TPG Results Presentation Deck

Other Operating Metrics

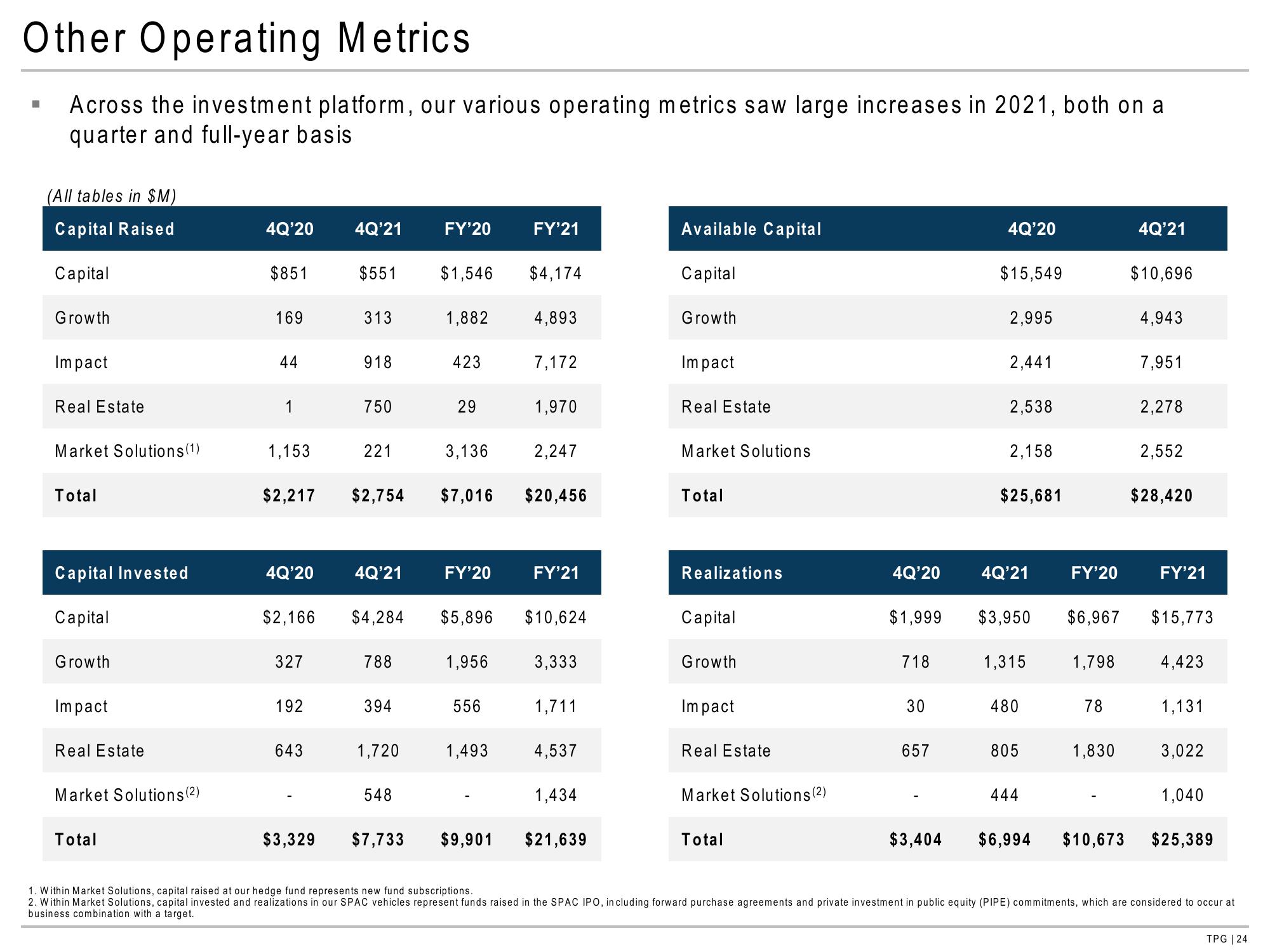

Across the investment platform, our various operating metrics saw large increases in 2021, both on a

quarter and full-year basis.

I

(All tables in $M)

Capital Raised

Capital

Growth

Impact

Real Estate

Market Solutions (1)

Total

Capital Invested

Capital

Growth

Impact

Real Estate

Market Solutions (2)

Total

4Q'20

$851

169

44

1

1,153

4Q'20

$2,166

327

192

643

4Q'21

$2,217 $2,754

$3,329

$551

313

918

750

221

4Q'21

$4,284

788

394

1,720

548

$7,733

FY'20

$1,546 $4,174

1,882

423

29

3,136

$7,016

FY'20

$5,896

1,956

556

1,493

FY'21

$9,901

4,893

7,172

1,970

2,247

$20,456

FY'21

$10,624

3,333

1,711

4,537

1,434

$21,639

Available Capital

Capital

Growth

Impact

Real Estate

Market Solutions

Total

Realizations

Capital

Growth

Impact

Real Estate

Market Solutions (2)

Total

4Q'20

$1,999

718

30

657

$3,404

4Q'20

$15,549

2,995

2,441

2,538

2,158

$25,681

4Q'21

1,315

480

805

FY'20

444

1,798

78

1,830

4Q'21

$3,950 $6,967 $15,773

$6,994 $10,673

$10,696

4,943

7,951

2,278

2,552

$28,420

FY'21

4,423

1,131

3,022

1,040

$25,389

1. Within Market Solutions, capital raised at our hedge fund represents new fund subscriptions.

2. Within Market Solutions, capital invested and realizations in our SPAC vehicles represent funds raised in the SPAC IPO, including forward purchase agreements and private investment in public equity (PIPE) commitments, which are considered to occur at

business combination with a target.

TPG | 24View entire presentation