Mesirow Private Equity

1.

2.

3.

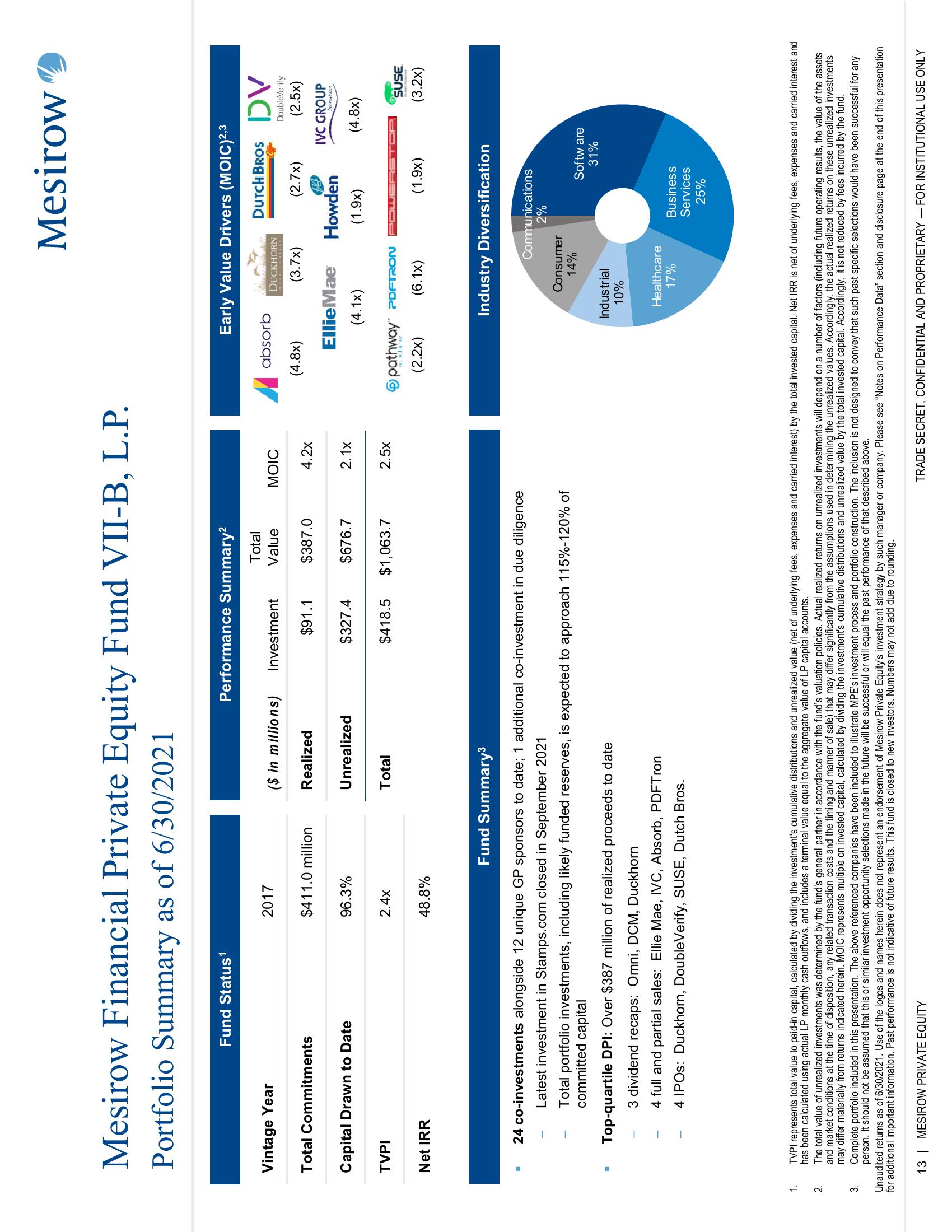

Mesirow Financial Private Equity Fund VII-B, L.P.

Portfolio Summary as of 6/30/2021

Vintage Year

Total Commitments

Fund Status¹

Capital Drawn to Date

TVPI

Net IRR

2017

$411.0 million

96.3%

2.4x

48.8%

($ in millions) Investment

Realized

Unrealized

13 MESIROW PRIVATE EQUITY

Total

Performance Summary²

Total

Value

$387.0

Top-quartile DPI: Over $387 million of realized proceeds to date

3 dividend recaps: Omni, DCM, Duckhorn

4 full and partial sales: Ellie Mae, IVC, Absorb, PDFTron

4 IPOS: Duckhorn, DoubleVerify, SUSE, Dutch Bros.

$91.1

$327.4

$676.7

Fund Summary³

24 co-investments alongside 12 unique GP sponsors to date; 1 additional co-investment in due diligence

Latest investment in Stamps.com closed in September 2021

$418.5 $1,063.7

Total portfolio investments, including likely funded reserves, is expected to approach 115%-120% of

committed capital

MOIC

4.2x

2.1x

2.5x

absorb

(4.8x)

Early Value Drivers (MOIC)2,3

DUTCH BROS

Mesirow

DUCKHORN

(3.7x)

Ellie Mae

(4.1x)

pathway PDFTRON

(2.2x)

(6.1x)

Industrial

10%

(2.7x)

Howden

(1.9x)

Consumer

14%

Industry Diversification

Healthcare

17%

(1.9x)

Communications

2%

IVC GROUP

internation

Business

Services

25%

DV

DoubleVerify

(2.5x)

Software

31%

(4.8x)

SUSE

(3.2x)

TVPI represents total value to paid-in capital, calculated by dividing the investment's cumulative distributions and unrealized value (net of underlying fees, expenses and carried interest) by the total invested capital. Net IRR is net of underlying fees, expenses and carried interest and

has been calculated using actual LP monthly cash outflows, and includes a terminal value equal to the aggregate value of LP capital accounts.

The total value of unrealized investments was determined by the fund's general partner in accordance with the fund's valuation policies. Actual realized returns on unrealized investments will depend on a number of factors (including future operating results, the value of the assets

and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale) that may differ significantly from the assumptions used in determining the unrealized values. Accordingly, the actual realized returns on these unrealized investments

may differ materially from returns indicated herein. MOIC represents multiple on invested capital, calculated by dividing the investment's cumulative distributions and unrealized value by the total invested capital. Accordingly, it is not reduced by fees incurred by the fund.

Complete portfolio included in this presentation. The above referenced companies have been included to illustrate MPE's investment process and portfolio construction. The inclusion is not designed to convey that such past specific selections would have been successful for any

person. It should not be assumed that this or similar investment opportunity selections made in the future will be successful or will equal the past performance of that described above.

Unaudited returns as of 6/30/2021. Use of the logos and names herein does not represent an endorsement of Mesirow Private Equity's investment strategy by such manager or company. Please see "Notes on Performance Data" section and disclosure page at the end of this presentation

for additional important information. Past performance is not indicative of future results. This fund is closed to new investors. Numbers may not add due to rounding.

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation