WeWork Results Presentation Deck

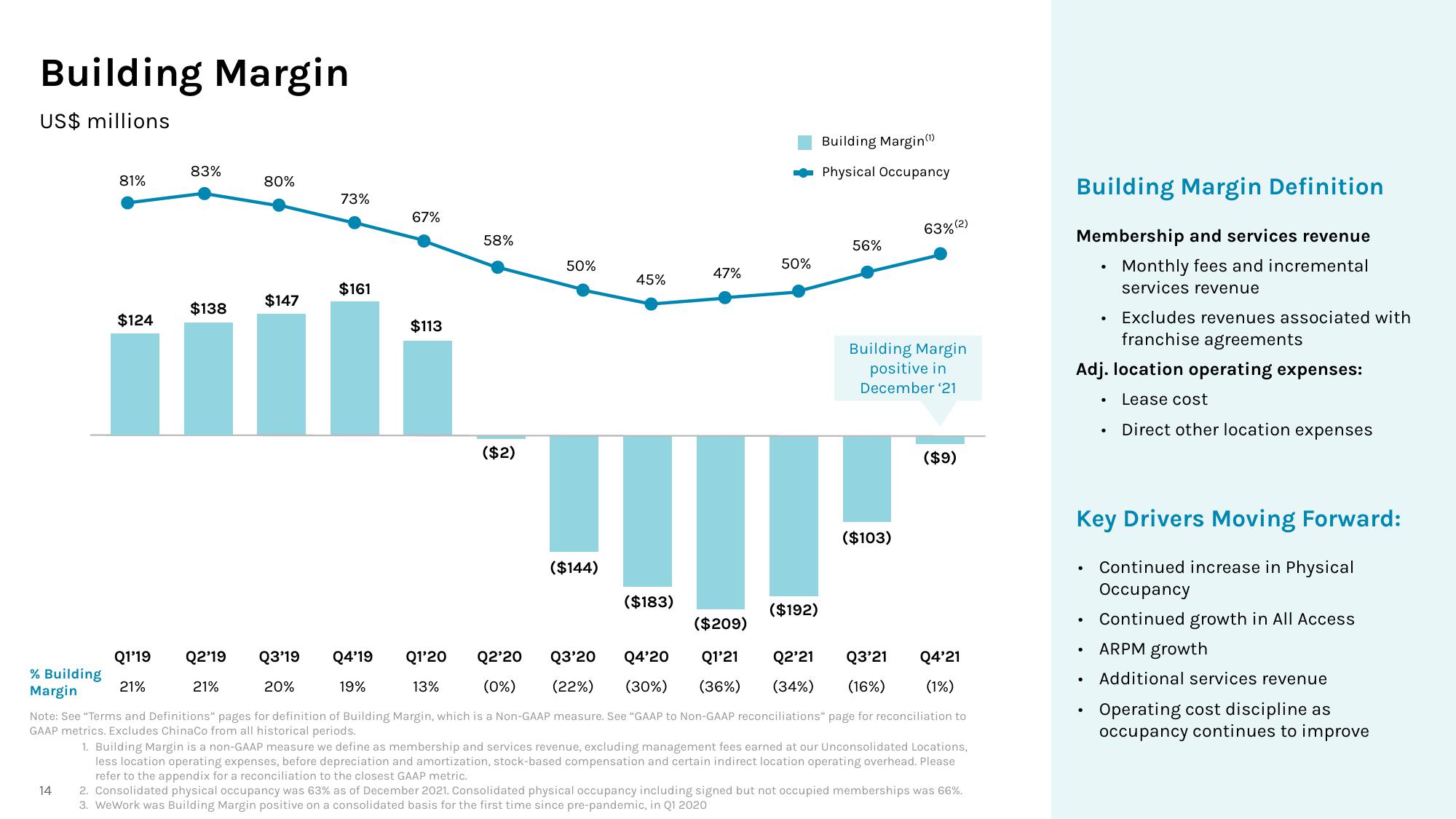

Building Margin

US$ millions

% Building

Margin

81%

14

$124

Q1'19

21%

83%

$138

80%

$147

73%

$161

Q2'19 Q3'19 Q4'19

21%

20%

19%

67%

$113

Q1'20

13%

58%

($2)

Q2'20

(0%)

50%

($144)

45%

($183)

47%

50%

($192)

Building Margin(¹)

Physical Occupancy

56%

Building Margin

positive in

December ¹21

($103)

63% (2)

($209)

Q3'20 Q4'20

Q1'21 Q2'21 Q3'21

(22%) (30%) (36%) (34%) (16%)

($9)

Q4'21

(1%)

Note: See "Terms and Definitions" pages for definition of Building Margin, which is a Non-GAAP measure. See "GAAP to Non-GAAP reconciliations" page for reconciliation to

GAAP metrics. Excludes ChinaCo from all historical periods.

1. Building Margin is a non-GAAP measure we define as membership and services revenue, excluding management fees earned at our Unconsolidated Locations,

less location operating expenses, before depreciation and amortization, stock-based compensation and certain indirect location operating overhead. Please

refer to the appendix for a reconciliation to the closest GAAP metric.

2. Consolidated physical occupancy was 63% as of December 2021. Consolidated physical occupancy including signed but not occupied memberships was 66%.

3. WeWork was Building Margin positive on a consolidated basis for the first time since pre-pandemic, in Q1 2020

Building Margin Definition

Membership and services revenue

Monthly fees and incremental

services revenue

●

• Excludes revenues associated with

franchise agreements

Adj. location operating expenses:

Lease cost

• Direct other location expenses

●

.

Key Drivers Moving Forward:

Continued increase in Physical

Occupancy

Continued growth in All Access

• ARPM growth

. Additional services revenue

Operating cost discipline as

occupancy continues to improveView entire presentation