dLocal Results Presentation Deck

d

■

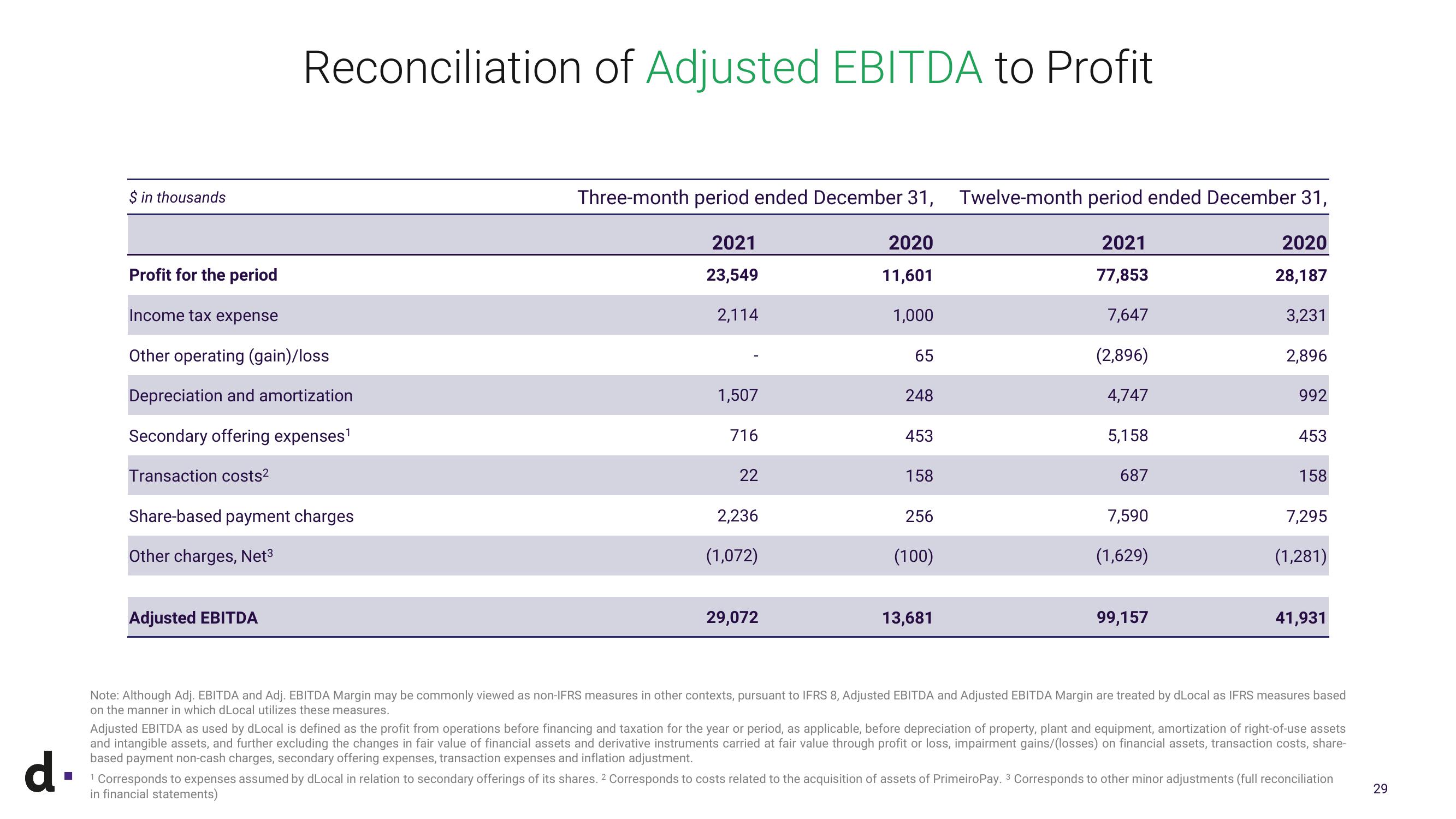

$ in thousands

Reconciliation of Adjusted EBITDA to Profit

Profit for the period

Income tax expense

Other operating (gain)/loss

Depreciation and amortization

Secondary offering expenses¹

Transaction costs²

Share-based payment charges

Other charges, Net³

Adjusted EBITDA

Three-month period ended December 31, Twelve-month period ended December 31,

2021

77,853

7,647

(2,896)

4,747

5,158

2021

23,549

2,114

1,507

716

22

2,236

(1,072)

29,072

2020

11,601

1,000

65

248

453

158

256

(100)

13,681

687

7,590

(1,629)

99,157

2020

28,187

3,231

2,896

992

453

158

7,295

(1,281)

41,931

Note: Although Adj. EBITDA and Adj. EBITDA Margin may be commonly viewed as non-IFRS measures in other contexts, pursuant to IFRS 8, Adjusted EBITDA and Adjusted EBITDA Margin are treated by dLocal as IFRS measures based

on the manner in which dLocal utilizes these measures.

Adjusted EBITDA as used by dLocal is defined as the profit from operations before financing and taxation for the year or period, as applicable, before depreciation of property, plant and equipment, amortization of right-of-use assets

and intangible assets, and further excluding the changes in fair value of financial assets and derivative instruments carried at fair value through profit or loss, impairment gains/(losses) on financial assets, transaction costs, share-

based payment non-cash charges, secondary offering expenses, transaction expenses and inflation adjustment.

1 Corresponds to expenses assumed by dLocal in relation to secondary offerings of its shares. 2 Corresponds to costs related to the acquisition of assets of PrimeiroPay. 3 Corresponds to other minor adjustments (full reconciliation

in financial statements)

29View entire presentation