Trian Partners Activist Presentation Deck

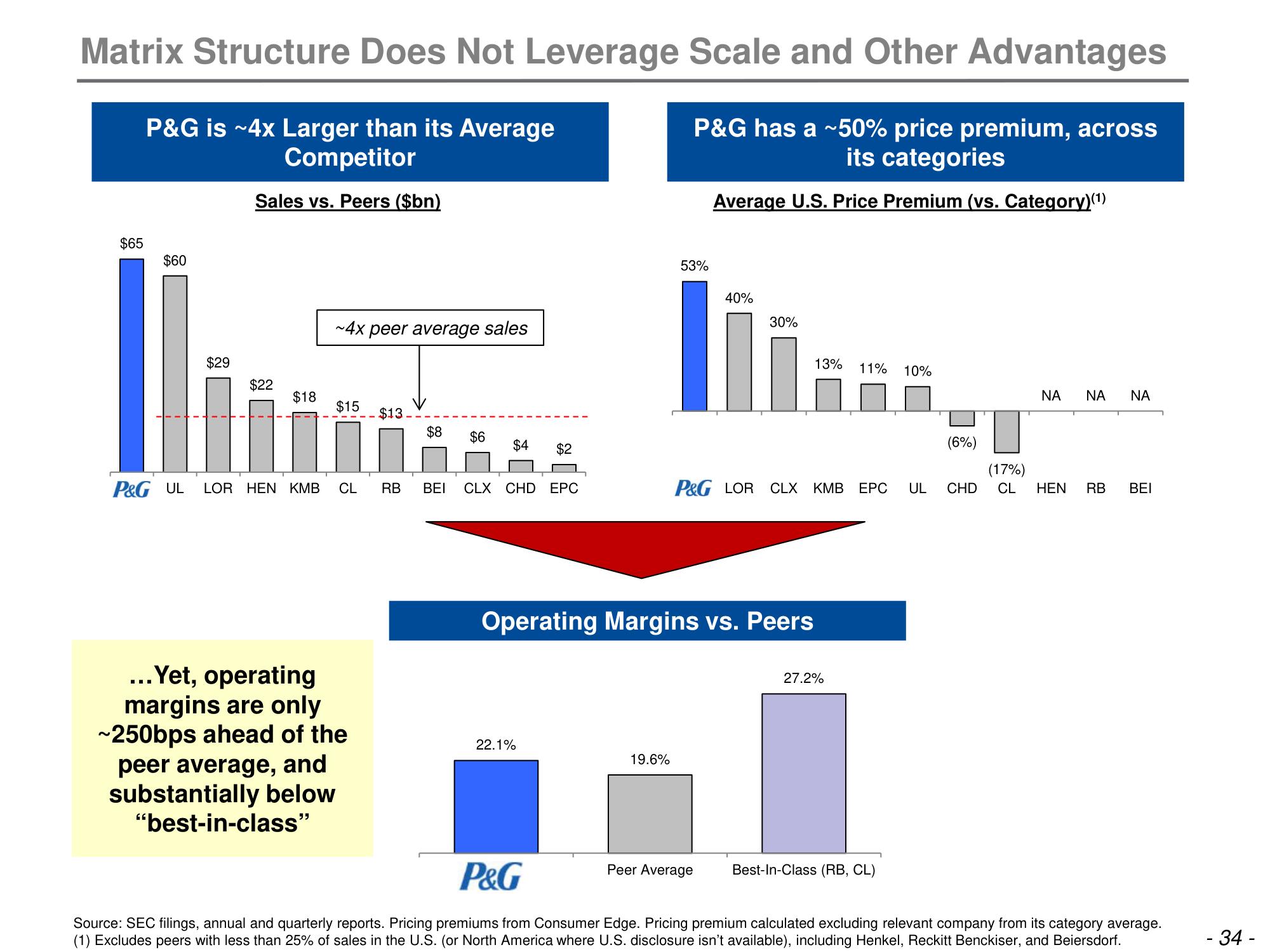

Matrix Structure Does Not Leverage Scale and Other Advantages

P&G is ~4x Larger than its Average

Competitor

P&G has a ~50% price premium, across

its categories

Sales vs. Peers ($bn)

Average U.S. Price Premium (vs. Category)(¹)

$65

$60

$29

$22

$18

~4x peer average sales

$15

$13

... Yet, operating

margins are only

~250bps ahead of the

peer average, and

substantially below

"best-in-class"

$8 $6

$4

P&G UL LOR HEN KMB CL RB BEI CLX CHD EPC

$2

22.1%

53%

19.6%

40%

Operating Margins vs. Peers

30%

Peer Average

13% 11%

P&G LOR CLX KMB EPC UL

27.2%

10%

Best-In-Class (RB, CL)

(6%)

ΝΑ ΝΑ ΝΑ

(17%)

CHD CL HEN RB BEI

P&G

Source: SEC filings, annual and quarterly reports. Pricing premiums from Consumer Edge. Pricing premium calculated excluding relevant company from its category average.

(1) Excludes peers with less than 25% of sales in the U.S. (or North America where U.S. disclosure isn't available), including Henkel, Reckitt Benckiser, and Beiersdorf.

- 34 -View entire presentation