Evercore Investment Banking Pitch Book

Appendix

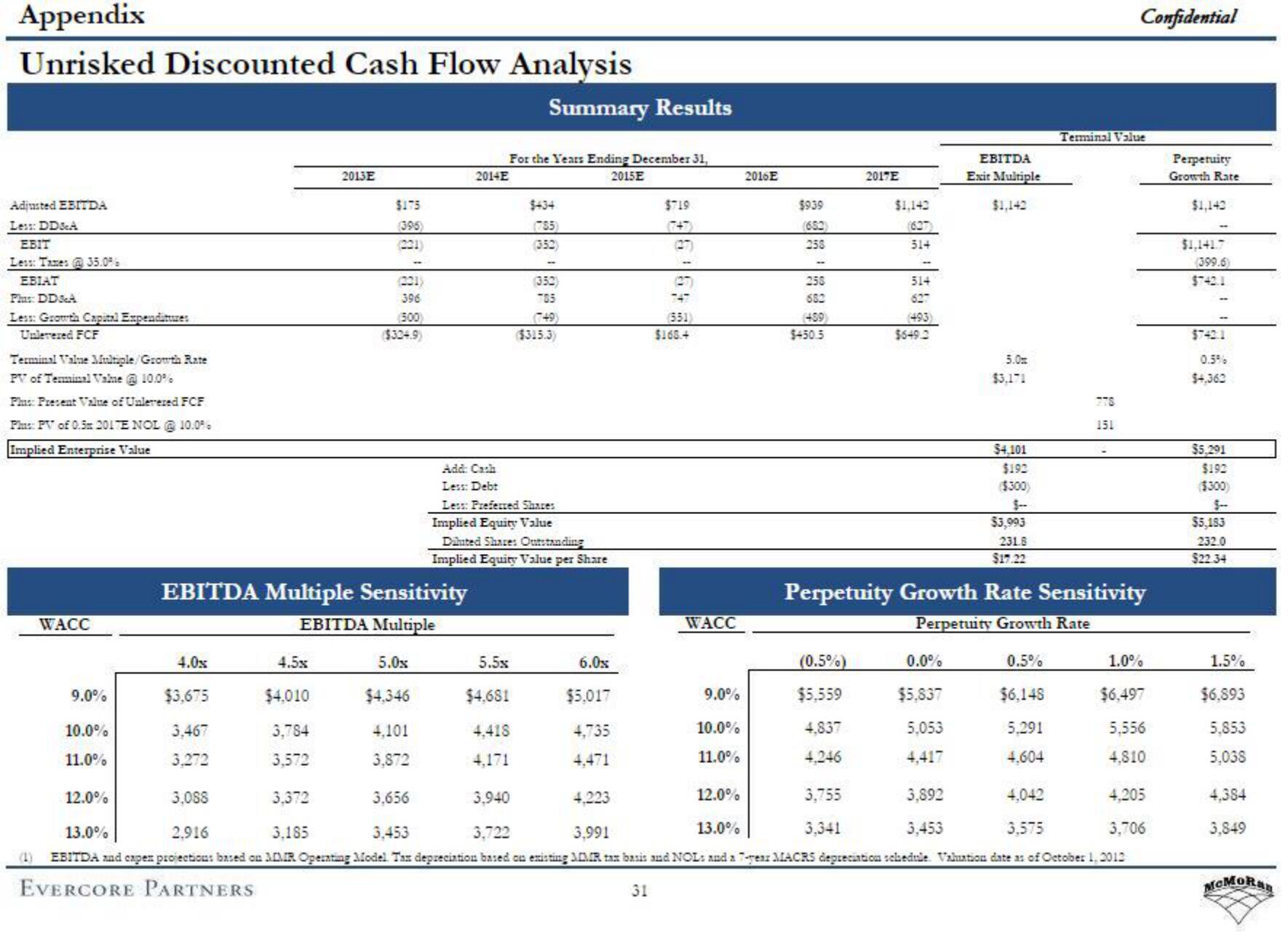

Unrisked Discounted Cash Flow Analysis

Adjusted EBITDA

Less: DD&A

EBIT

Less: Taxes @ 35.0%

EBIAT

Plus: DD&A

Less: Growth Capital Expenditures

Unlevered FCF

Terminal Value Multiple/Growth Rate

PV of Terminal Valme @ 10.0%

Plus: Present Value of Unlerered FCF

Plus: PV of 0.5 2017E NOL @ 10.0%

Implied Enterprise Value

WACC

9.0%

10.0%

11.0%

12.0%

4.0x

$3.675

3,467

3,272

4.5x

2013E

$4,010

3,784

3,572

$175

(396)

(221)

396

(500)

($324.9)

EBITDA Multiple Sensitivity

EBITDA Multiple

5.0x

$4,346

4,101

3,872

2014E

Summary Results

For the Years Ending December 31,

2015E

$434

(785)

(352)

5.5x

$4,681

4,418

4,171

(352)

785

Add: Cach

Less: Debt

Less: Preferred Shares

Implied Equity Value

($315.3)

Dihted Share: Outstanding

Implied Equity Value per Share

6.0x

$5.017

4,735

4,471

$719

(551)

$168.4

WACC

9.0%

10.0%

11.0%

2016E

$939

(652)

258

258

682

(459)

$450.5

(0.5%)

$5,559

4,837

4,246

2017E

3,755

3,341

$1,142

(637)

314

514

627

(493)

$649.2

EBITDA

Exit Multiple

0.0%

$5,837

5,053

4,417

$1,142

5.0

$3,171

$4,101

$192

($300)

$3,993

231.8

$17.22

Perpetuity Growth Rate Sensitivity

Perpetuity Growth Rate

0.5%

$6,148

5,291

4.604

Confidential

Terminal Value

3TS

151

1.0%

$6,497

5.556

4,810

3,088

3,372

3,656

3,940

4,223

12.0%

3,892

4,042

4,205

2,916

3,185

3.453

3,722

3,991

13.0%

3,453

3,575

3,706

13.0%

EBITDA and capen projections based on MMR Operating Model Tax depreciation based on existing MMR tax basis and NOL: and a 7-year MACRS depreciation schedule. Valuation date as of October 1, 2012

EVERCORE PARTNERS

31

Perpetuity

Growth Rate

$1,142

$1,141.7

(399.6)

$742.1

$742.1

0.5%

$4,362

35,291

$192

($300)

$5,183

232.0

$22.34

1.5%

$6,893

5,853

5,038

4,384

3,849

McMoRanView entire presentation