Kinnevik Results Presentation Deck

OUR USD 50 MILLION FOLLOW-ON INVESTMENT INTO SPRING HEALTH IN Q1

IS A PERFECT EXAMPLE OF USING 2023 TO DOUBLE DOWN IN OUR WINNERS

■

■

Redoubling our commitment in one of our high-

conviction, strong-performing businesses at a

balanced USD 2.5bn valuation

■

■

Significant Follow-On in Spring Health

Supporting & Maximizing Impact of High-Conviction Businesses

I

USD 40m primary investment in a 71m round,

corresponding to >10x our pro rata share

USD 10m secondary purchase from an early-stage

investor in need of liquidity

Accreting ownership from 5 to 7%

Spring has grown revenues by more than 4x

since our 2021 investment on an NTM basis, and

by more than 7x on an LTM basis

The business is now funded to break-even with a

path to reach cash flow profitability in 2024

through operating leverage

Emerging as a new star healthcare investment

behind Livongo, Cedar, Cityblock and VillageMD

with significant growth opportunities ahead

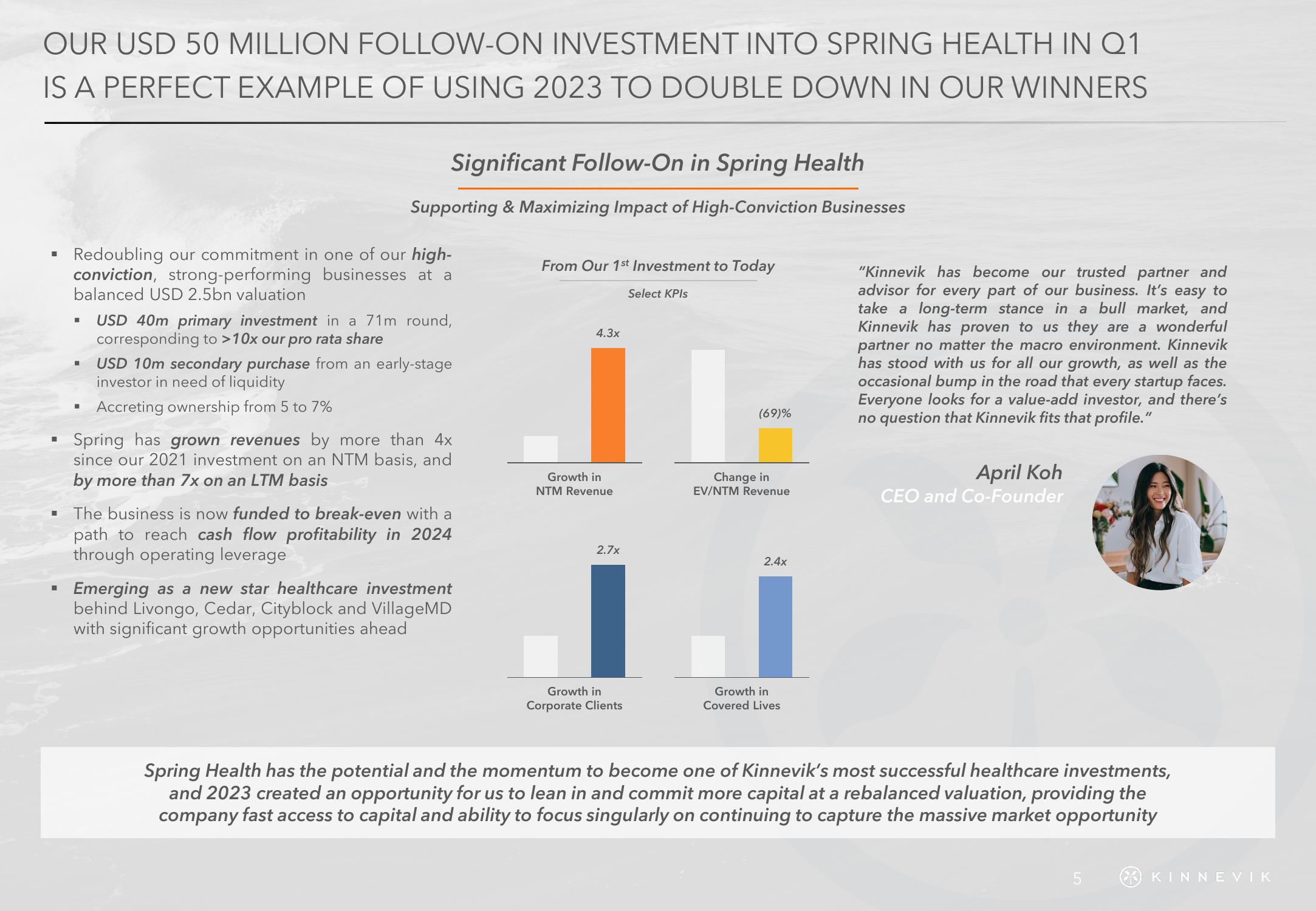

From Our 1st Investment to Today

Select KPIs

4.3x

Growth in

NTM Revenue

2.7x

Growth in

Corporate Clients

(69)%

Change in

EV/NTM Revenue

2.4x

Growth in

Covered Lives

"Kinnevik has become our trusted partner and

advisor for every part of our business. It's easy to

take a long-term stance in a bull market, and

Kinnevik has proven to us they are a wonderful

partner no matter the macro environment. Kinnevik

has stood with us for all our growth, as well as the

occasional bump in the road that every startup faces.

Everyone looks for a value-add investor, and there's

no question that Kinnevik fits that profile."

April Koh

CEO and Co-Founder

Spring Health has the potential and the momentum to become one of Kinnevik's most successful healthcare investments,

and 2023 created an opportunity for us to lean in and commit more capital at a rebalanced valuation, providing the

company fast access to capital and ability to focus singularly on continuing to capture the massive market opportunity

KINNEVIKView entire presentation