Credit Suisse Credit Presentation Deck

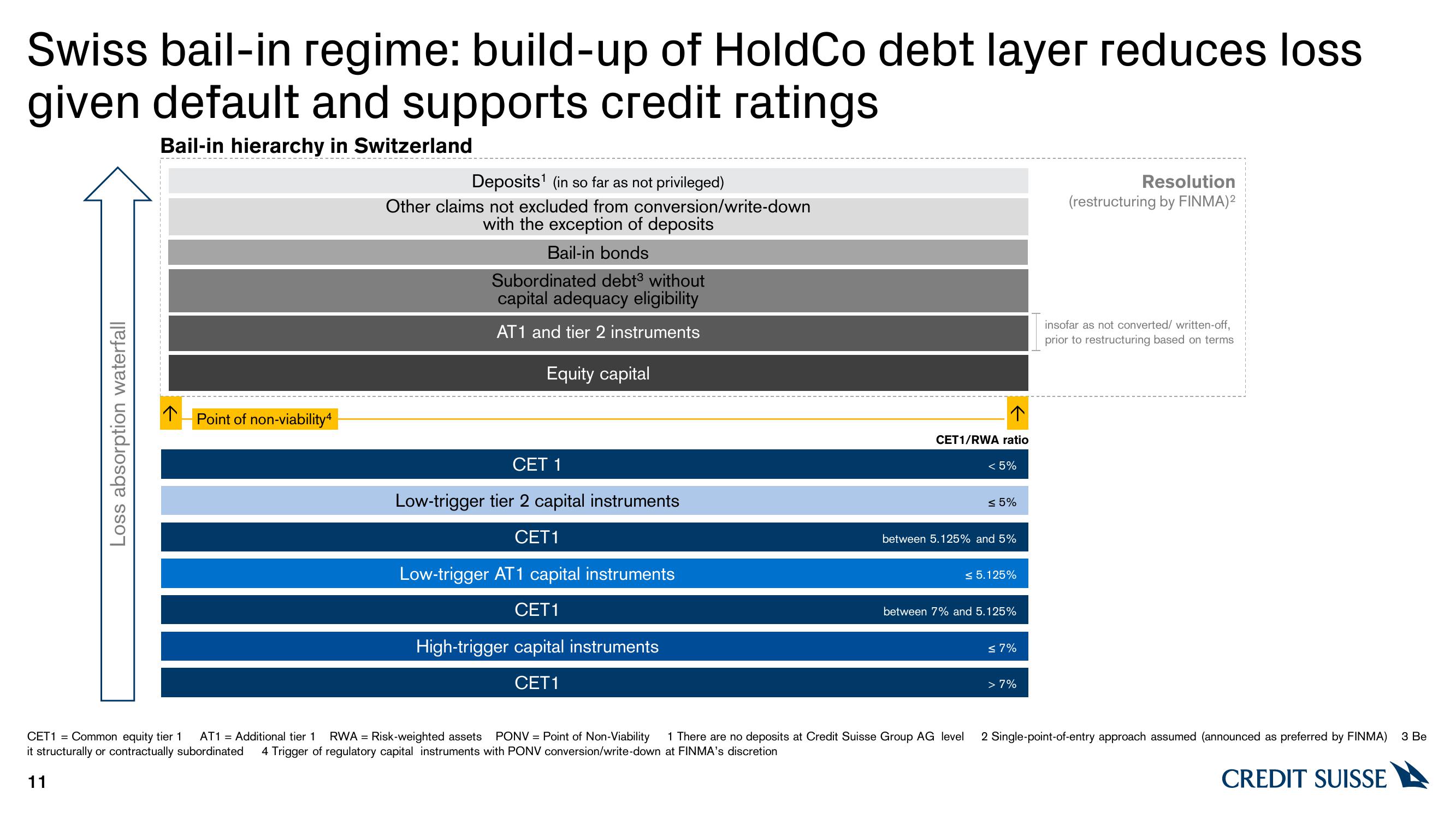

Swiss bail-in regime: build-up of HoldCo debt layer reduces loss

given default and supports credit ratings

Bail-in hierarchy in Switzerland

Loss absorption waterfall

个 Point of non-viability4

Deposits¹ (in so far as not privileged)

Other claims not excluded from conversion/write-down

with the exception of deposits

Bail-in bonds

Subordinated debt3 without

capital adequacy eligibility

AT1 and tier 2 instruments

Equity capital

CET 1

Low-trigger tier 2 capital instruments

CET1

Low-trigger AT1 capital instruments

CET1

High-trigger capital instruments

CET1

个

CET1/RWA ratio

< 5%

≤ 5%

between 5.125% and 5%

CET1 = Common equity tier 1 AT1 = Additional tier 1 RWA = Risk-weighted assets PONV = Point of Non-Viability 1 There are no deposits at Credit Suisse Group AG level

it structurally or contractually subordinated 4 Trigger of regulatory capital instruments with PONV conversion/write-down at FINMA's discretion

11

≤ 5.125%

between 7% and 5.125%

≤7%

> 7%

Resolution

(restructuring by FINMA)²

insofar as not converted/ written-off,

prior to restructuring based on terms

2 Single-point-of-entry approach assumed (announced as preferred by FINMA)

CREDIT SUISSE

3 BeView entire presentation