Paysafe Results Presentation Deck

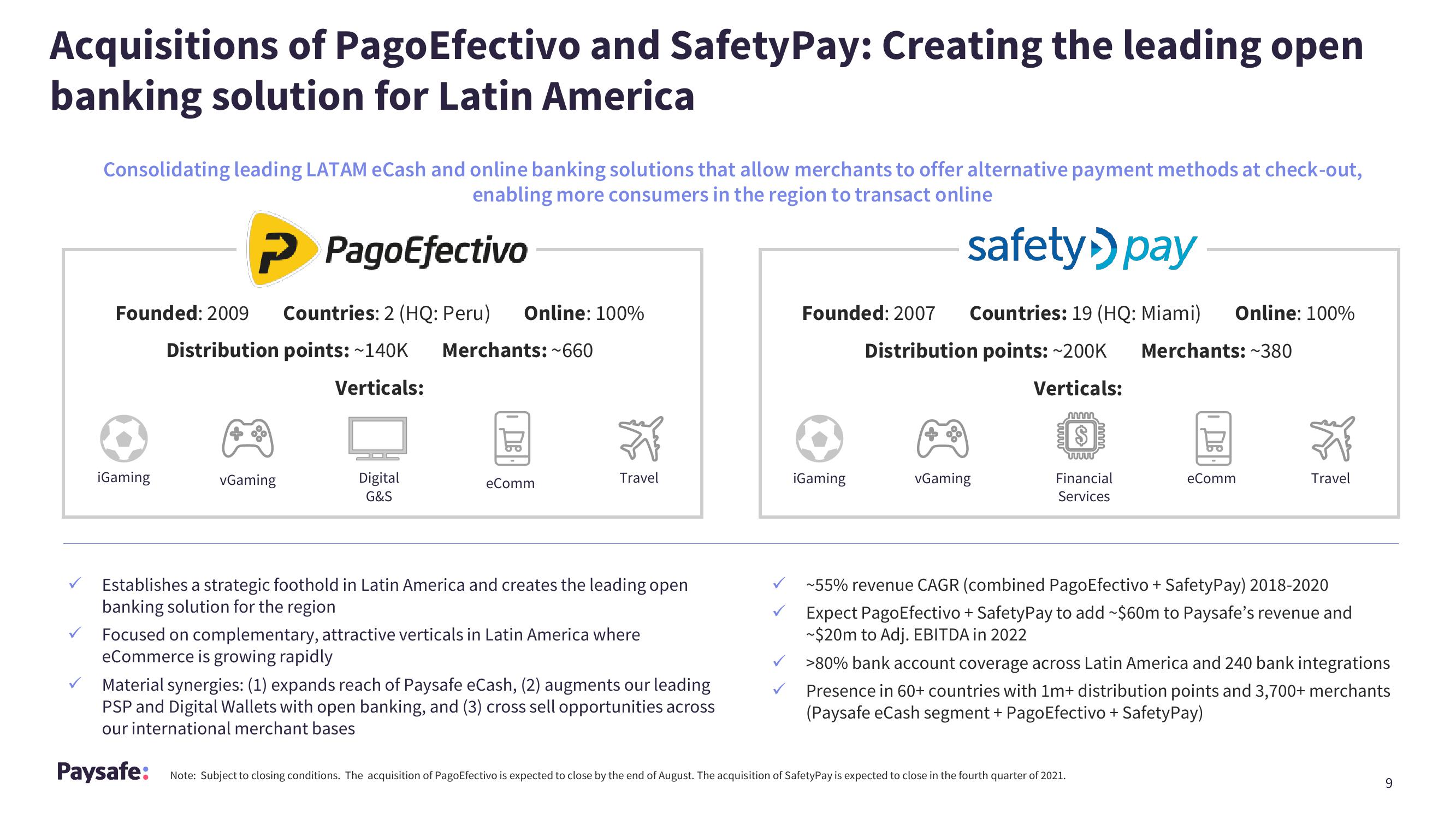

Acquisitions of PagoEfectivo and SafetyPay: Creating the leading open

banking solution for Latin America

Consolidating leading LATAM eCash and online banking solutions that allow merchants to offer alternative payment methods at check-out,

enabling more consumers in the region to transact online

→ PagoEfectivo

Founded: 2009 Countries: 2 (HQ: Peru) Online: 100%

Distribution points: ~140K Merchants: ~660

Verticals:

iGaming

vGaming

Digital

G&S

eComm

Trav

Establishes a strategic foothold in Latin America and creates the leading open

banking solution for the region

Focused on complementary, attractive verticals in Latin America where

eCommerce is growing rapidly

Material synergies: (1) expands reach of Paysafe eCash, (2) augments our leading

PSP and Digital Wallets with open banking, and (3) cross sell opportunities across

our international merchant bases

Paysafe:

safety pay

Founded: 2007 Countries: 19 (HQ: Miami) Online: 100%

Distribution points: ~200K Merchants: ~380

Verticals:

iGaming

vGaming

m

S

wwwww

Financial

Services

eComm

Travel

~55% revenue CAGR (combined PagoEfectivo + SafetyPay) 2018-2020

Expect PagoEfectivo + Safety Pay to add ~$60m to Paysafe's revenue and

~$20m to Adj. EBITDA in 2022

Note: Subject to closing conditions. The acquisition of PagoEfectivo is expected to close by the end of August. The acquisition of SafetyPay is expected to close in the fourth quarter of 2021.

>80% bank account coverage across Latin America and 240 bank integrations

Presence in 60+ countries with 1m+ distribution points and 3,700+ merchants

(Paysafe eCash segment + PagoEfectivo + Safety Pay)

9View entire presentation