DigitalOcean Results Presentation Deck

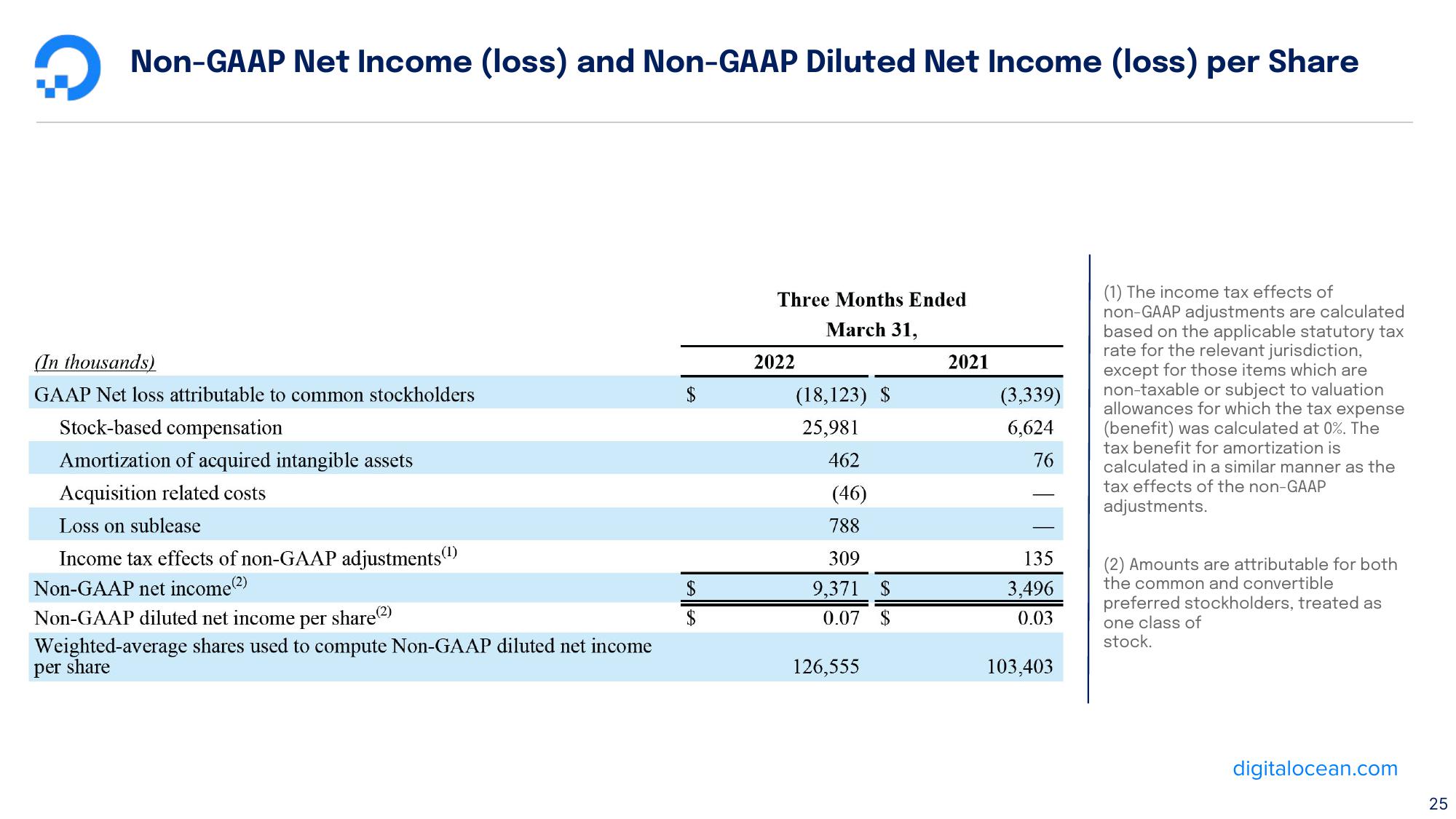

? Non-GAAP Net Income (loss) and Non-GAAP Diluted Net Income (loss) per Share

(In thousands)

GAAP Net loss attributable to common stockholders

Stock-based compensation

Amortization of acquired intangible assets

Acquisition related costs

Loss on sublease

Income tax effects of non-GAAP adjustments (¹)

Non-GAAP net income (2)

Non-GAAP diluted net income per share (2)

Weighted-average shares used to compute Non-GAAP diluted net income

per share

$

$

Three Months Ended

March 31,

2022

(18,123)

25,981

462

(46)

788

309

9,371

$

0.07 $

126,555

2021

(3,339)

6,624

76

135

3,496

0.03

103,403

(1) The income tax effects of

non-GAAP adjustments are calculated

based on the applicable statutory tax

rate for the relevant jurisdiction,

except for those items which are

non-taxable or subject to valuation

allowances for which the tax expense

(benefit) was calculated at 0%. The

tax benefit for amortization is

calculated in a similar manner as the

tax effects of the non-GAAP

adjustments.

(2) Amounts are attributable for both

the common and convertible

preferred stockholders, treated as

one class of

stock.

digitalocean.com

25View entire presentation