Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

instalments, offset by the sale of one product vessel, while 03

2014 was positively impacted by the divestment of the VLCC

segment.

Maersk Tankers signed a newbuilding contract for nine MR

vessels with a contract value of approximately USD 300m in

September. The order book totals 17 MR newbuildings to be

added to the fleet over the next three years, as part of the fleet

renewal.

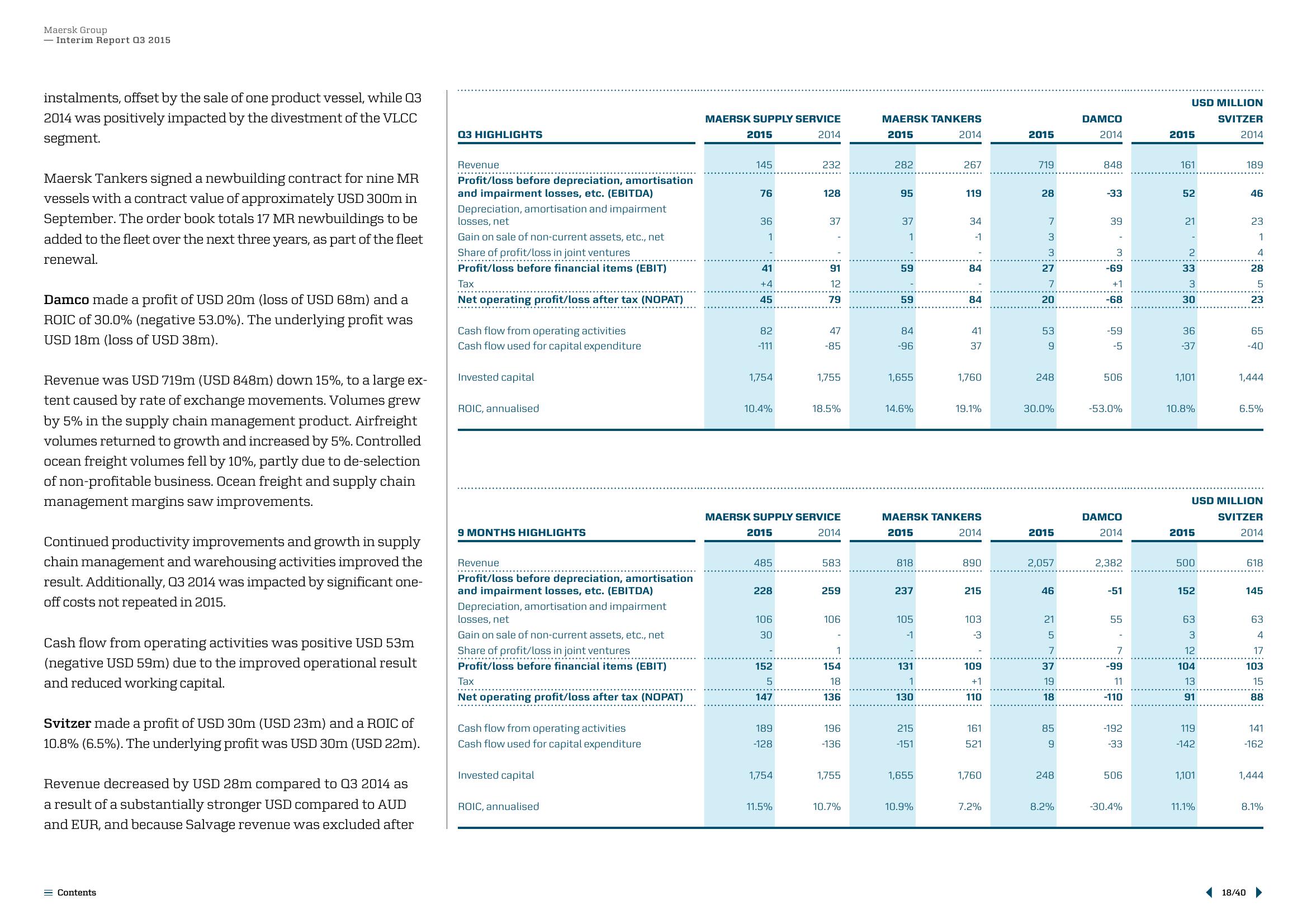

Damco made a profit of USD 20m (loss of USD 68m) and a

ROIC of 30.0% (negative 53.0%). The underlying profit was

USD 18m (loss of USD 38m).

Revenue was USD 719m (USD 848m) down 15%, to a large ex-

tent caused by rate of exchange movements. Volumes grew

by 5% in the supply chain management product. Airfreight

volumes returned to growth and increased by 5%. Controlled

ocean freight volumes fell by 10%, partly due to de-selection

of non-profitable business. Ocean freight and supply chain

management margins saw improvements.

Continued productivity improvements and growth in supply

chain management and warehousing activities improved the

result. Additionally, Q3 2014 was impacted by significant one-

off costs not repeated in 2015.

Cash flow from operating activities was positive USD 53m

(negative USD 59m) due to the improved operational result

and reduced working capital.

Svitzer made a profit of USD 30m (USD 23m) and a ROIC of

10.8% (6.5%). The underlying profit was USD 30m (USD 22m).

Revenue decreased by USD 28m compared to 03 2014 as

a result of a substantially stronger USD compared to AUD

and EUR, and because Salvage revenue was excluded after

Contents

Q3 HIGHLIGHTS

Revenue

Profit/loss before depreciation, amortisation

and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment

losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

**********

Profit/loss before financial items (EBIT)

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

ROIC, annualised

9 MONTHS HIGHLIGHTS

Revenue

.……….….....

Profit/loss before depreciation, amortisation

and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment

losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Profit/loss before financial items (EBIT)

.…………………..…….

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

ROIC, annualised

MAERSK SUPPLY SERVICE

2015

2014

145

76

36

1

41

+4

45

82

-111

1,754

10.4%

485

228

106

30

152

5

147

189

-128

1,754

232

MAERSK SUPPLY SERVICE

2015

2014

11.5%

128

37

91

12

79

47

-85

1,755

18.5%

583

259

106

1

154

18

136

196

-136

1,755

10.7%

MAERSK TANKERS

2015

2014

282

95

37

1

59

59

84

-96

1,655

14.6%

818

237

105

-1

131

1

130

215

-151

1,655

267

MAERSK TANKERS

2015

2014

10.9%

119

34

-1

84

84

41

37

1,760

19.1%

890

215

103

-3

109

+1

110

161

521

1,760

7.2%

2015

719

28

7

3

3

27

7

20

53

9

248

30.0%

2015

2,057

46

21

5

7

37

19

18

85

9

248

8.2%

DAMCO

2014

848

-33

39

3

-69

+1

-68

-59

-5

506

-53.0%

DAMCO

2014

2,382

-51

55

7

-99

11

-110

-192

-33

506

-30.4%

USD MILLION

SVITZER

2014

2015

161

52

21

2

33

3

30

36

-37

1,101

10.8%

2015

500

152

63

3

12

USD MILLION

SVITZER

2014

104

13

91

119

-142

1,101

11.1%

189

46

23

1

4

28

5

23

65

-40

1,444

6.5%

18/40

618

145

63

4

17

103

15

88

141

-162

1,444

8.1%View entire presentation