Owens&Minor Investor Conference Presentation Deck

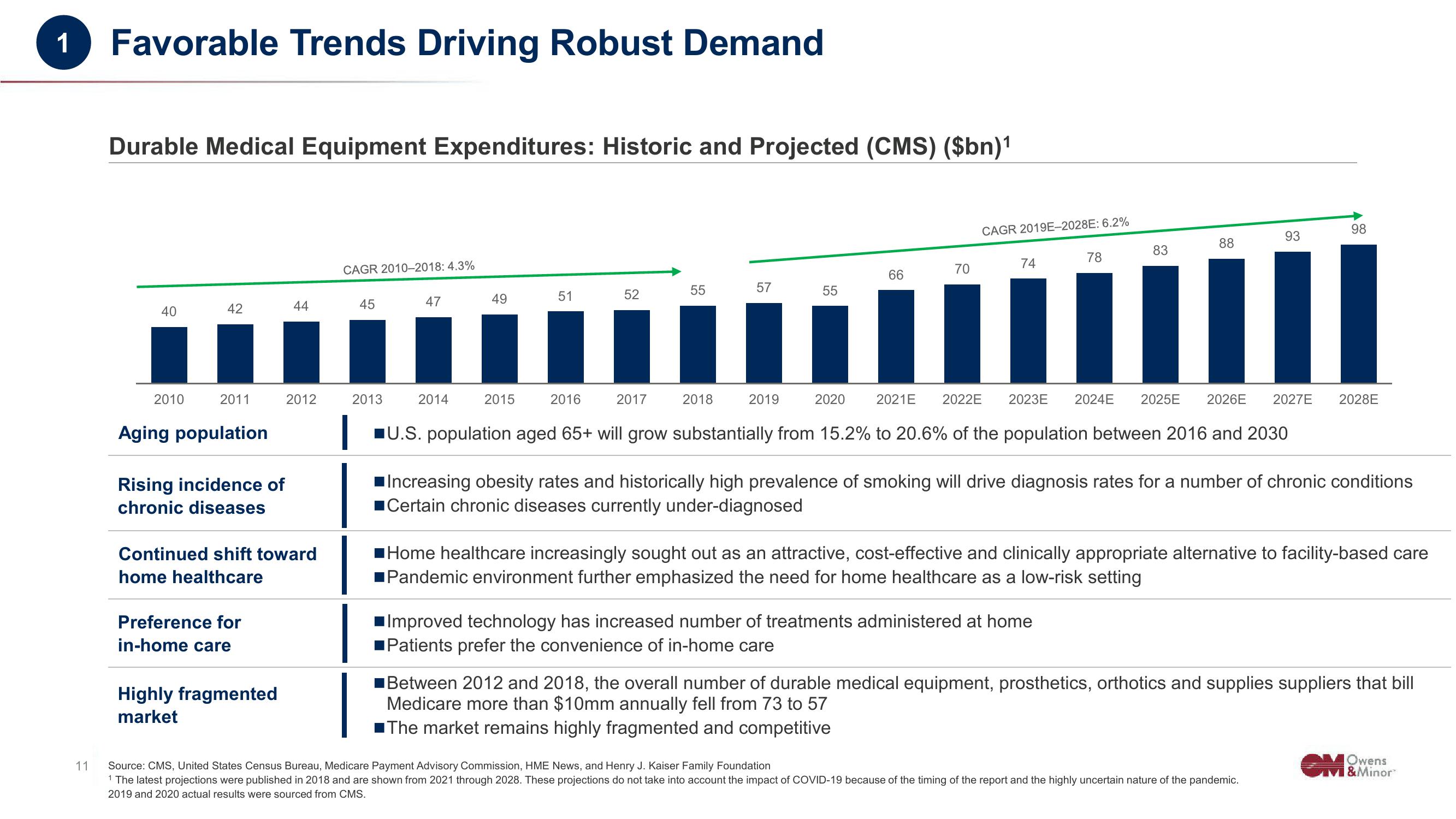

1 Favorable Trends Driving Robust Demand

11

Durable Medical Equipment Expenditures: Historic and Projected (CMS) ($bn)¹

40

2010

42

2011

Aging population

Rising incidence of

chronic diseases

Preference for

in-home care

44

2012

Continued shift toward

home healthcare

Highly fragmented

market

CAGR 2010-2018: 4.3%

45

2013

47

2014

49

2015

51

2016

52

2017

55

2018

57

2019

55

2020

66

70

CAGR 2019E-2028E: 6.2%

74

78

83

88

2021E 2022E 2023E 2024E 2025E 2026E 2027E

Improved technology has increased number of treatments administered at home

■Patients prefer the convenience of in-home care

93

U.S. population aged 65+ will grow substantially from 15.2% to 20.6% of the population between 2016 and 2030

98

Increasing obesity rates and historically high prevalence of smoking will drive diagnosis rates for a number of chronic conditions

Certain chronic diseases currently under-diagnosed

2028E

Home healthcare increasingly sought out as an attractive, cost-effective and clinically appropriate alternative to facility-based care

Pandemic environment further emphasized the need for home healthcare as a low-risk setting

Source: CMS, United States Census Bureau, Medicare Payment Advisory Commission, HME News, and Henry J. Kaiser Family Foundation

1 The latest projections were published in 2018 and are shown from 2021 through 2028. These projections do not take into account the impact of COVID-19 because of the timing of the report and the highly uncertain nature of the pandemic.

2019 and 2020 actual results were sourced from CMS.

Between 2012 and 2018, the overall number of durable medical equipment, prosthetics, orthotics and supplies suppliers that bill

Medicare more than $10mm annually fell from 73 to 57

The market remains highly fragmented and competitive

Owens

VI & MinorView entire presentation