Spotify Results Presentation Deck

Financial Summary

Revenue

Profitability

Free Cash Flow

& Liquidity

Spotify

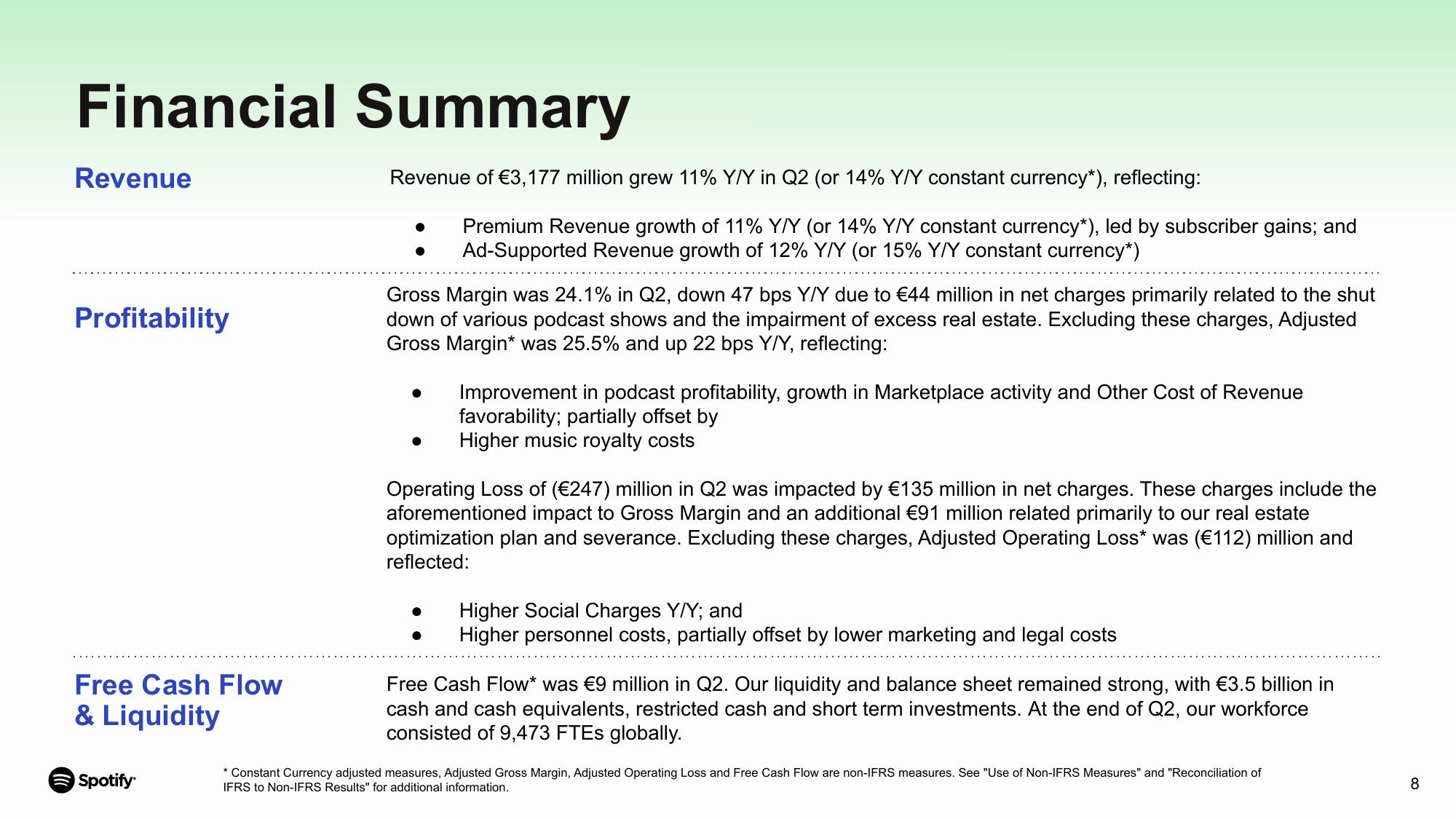

Revenue of €3,177 million grew 11% Y/Y in Q2 (or 14% Y/Y constant currency*), reflecting:

Premium Revenue growth of 11% Y/Y (or 14% Y/Y constant currency*), led by subscriber gains; and

Ad-Supported Revenue growth of 12% Y/Y (or 15% Y/Y constant currency*)

Gross Margin was 24.1% in Q2, down 47 bps Y/Y due to €44 million in net charges primarily related to the shut

down of various podcast shows and the impairment of excess real estate. Excluding these charges, Adjusted

Gross Margin* was 25.5% and up 22 bps Y/Y, reflecting:

Improvement in podcast profitability, growth in Marketplace activity and Other Cost of Revenue

favorability; partially offset by

Higher music royalty costs

Operating Loss of (€247) million in Q2 was impacted by €135 million in net charges. These charges include the

aforementioned impact to Gross Margin and an additional €91 million related primarily to our real estate

optimization plan and severance. Excluding these charges, Adjusted Operating Loss* was (€112) million and

reflected:

Higher Social Charges Y/Y; and

Higher personnel costs, partially offset by lower marketing and legal costs

Free Cash Flow* was €9 million in Q2. Our liquidity and balance sheet remained strong, with €3.5 billion in

cash and cash equivalents, restricted cash and short term investments. At the end of Q2, our workforce

consisted of 9,473 FTES globally.

* Constant Currency adjusted measures, Adjusted Gross Margin, Adjusted Operating Loss and Free Cash Flow are non-IFRS measures. See "Use of Non-IFRS Measures" and "Reconciliation of

IFRS to Non-IFRS Results" for additional information.

8View entire presentation