Bakkt Results Presentation Deck

Summary of 3Q23 condensed results

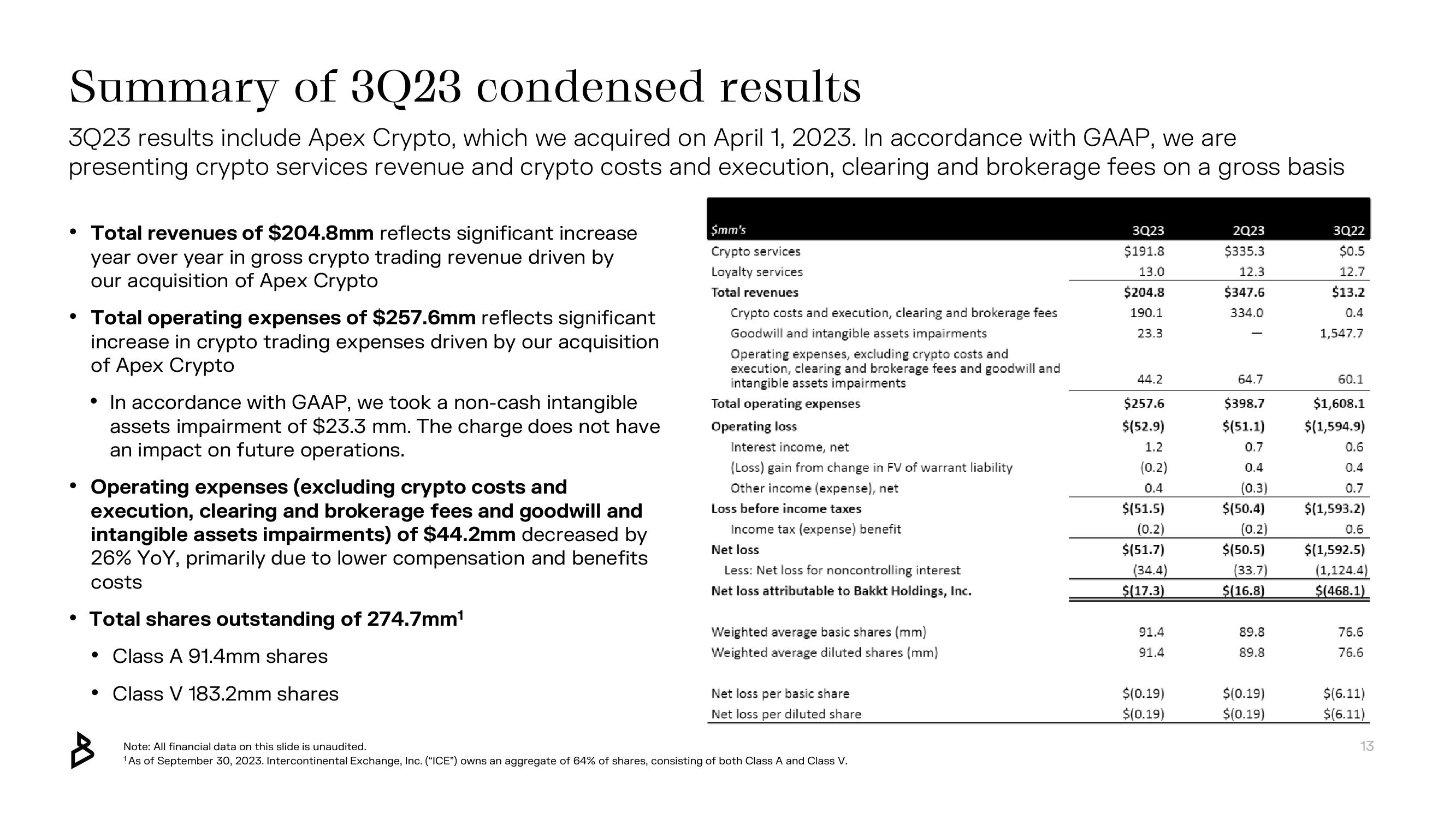

3Q23 results include Apex Crypto, which we acquired on April 1, 2023. In accordance with GAAP, we are

presenting crypto services revenue and crypto costs and execution, clearing and brokerage fees on a gross basis

• Total revenues of $204.8mm reflects significant increase

year over year in gross crypto trading revenue driven by

our acquisition of Apex Crypto

• Total operating expenses of $257.6mm reflects significant

increase in crypto trading expenses driven by our acquisition

of Apex Crypto

●

• In accordance with GAAP, we took a non-cash intangible

assets impairment of $23.3 mm. The charge does not have

an impact on future operations.

Operating expenses (excluding crypto costs and

execution, clearing and brokerage fees and goodwill and

intangible assets impairments) of $44.2mm decreased by

26% YOY, primarily due to lower compensation and benefits

costs

• Total shares outstanding of 274.7mm¹

• Class A 91.4mm shares

• Class V 183.2mm shares

$mm's

Crypto services

Loyalty services

Total revenues

Crypto costs and execution, clearing and brokerage fees

Goodwill and intangible assets impairments

Operating expenses, excluding crypto costs and

execution, clearing and brokerage fees and goodwill and

intangible assets impairments

Total operating expenses

Operating loss

Interest income, net

(Loss) gain from change in FV of warrant liability

Other income (expense), net

Loss before income taxes

Income tax (expense) benefit

Net loss

Less: Net loss for noncontrolling interest

Net loss attributable to Bakkt Holdings, Inc.

Weighted average basic shares (mm)

Weighted average diluted shares (mm)

Net loss per basic share

Net loss per diluted share

Note: All financial data on this slide is unaudited.

¹ As of September 30, 2023. Intercontinental Exchange, Inc. ("ICE") owns an aggregate of 64% of shares, consisting of both Class A and Class V.

3Q23

$191.8

13.0

$204.8

190.1

23.3

44.2

$257.6

$(52.9)

1.2

(0.2)

0.4

$(51.5)

(0.2)

$(51.7)

(34.4)

$(17.3)

91.4

91.4

$(0.19)

$(0.19)

2Q23

$335.3

12.3

$347.6

334.0

64.7

$398.7

$(51.1)

0.7

0.4

(0.3)

$(50.4)

(0.2)

$(50.5)

(33.7)

$(16.8)

89.8

89.8

$(0.19)

$(0.19)

3Q22

$0.5

12.7

$13.2

0.4

1,547.7

60.1

$1,608.1

$(1,594.9)

0.6

0.4

0.7

$(1,593.2)

0.6

$(1,592.5)

(1,124.4)

$(468.1)

76.6

76.6

$(6.11)

$(6.11)

13View entire presentation