flyExclusive SPAC Presentation Deck

TRANSACTION SUMMARY

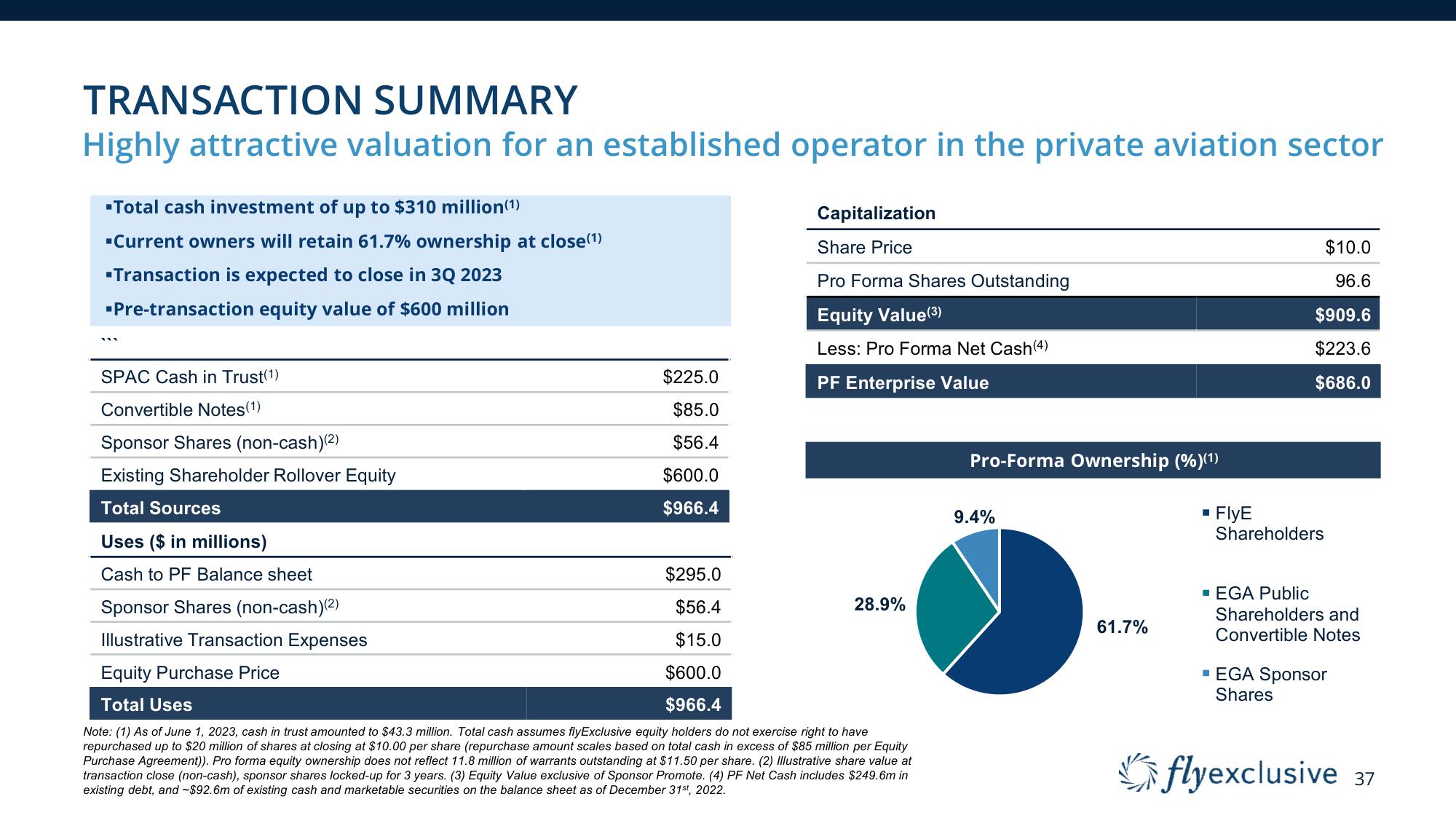

Highly attractive valuation for an established operator in the private aviation sector

▪Total cash investment of up to $310 million(¹)

▪Current owners will retain 61.7% ownership at close(1)

▪Transaction is expected to close in 3Q 2023

▪Pre-transaction equity value of $600 million

SPAC Cash in Trust(1)

Convertible Notes (1)

Sponsor Shares (non-cash)(2)

Existing Shareholder Rollover Equity

Total Sources

Uses ($ in millions)

Cash to PF Balance sheet

Sponsor Shares (non-cash)(²)

Illustrative Transaction Expenses

$225.0

$85.0

$56.4

$600.0

$966.4

Capitalization

Share Price

Pro Forma Shares Outstanding

Equity Value (3)

Less: Pro Forma Net Cash (4)

PF Enterprise Value

$295.0

$56.4

$15.0

Equity Purchase Price

$600.0

$966.4

Total Uses

Note: (1) As of June 1, 2023, cash in trust amounted to $43.3 million. Total cash assumes flyExclusive equity holders do not exercise right to have

repurchased up to $20 million of shares at closing at $10.00 per share (repurchase amount scales based on total cash in excess of $85 million per Equity

Purchase Agreement)). Pro forma equity ownership does not reflect 11.8 million of warrants outstanding at $11.50 per share. (2) Illustrative share value at

transaction close (non-cash), sponsor shares locked-up for 3 years. (3) Equity Value exclusive of Sponsor Promote. (4) PF Net Cash includes $249.6m in

existing debt, and -$92.6m of existing cash and marketable securities on the balance sheet as of December 31st, 2022.

28.9%

Pro-Forma Ownership (%)(¹)

9.4%

61.7%

$10.0

96.6

$909.6

$223.6

$686.0

▪ FlyE

Shareholders

▪ EGA Public

Shareholders and

Convertible Notes

▪ EGA Sponsor

Shares

flyexclusive 37View entire presentation