Melrose Results Presentation Deck

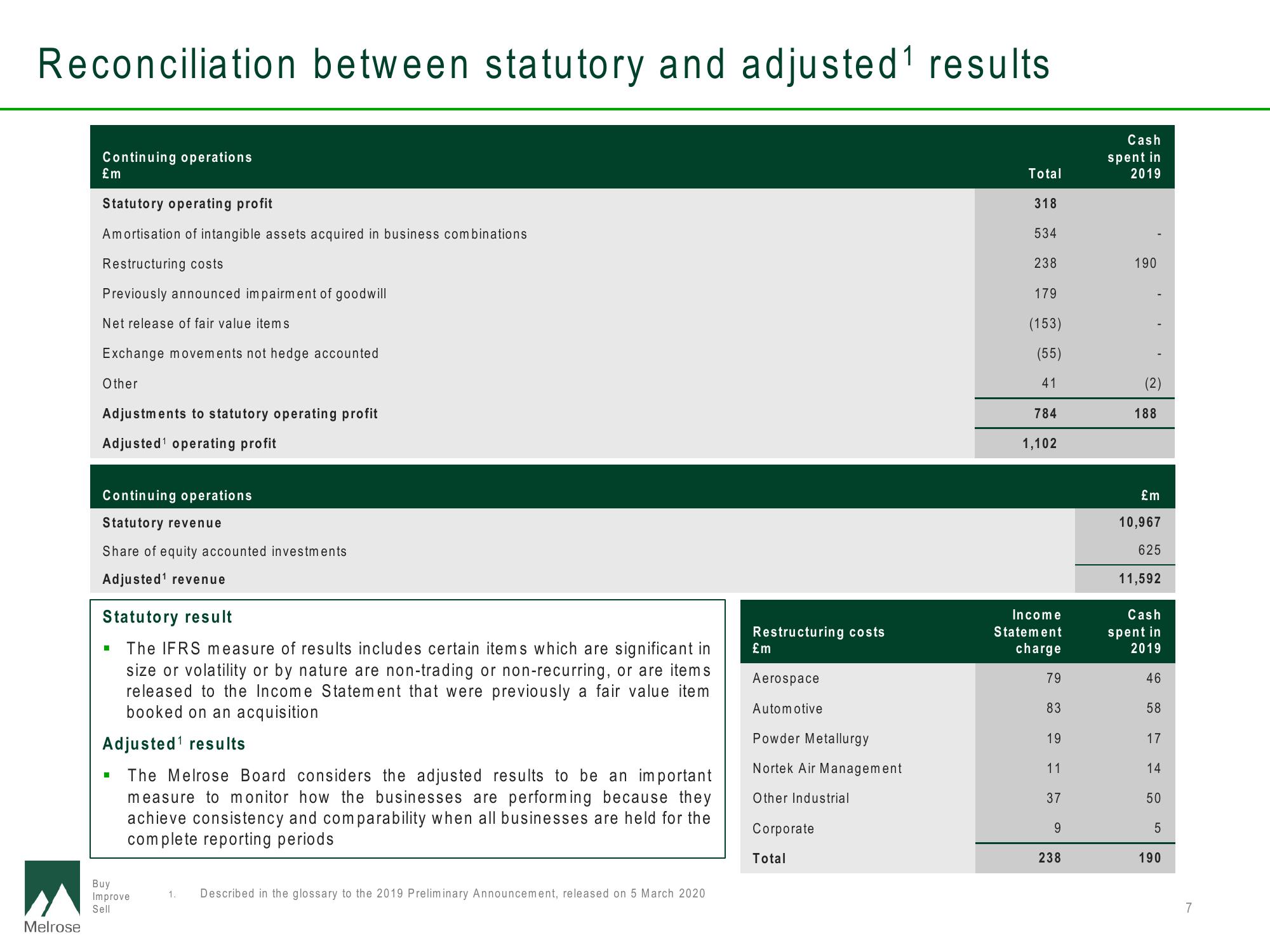

Reconciliation between statutory and adjusted ¹ results

Melrose

Continuing operations

£m

Statutory operating profit

Amortisation of intangible assets acquired in business combinations

Restructuring costs

Previously announced impairment of goodwill

Net release of fair value items

Exchange movements not hedge accounted

Other

Adjustments to statutory operating profit

Adjusted¹ operating profit

Continuing operations

Statutory revenue

Share of equity accounted investments

Adjusted¹ revenue

Statutory result

The IFRS measure of results includes certain items which are significant in

size or volatility or by nature are non-trading or non-recurring, or are items

released to the Income Statement that were previously a fair value item

booked on an acquisition

Adjusted¹ results

The Melrose Board considers the adjusted results to be an important

measure to monitor how the businesses are performing because they

achieve consistency and comparability when all businesses are held for the

complete reporting periods

I

Buy

Improve

Sell

1. Described in the glossary to the 2019 Preliminary Announcement, released on 5 March 2020

Restructuring costs

£m

Aerospace

Automotive

Powder Metallurgy

Nortek Air Management

Other Industrial

Corporate

Total

Total

318

534

238

179

(153)

(55)

41

784

1,102

Income

Statement

charge

79

83

19

11

37

9

238

Cash

spent in

2019

190

(2)

188

£m

10,967

625

11,592

Cash

spent in

2019

46

58

17

14

50

5

190

7View entire presentation