Spirit Mergers and Acquisitions Presentation Deck

>>> Spirit Shareholders Lose in All NEA Litigation Scenarios

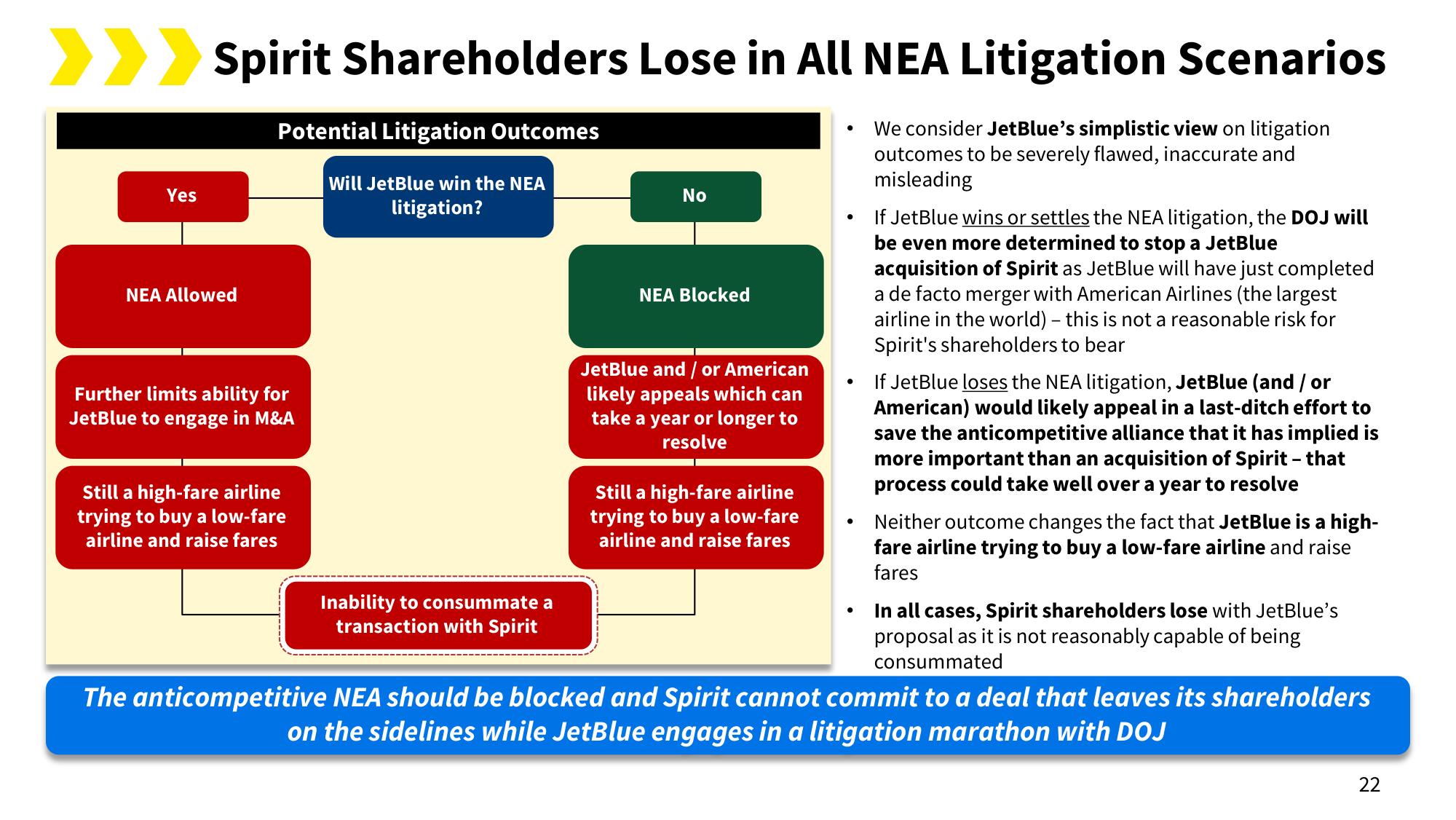

We consider Jet Blue's simplistic view on litigation

outcomes to be severely flawed, inaccurate and

misleading

Yes

NEA Allowed

Potential Litigation Outcomes

Will JetBlue win the NEA

litigation?

Further limits ability for

JetBlue to engage in M&A

Still a high-fare airline

trying to buy a low-fare

airline and raise fares

Inability to consummate a

transaction with Spirit

No

NEA Blocked

JetBlue and / or American

likely appeals which can

take a year or longer to

resolve

Still a high-fare airline

trying to buy a low-fare

airline and raise fares

If JetBlue wins or settles the NEA litigation, the DOJ will

be even more determined to stop a JetBlue

acquisition of Spirit as JetBlue will have just completed

a de facto merger with American Airlines (the largest

airline in the world) - this is not a reasonable risk for

Spirit's shareholders to bear

If JetBlue loses the NEA litigation, JetBlue (and / or

American) would likely appeal in a last-ditch effort to

save the anticompetitive alliance that it has implied is

more important than an acquisition of Spirit - that

process could take well over a year to resolve

Neither outcome changes the fact that JetBlue is a high-

fare airline trying to buy a low-fare airline and raise

fares

In all cases, Spirit shareholders lose with JetBlue's

proposal as it is not reasonably capable of being

consummated

The anticompetitive NEA should be blocked and Spirit cannot commit to a deal that leaves its shareholders

on the sidelines while JetBlue engages in a litigation marathon with DOJ

22View entire presentation