Corecentric Investor Conference Presentation Deck

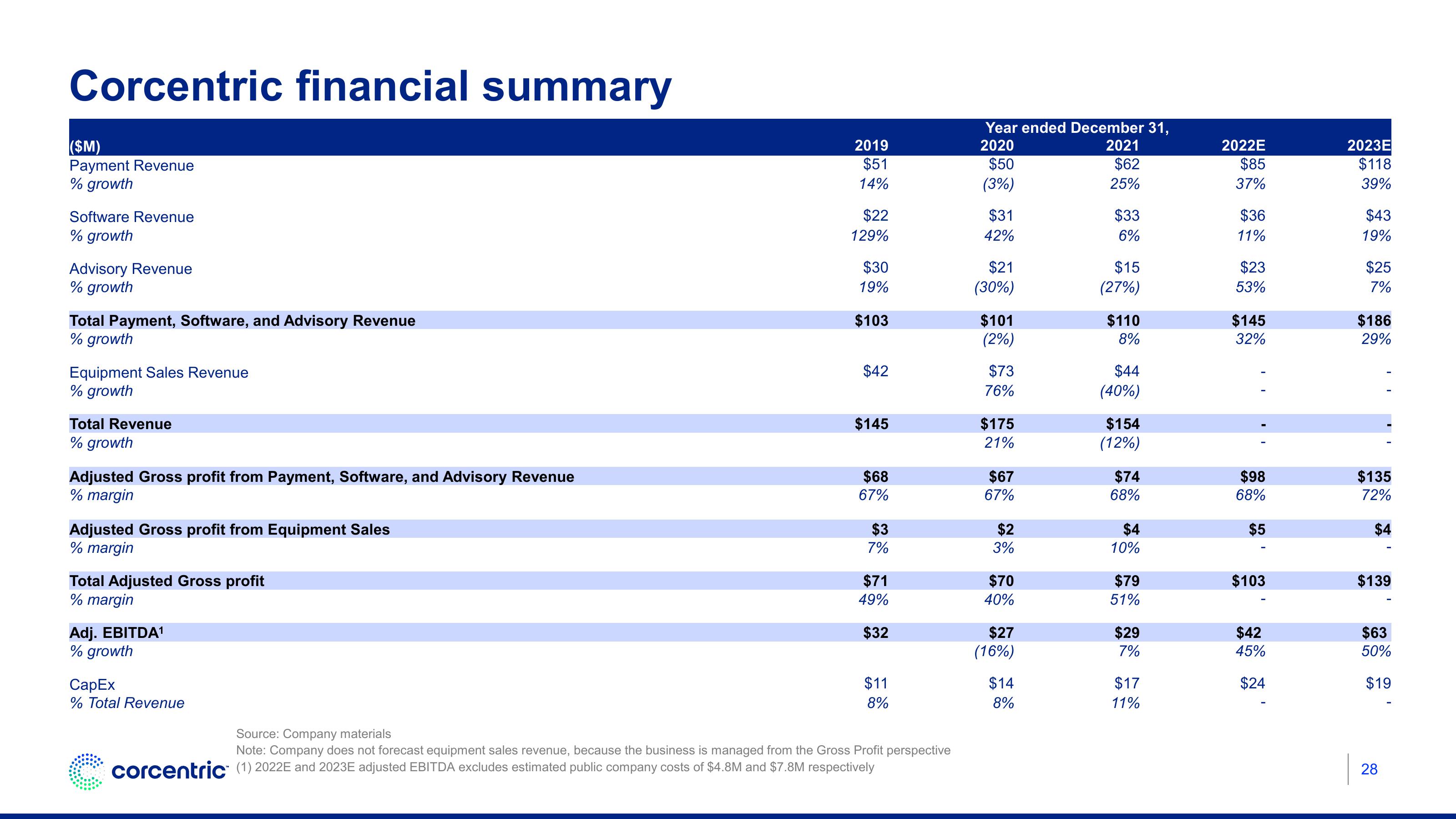

Corcentric financial summary

($M)

Payment Revenue

% growth

Software Revenue

% growth

Advisory Revenue

% growth

Total Payment, Software, and Advisory Revenue

% growth

Equipment Sales Revenue

% growth

Total Revenue

% growth

Adjusted Gross profit from Payment, Software, and Advisory Revenue

% margin

Adjusted Gross profit from Equipment Sales

% margin

Total Adjusted Gross profit

% margin

Adj. EBITDA¹

% growth

CapEx

% Total Revenue

2019

$51

14%

$22

129%

$30

19%

$103

$42

$145

$68

67%

$3

7%

$71

49%

$32

$11

8%

Source: Company materials

Note: Company does not forecast equipment sales revenue, because the business is managed from the Gross Profit perspective

corcentric (1) 2022E and 2023E adjusted EBITDA excludes estimated public company costs of $4.8M and $7.8M respectively

Year ended December 31,

2020

$50

(3%)

$31

42%

$21

(30%)

$101

(2%)

$73

76%

$175

21%

$67

67%

$2

3%

$70

40%

$27

(16%)

$14

8%

2021

$62

25%

$33

6%

$15

(27%)

$110

8%

$44

(40%)

$154

(12%)

$74

68%

$4

10%

$79

51%

$29

7%

$17

11%

2022E

$85

37%

$36

11%

$23

53%

$145

32%

$98

68%

$5

$103

$42

45%

$24

2023E

$118

39%

$43

19%

$25

7%

$186

29%

$135

72%

$4

$139

$63

50%

$19

28View entire presentation