Liberty Global Results Presentation Deck

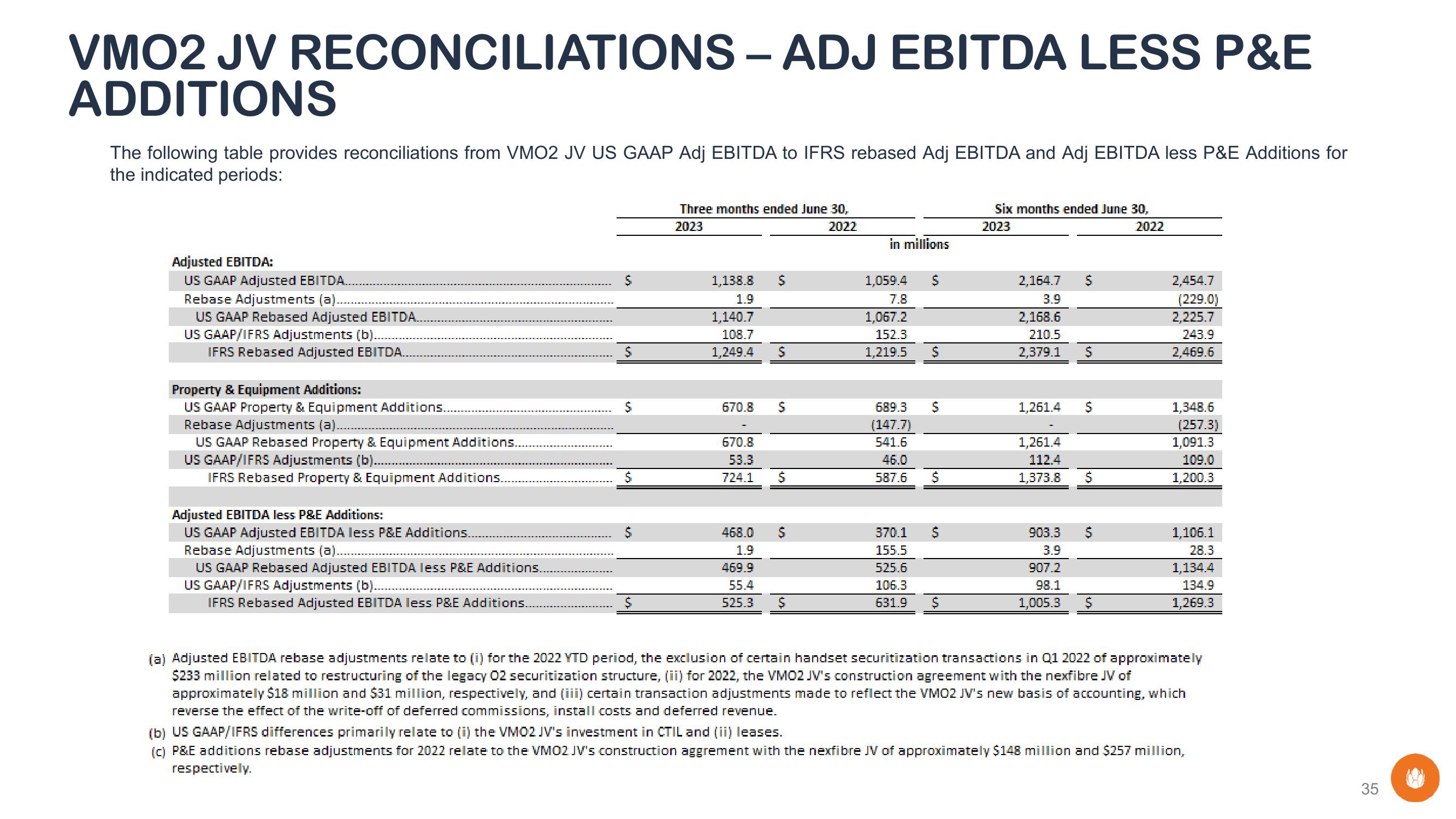

VMO2 JV RECONCILIATIONS - ADJ EBITDA LESS P&E

ADDITIONS

The following table provides reconciliations from VMO2 JV US GAAP Adj EBITDA to IFRS rebased Adj EBITDA and Adj EBITDA less P&E Additions for

the indicated periods:

Adjusted EBITDA:

US GAAP Adjusted EBITDA.

Rebase Adjustments (a).

US GAAP Rebased Adjusted EBITDA..

US GAAP/IFRS Adjustments (b).

IFRS Rebased Adjusted EBITDA.

Property & Equipment Additions:

US GAAP Property & Equipment Additions..

Rebase Adjustments (a).

US GAAP Rebased Property & Equipment Additions..

US GAAP/IFRS Adjustments (b).......

IFRS Rebased Property & Equipment Additions...

Adjusted EBITDA less P&E Additions:

US GAAP Adjusted EBITDA less P&E Additions.

Rebase Adjustments (a).

US GAAP Rebased Adjusted EBITDA less P&E Additions.

US GAAP/IFRS Adjustments (b).

IFRS Rebased Adjusted EBITDA less P&E Additions..

$

$

$

$

Three months ended June 30,

2023

2022

1,138.8

1.9

1,140.7

108.7

1,249.4

670.8

670.8

53.3

724.1

$

$

$

$

468.0

1.9

469.9

55.4

525.3 $

S

in millions

1,059.4

7.8

1,067.2

152.3

1,219.5

689.3

(147.7)

541.6

46.0

587.6

370.1

155.5

525.6

106.3

631.9

$

$

$

Ś

$

Six months ended June 30,

2023

2022

2,164.7

3.9

2,168.6

210.5

2,379.1

1,261.4

1,261.4

112.4

1,373.8

$

$

$

$

903.3 S

3.9

907.2

98.1

1,005.3

$

2,454.7

(229.0)

2,225.7

243.9

2,469.6

1,348.6

(257.3)

1,091.3

109.0

1,200.3

1,106.1

28.3

1,134.4

134.9

1,269.3

(a) Adjusted EBITDA rebase adjustments relate to (i) for the 2022 YTD period, the exclusion of certain handset securitization transactions in Q1 2022 of approximately

$233 million related to restructuring of the legacy 02 securitization structure, (ii) for 2022, the VM02 JV's construction agreement with the nexfibre JV of

approximately $18 million and $31 million, respectively, and (iii) certain transaction adjustments made to reflect the VMO2 JV's new basis of accounting, which

reverse the effect of the write-off of deferred commissions, install costs and deferred revenue.

(b) US GAAP/IFRS differences primarily relate to (i) the VM02 JV's investment in CTIL and (ii) leases.

(c) P&E additions rebase adjustments for 2022 relate to the VM02 JV's construction aggrement with the nexfibre JV of approximately $148 million and $257 million,

respectively.

35

(8)View entire presentation