Barclays Capital 2010 Global Financial Services Conference

Action plans for lagging units - Ulster Bank

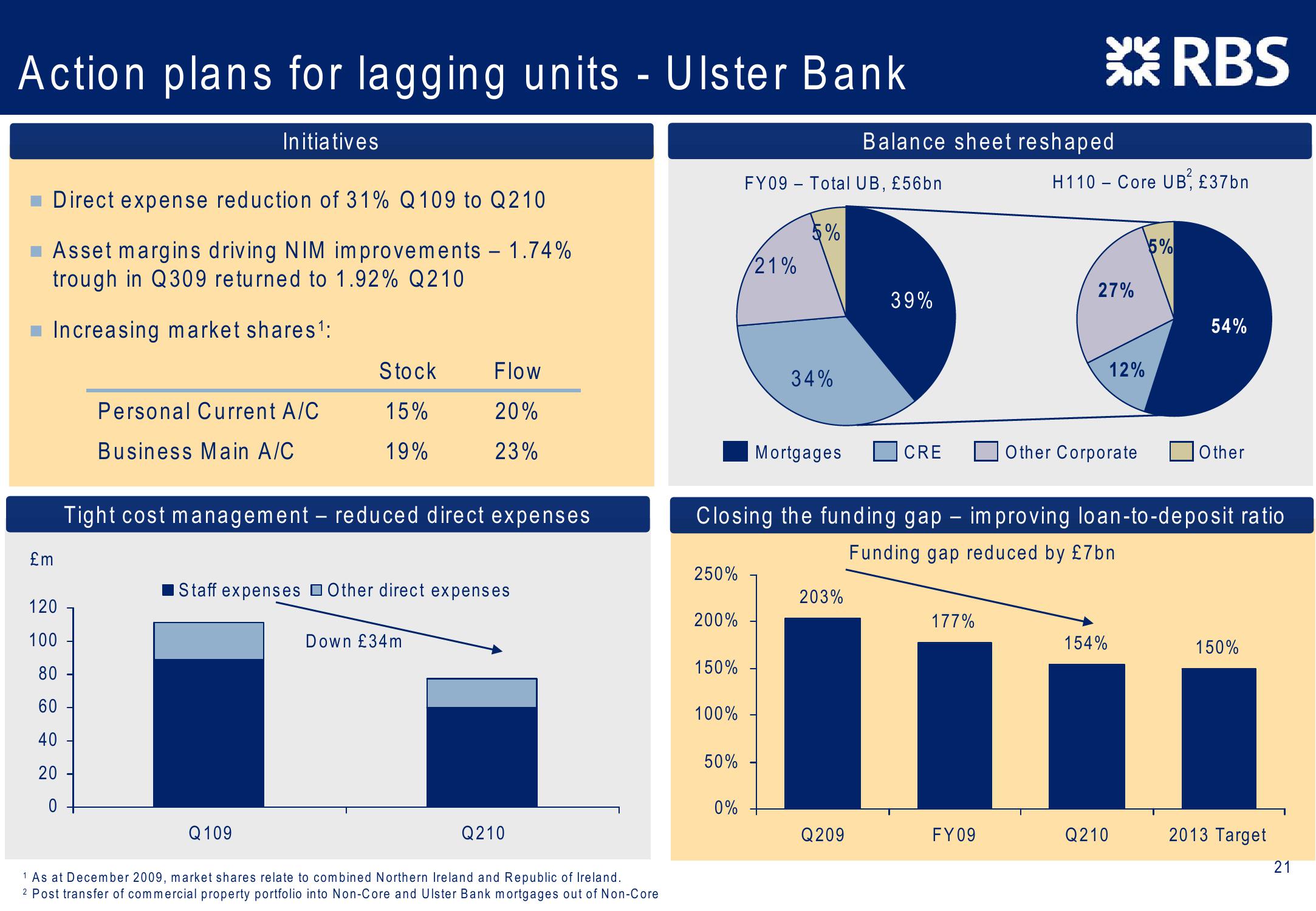

Initiatives

Direct expense reduction of 31% Q109 to Q210

■ Asset margins driving NIM improvements - 1.74%

trough in Q309 returned to 1.92% Q210

Balance sheet reshaped

FY09 Total UB, £56bn

21%

5%

Increasing market shares 1:

Stock

Flow

34%

Personal Current A/C

15%

20%

Business Main A/C

19%

23%

XRBS

H110 Core UB £37bn

5%

27%

39%

54%

12%

Mortgages

CRE

Other Corporate

Other

Tight cost management - reduced direct expenses

£m

■Staff expenses ☐ Other direct expenses

120

100

Down £34m

80

60

40

20

20

0

Q109

Q210

1 As at December 2009, market shares relate to combined Northern Ireland and Republic of Ireland.

2 Post transfer of commercial property portfolio into Non-Core and Ulster Bank mortgages out of Non-Core

Closing the funding gap – improving loan-to-deposit ratio

Funding gap reduced by £7bn

250%

203%

200%

177%

154%

150%

150%

100%

50%

0%

Q209

FY09

Q210

2013 Target

21View entire presentation