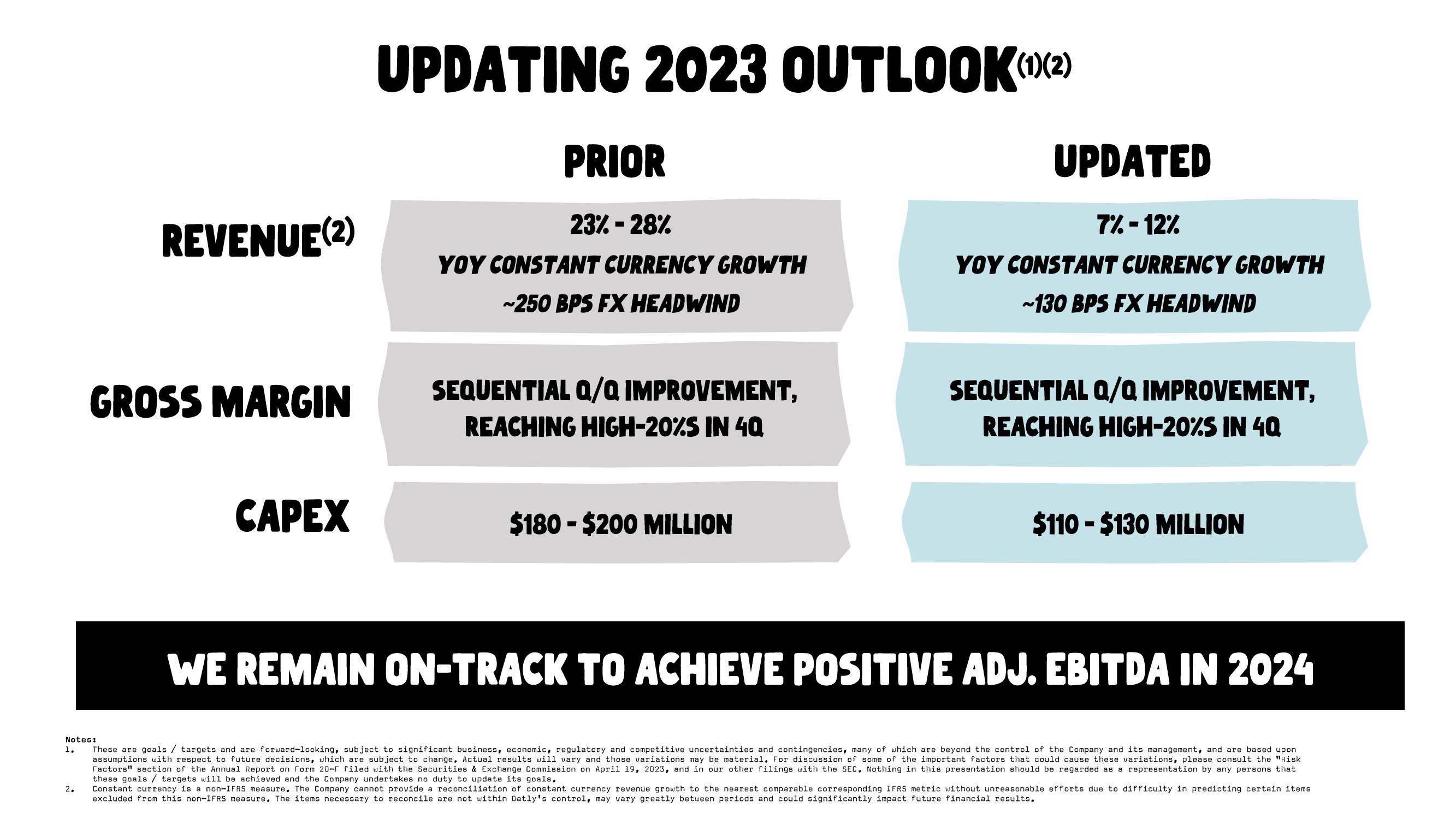

REVENUE(2)

GROSS MARGIN

Notes:

1.

CAPEX

UPDATING 2023 OUTLOOK(¹)(²)

PRIOR

23% -28%

YOY CONSTANT CURRENCY GROWTH

~250 BPS FX HEADWIND

SEQUENTIAL Q/Q IMPROVEMENT,

REACHING HIGH-20%S IN 40

$180-$200 MILLION

UPDATED

7% -12%

YOY CONSTANT CURRENCY GROWTH

~130 BPS FX HEADWIND

SEQUENTIAL Q/Q IMPROVEMENT,

REACHING HIGH-20%S IN 40

$110-$130 MILLION

WE REMAIN ON-TRACK TO ACHIEVE POSITIVE ADJ. EBITDA IN 2024

These are goals / targets and are forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon

assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the "Risk

Factors" section of the Annual Report on Form 20-F filed with the Securities & Exchange Commission on April 19, 2023, and in our other filings with the SEC. Nothing in this presentation should be regarded as a representation by any persons that

these goals / targets will be achieved and the Company undertakes no duty to update its goals.

Constant currency is a non-IFRS measure. The Company cannot provide a reconciliation of constant currency revenue growth to the nearest comparable corresponding IFRS metric without unreasonable efforts due to difficulty in predicting certain items

excluded from this non-IFRS measure. The items necessary to reconcile are not within Oatly's control, may vary greatly between periods and could significantly impact future financial results.View entire presentation