OppFi Investor Presentation Deck

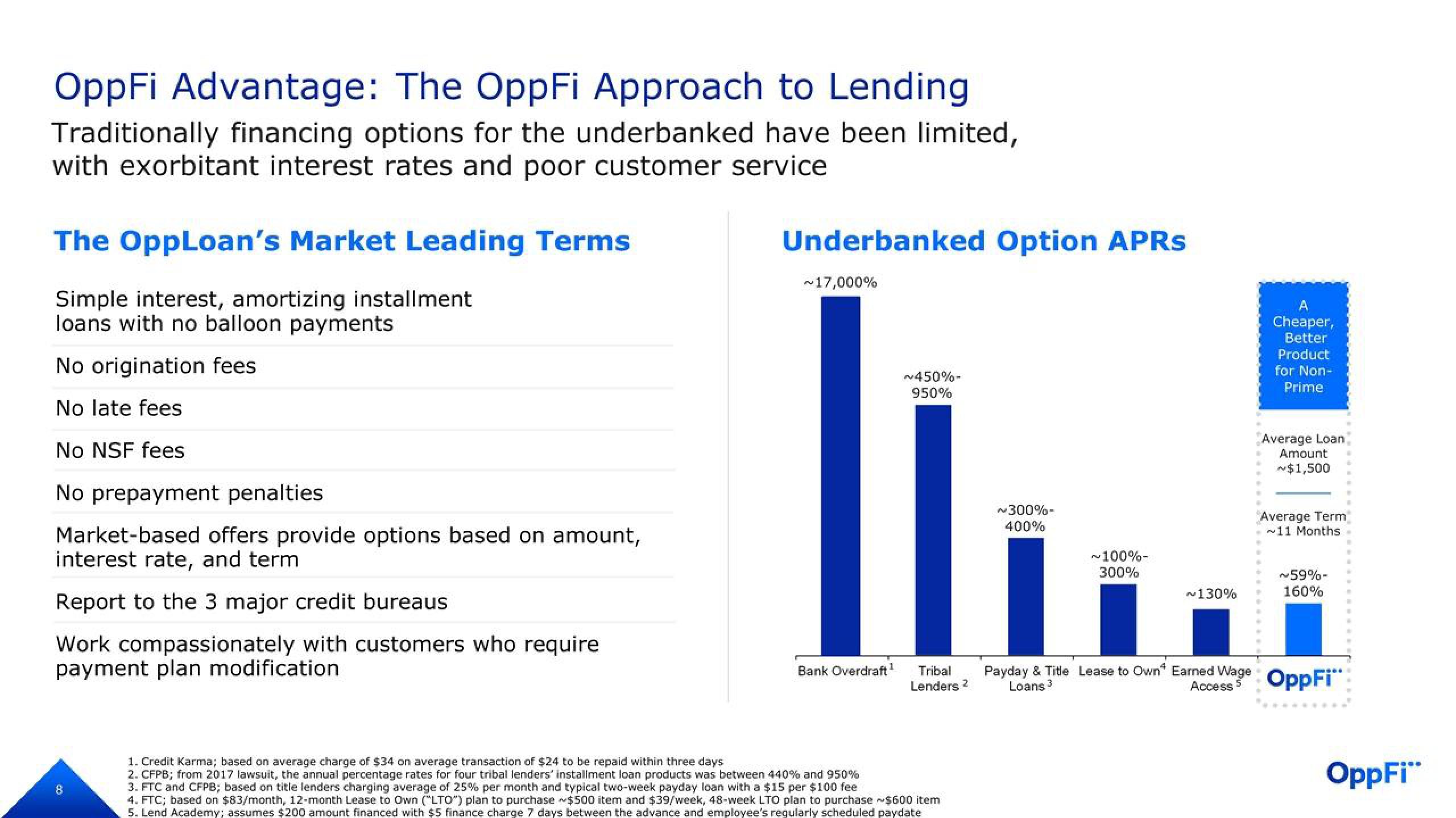

OppFi Advantage: The OppFi Approach to Lending

Traditionally financing options for the underbanked have been limited,

with exorbitant interest rates and poor customer service

The OppLoan's Market Leading Terms

Simple interest, amortizing installment

loans with no balloon payments

No origination fees

No late fees

No NSF fees

No prepayment penalties

Market-based offers provide options based on amount,

interest rate, and term

Report to the 3 major credit bureaus.

Work compassionately with customers who require

payment plan modification

00

Underbanked Option APRS

~17,000%

~450%-

950%

li

Bank Overdraft¹ Tribal

Lenders 2

1. Credit Karma; based on average charge of $34 on average transaction of $24 to be repaid within three days

2. CFPB; from 2017 lawsuit, the annual percentage rates for four tribal lenders' installment loan products was between 440% and 950%

3. FTC and CFPB; based on title lenders charging average of 25% per month and typical two-week payday loan with a $15 per $100 fee

4. FTC; based on $83/month, 12-month Lease to Own ("LTO") plan to purchase $500 item and $39/week, 48-week LTO plan to purchase $600 item

5. Lend Academy; assumes $200 amount financed with $5 finance charge 7 days between the advance and employee's regularly scheduled paydate

~300%-

400%

~100%-

300%

~130%

A

Cheaper,

Better

Product

for Non-

Prime

Average Loan

Amount

~$1,500

Average Term

~11 Months

~59%-

160%

Payday & Title Lease to Own* Earned Wage OppFi™

Loans 3

Access 5

OppFi"View entire presentation